(Bloomberg) — Document warmth, excessive climate occasions and conflict are nonetheless upending world commodity markets. Rice — a meals staple for almost half the worldwide inhabitants — is surging, whereas vitality prices are additionally rising. Earnings from the world’s greatest oil firms at the moment are within the books, however a slew of outcomes from unbiased US shale operators are due within the coming days. Additionally on faucet: second-quarter earnings from Caterpillar Inc.

Most Learn from Bloomberg

Listed below are 5 notable charts to think about because the week will get underway.

Large Oil

Whereas earnings from Large Oil have declined from the blowout leads to prior quarters, the businesses are nonetheless delivering vital returns to shareholders by way of buybacks, dividends and different means. Even so, persistent considerations over the sector’s environmental, social and governance efficiency and the danger of declining demand for fossil fuels within the a long time forward have soured many buyers on the business. Yr-to-date, the S&P 500 Vitality Index is the second-worst performer among the many broader market’s 11 sector teams — a outstanding change of fortune from the prior yr when the gauge trounced its friends. Traders will flip their consideration this week to outcomes from shale operators together with ConocoPhillips, Diamondback Vitality Inc. and EOG Assets Inc.

Local weather

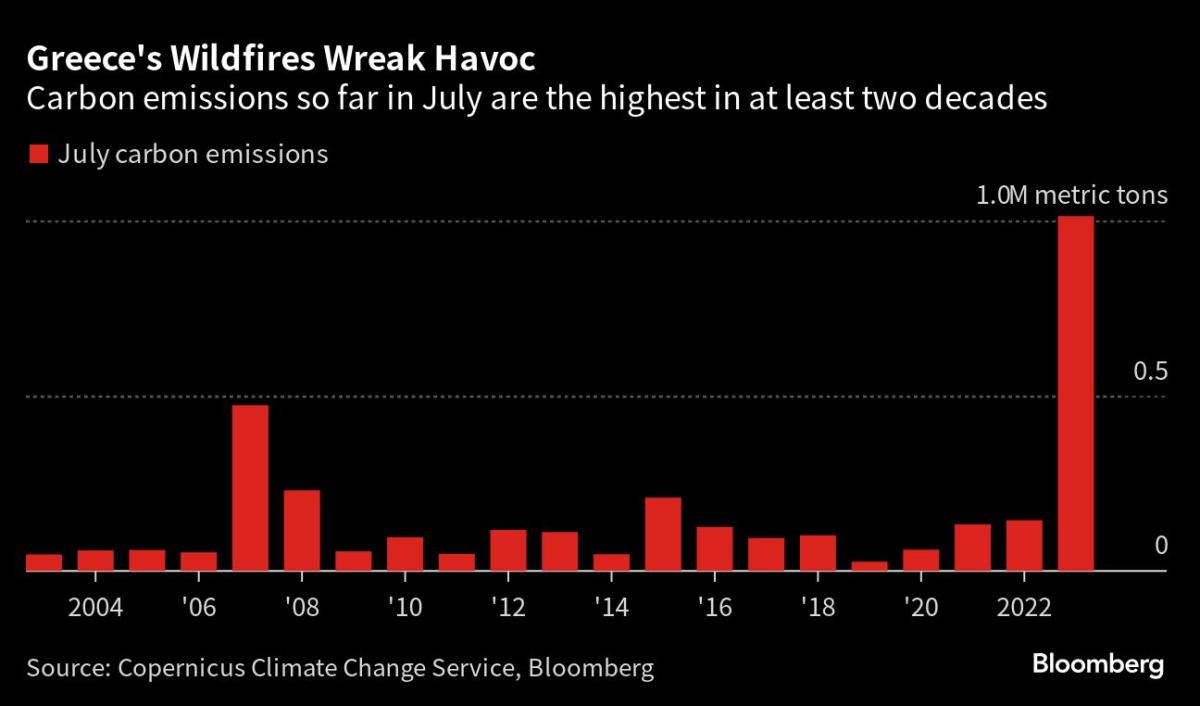

The scorching temperatures in Greece are being exacerbated by devastating wildfires, that are destroying the nation’s pure carbon sinks. To this point this month, greater than 100 wildfires within the nation have emitted in extra of 1,000,000 metric tons of carbon into the environment, probably the most in at the very least 20 years, in line with the Copernicus Local weather Change Service. Whereas the emissions make up a small proportion of Greece’s total air pollution, the event is the most recent signal of the hazards posed by more and more excessive climate and the burning of forests that may in any other case assist take away the carbon naturally. The identical state of affairs is enjoying out in Canada, the place emissions this yr are “off the dimensions” from unprecedented wildfires and are set to double the air pollution output from all different sectors of the nation’s economic system mixed.

Agriculture

And it’s not simply air high quality that’s in danger. Meals provides are underneath menace from the dangerous climate and worsening battle in Ukraine, pushing up prices for shoppers and elevating the prospects that rampant inflation will stick round for longer. The worth of rice, important to the diets of billions in Asia and Africa, is surging after high shipper India banned a big portion of its exports. A rally in rice — plus the positive factors in wheat, corn and different agricultural commodities seen thus far in July — appears set to spur a rebound in world meals prices after a future of declines. In the meantime, in Indonesia, some rice farmers are planting corn and different crops that require much less water because the nation braces for its most extreme dry season since 2019, partly because of the return of an El Niño climate sample.

Gasoline

Oil costs are on the rise world wide and so, too, are pump costs. Within the US, gasoline is contemporary off its greatest weekly advance in additional than a yr, in line with AAA knowledge compiled by Bloomberg. That comes simply as futures soared to a nine-month excessive in New York. An analogous sample is enjoying out in Asia and Europe, the place demand for motor gas is on the rise. That’s compounding already tight world markets which are being squeezed by sudden refinery outages and unseasonably low stockpiles at key storage hubs on the US Gulf Coast and in Singapore.

Mining & Building

Caterpillar, thought of an financial barometer, is about to report earnings on Tuesday. Worldwide retail gross sales progress of the corporate’s iconic yellow machines has been on a gradual upward crawl since final yr, primarily based on a three-month rolling foundation. Whereas that helped prop up shares amid indicators of a restoration at one of many world’s greatest makers of development and mining gear, buyers might be searching for particulars on orders and order backlog heading into the second half, notably from China, the place an financial rebound has but to materialize.

–With help from John Ainger.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.