coldsnowstorm/iStock Unreleased through Getty Photographs

Bitcoin (BTC-USD) has been trying to reclaim $30K, following a bout of market correction final week. The highest cryptocurrency is on observe to finish the week greater than 7% larger, whereas ether (ETH-USD) is about for an over 2% weekly achieve.

Renewed banking woes propped up bitcoin (BTC-USD) this week as market contributors sought various property in anticipation of First Republic Financial institution (FRC) imminent takeover by authorities.

“The crypto market is struggling for a contemporary catalyst because the banking disaster appears to be like prefer it would possibly finish with First Republic (FRC),” mentioned Edward Moya, senior market analyst, OANDA. “The Fed will shield the banks and that ought to imply the current development of crypto power on banking woes is coming to an finish. Merchants stay in wait-and-see mode over U.S. crypto regulation.”

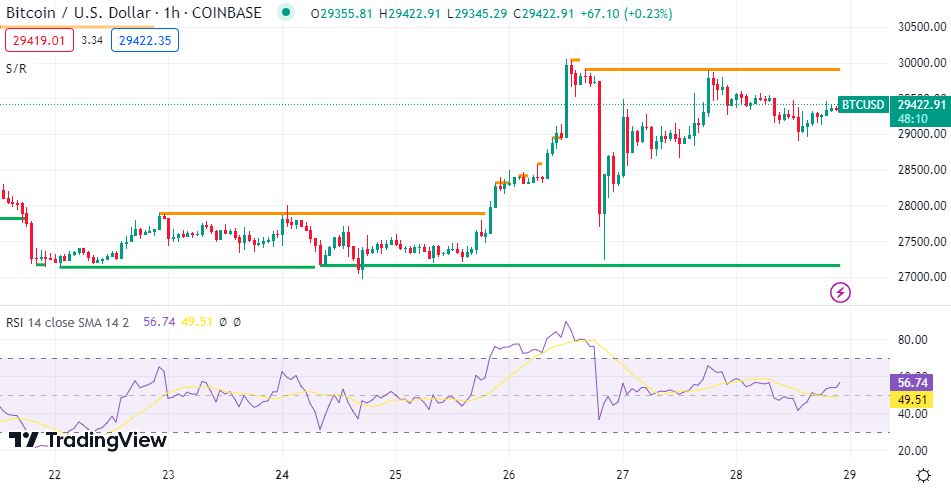

Bitcoin (BTC-USD) traded within the vary of $27.07K-$29.99K, however promoting pressures saved the crypto firmly beneath $30K. Ether (ETH-USD) traded beneath $2K all through the week, giving up the positive factors it noticed after its community’s Shanghai improve, buying and selling within the vary of $1.79K-$1.96K.

The general crypto market cap totaled $1.21T, down 0.9% over Thursday, CoinMarketCap information confirmed.

Regulatory issues continued within the business, with the “hostile” regulatory local weather within the U.S. pushing Binance.US to scrap its $1B deal to purchase Voyager Digital’s (OTCPK:VYGVQ) property.

Coinbase (COIN) filed an motion in court docket to compel the SEC to reply with a “sure” or “no” to its July 2022 petition asking it to make use of its formal rulemaking course of for the crypto business.

Counsel for disgraced Terraform Labs cofounder Do Hyeong Kwon sought the dismissal of the SEC’s fees in opposition to him, arguing that TerraUSD (UST-USD) would not fall beneath its purview as it’s a forex, not a safety. Terraform’s different cofounder Daniel Shin was indicted by South Korea.

In the meantime, Ark Make investments’s Cathie Wooden and 21Shares are persevering with their pursuit of the primary spot bitcoin (BTC-USD) ETF within the U.S. and refiled an software with the SEC for a similar. This marks the third submitting after the primary two have been shot down.

Notable Information

- Mastercard (MA) eyes partnering with extra crypto-related corporations to develop its crypto-linked cost playing cards program, regardless of elevated regulatory scrutiny.

- Miami Worldwide, proprietor of Miami Worldwide Securities Trade, will purchase LedgerX, one of many few solvent elements of Sam Bankman-Fried’s former empire.

- Ripple offered $361.1M price of XRP (XRP-USD) throughout Q1 vs. $226.3M in This fall 2022. The gross sales have been in reference to Ripple’s on-demand liquidity product.

Bitcoin, Ether Costs

- Bitcoin (BTC-USD) dipped 0.7% to $29.41K at 6.15 pm ET and ether (ETH-USD) was 0.9% decrease at $1.90K.

- Customary Chartered believes bitcoin (BTC-USD) may attain $100K by 2024-end because it believes the crypto winter is over. The potential rally might be pushed by the current banking turmoil and a “step by step enhancing” macroeconomic backdrop for dangerous/various property.

Extra on Crypto

Grayscale Bitcoin Belief: Underappreciated Alternative

Monero: An Supreme Lengthy-Time period Alternative In Digital Belongings?

Bitcoin Miners Are Flying, However The place Is Hut 8 Going?

Promote Bitcoin In Could & Go Away (Till It Crosses This Shifting Avg)