sitox

With the primary buying and selling day in Could approaching Monday, many pharmaceutical firms might be hoping their returns fare higher than they did in April.

The iShares U.S. Prescribed drugs ETF (IHE) returned a paltry 1.6% in April. The ETF’s high two holdings are Johnson & Johnson (NYSE:JNJ) and Merck (NYSE:MRK), which account for, respectively, 23.6% and 20.7% of the fund.

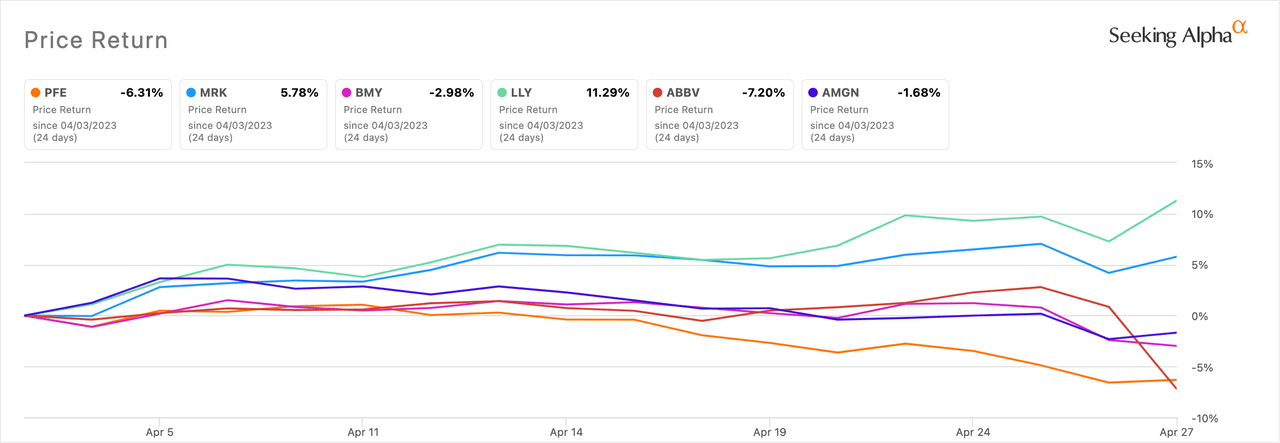

The perfect performing US giant pharma or biotech within the month was Eli Lilly (LLY), handing over a formidable 11.3% return. Regardless of a Q1 2023 backside line miss, the pharma was buoyed by weight reduction information for its diabetes drug Mounjaro (tirzepatide).

AbbVie (NYSE:ABBV) was the worst performer with a -7.2% return. It was negatively impacted by disappointing Q1 outcomes.

A number of firms that want to neglect April have an opportunity to redeem themselves in Could as there are main occasions, equivalent to US FDA motion dates on drug or biologic functions, that would present a share worth increase.

Could 3 might deliver a smile to the faces of GlaxoSmithKline (GSK) administration and stockholders as that is the date the FDA is slated to render a call on its respiratory syncytial virus (RSV) vaccine Arexvy. In March, a panel of FDA advisors unanimously really useful its approval.

SVB Securities analyst Geoffrey Porges has beforehand mentioned the RSV vaccine market might attain $10B by 2030.

Pfizer (NYSE:PFE) will even hear from the FDA in Could about its personal RSV shot, Abrysvo. Company advisors additionally really useful Abrysvo. Each Pfizer (PFE) and GSK (GSK) are gearing as much as launch the jabs earlier than the tip of the yr.

Eyenovia (EYEN) is anticipating a call on Could 8 on its resubmitted New Drug Software for MydCombi ophthalmic spray for mydriasis. The next day, a call is anticipated for Protalix Biotherapeutics’ (PLX) resubmitted Biologics License Software for pegunigalsidase alfa for Fabry illness.

An FDA advisory committee will meet Could 12 to debate Sarepta Therapeutics’ (SRPT) BLA for SRP-9001 for Duchenne muscular dystrophy. The motion date is Could 29. Sarepta (SRPT) inventory was hit earlier this month after a report that some FDA workers opposed the gene remedy.

On Could 19, the FDA is anticipated to behave on Krystal Biotech’s (KRYS) B-VEC for dystrophic epidermolysis bullosa. A choice is anticipated the identical day on an NDA for obeticholic acid as a remedy for pre-cirrhotic liver fibrosis as a consequence of nonalcoholic steatohepatitis from Intercept Prescribed drugs (ICPT).

AbbVie (ABBV) will discover out on Could 21 the destiny of its epcoritamab BLA for relapsed/refractory giant B-cell lymphoma. The corporate is partnered with Genmab (GMAB) on the candidate.

An FDA determination on a further indication for Blueprint Medication’s (BPMC) Ayvakit (avapritinib) for indolent systemic mastocytosis is anticipated Could 22. The next day, a call of ImmunityBio’s (IBRX) Anktiva (N-803) for BCG-unresponsive non-muscle-invasive bladder most cancers carcinoma is deliberate.

The ultimate catalyst of Could is probably going on Could 29 with a call on Innoviva’s (INVA) sulbactam-durlobactam for the remedy of hospital-acquired bacterial pneumonia and ventilator-associated bacterial pneumonia.

Someday through the month, the FDA is slated to behave on Lexicon Prescribed drugs’ (LXRX) sotagliflozin for coronary heart failure.