Shares of EV maker Tesla shut the week decrease after its first-quarter earnings miss and its newest choice to hike EV costs after a number of rounds of value reductions.

Video Transcript

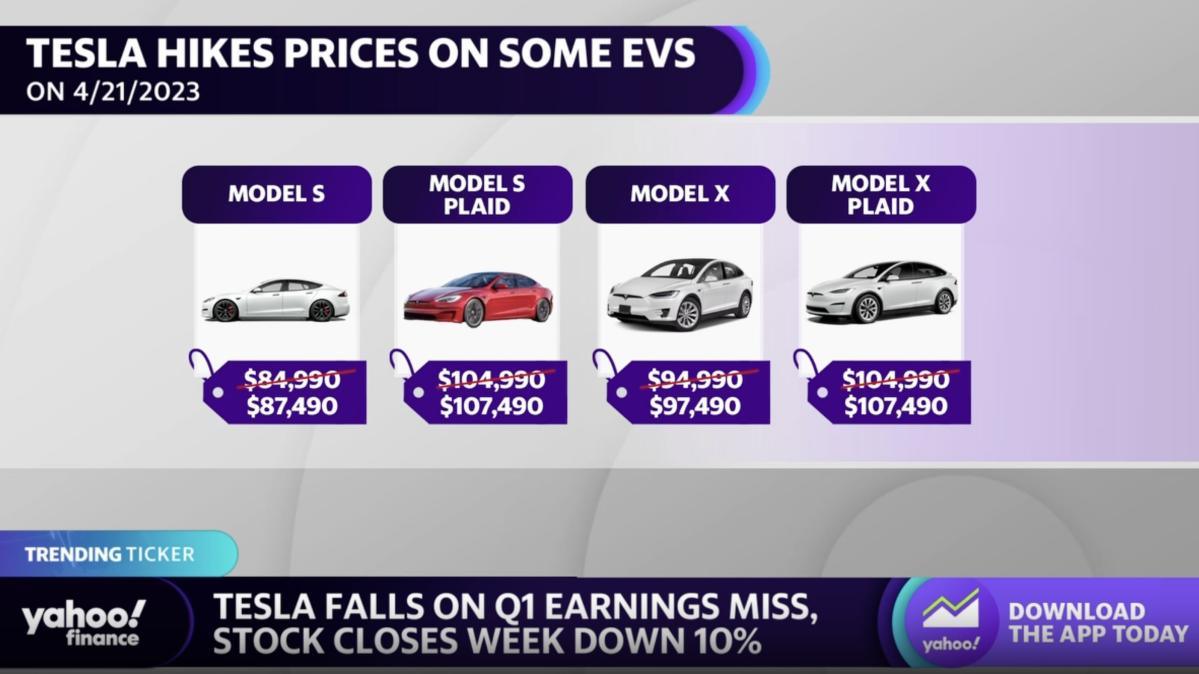

– Been a wild week for Tesla, hasn’t it? What a trip, down greater than 10% during the last 5 days, the EV maker’s Q1 earnings disappointing the Road. Gross margins actually coming in under expectation, and that was the main focus moving into, revealing a revenue miss as the corporate slashed costs on its autos to spur demand. Then immediately asserting value hikes on fashions S and X. The inventory closing up simply over 1% immediately.

Select your individual journey right here, Seana. We might speak about any variety of issues for the previous week in Tesla.

I used to be going to say, there is definitely quite a bit to unpack, quite a lot of headlines popping out. In relation to the worth of the Mannequin S and the Mannequin X, what they have been simply elevating there, the costs of these two autos, to place this in perspective, it is nonetheless decrease than what they have been on the finish of the primary quarter, which was solely three and a half to 4 weeks in the past. So sure, we’re seeing a bit of little bit of a rise there. However actually not going to have, you would not assume, a big impact on Tesla, given the truth that the Mannequin Y and the Mannequin 3 are their prime sellers there.

However in the case of how the Road was these outcomes right here, the revenue margins clearly beneath stress. Seven analysts, I consider it was, lowered their value targets on the inventory. Truist downgraded it to a maintain immediately. So I believe the Road is form of taking pause, catching its breath, making an attempt to determine precisely what Tesla appears to be like like, a minimum of within the coming quarters, given the truth that they could be beneath some stress within the close to time period.

– And I am simply shortly watching the 17 shareholders writing a letter. They personal a mixed $1.5 billion in Tesla shares. They are saying they have a governance downside, that Elon Musk, the CEO, is distracted. Far too many duties– his consideration is diverted. Will there be some modifications? This has been the decision for weeks, months, greater than a yr. Will he discover somebody to run Twitter by the top of yr? I am not holding my breath.

– I am not holding my breath both.