By Brynne Ramella, Content material Advertising Supervisor, ProNavigator —

Getting reimbursed for claims is a excessive precedence to your insureds. That places a number of strain in your adjusters. Conventional insurance coverage claims processing includes adjusters working via massive volumes of paperwork. Counting on these handbook processes or legacy software program can result in wrongful claims, incorrect quotes, or lacking paperwork.

In case your group is beginning to expertise these points, it’s time to improve your claims administration software program. On this article, we’ll break down the enterprise wants it is best to think about and options to prioritize earlier than buying a brand new resolution.

What to Take into account Earlier than Buying Claims Administration Software program

Claims administration options usually are not a one-size-fits-all know-how. You have to be sure to choose a software that matches your corporation’s distinctive wants. Earlier than you start researching software program options, ask inner stakeholders the next questions. The solutions you get may also help dictate the claims administration software program you look into.

Do you want on-premises or cloud software program?

On-premises software program is put in straight into your in-house IT system. Cloud-based software program is saved, managed, and accessed via the cloud. There are advantages to each choices.

On-premises methods are usually extra customizable and cloud-based software program requires fewer IT assets. Discuss to your IT division and see which choice is most appropriate together with your present software program setup.

What methods do you might want to combine?

Take into account the extra software program options your claims division makes use of every day, akin to your insurance coverage information administration system. Be sure that your new resolution integrates with these present instruments. A claims administration software could seem excellent on paper. But when it doesn’t combine with the instruments your claims adjusters use, you’re making their jobs more difficult.

What are your plans for development?

Be sure to’re conscious of any plans to develop the claims division within the coming months. In case your division plans to rent a number of extra adjusters, choose a software program resolution that may accommodate extra customers.

What insurance policy do you present?

The traces of insurance coverage you present might dictate the claims administration resolution you go together with. Some distributors will provide customizable options, however others might have a extra slim deal with particular traces. Discuss to the distributors you’re contemplating and ensure they’re appropriate together with your firm’s insurance coverage choices.

What Options Ought to You Search for in a Claims Administration Software program?

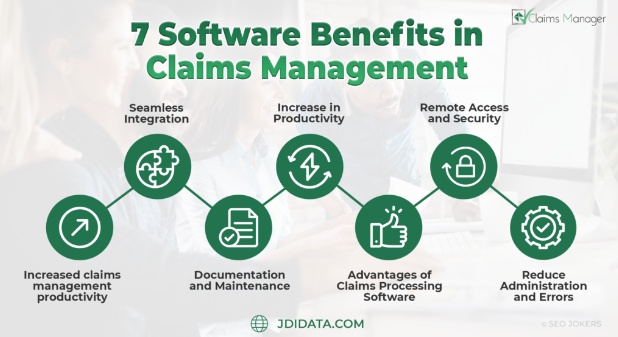

Contemplating your particular enterprise objectives and wishes is step one to find the appropriate claims administration resolution for your corporation. The following step is to verify the software you choose can perform within the precise method you want. Listed here are some normal options you ought to be in search of in a claims administration resolution.

Environment friendly First Notification of Loss (FNOL)

The aim of a claims administration resolution is to make the whole claims workflow run faster and smoother. One option to expedite the method is by choosing an answer with a FNOL characteristic. These options can decide possible whole losses on the FNOL with simply picture information. Adjusters can rapidly decide the following steps in a claims course of with a characteristic like this.

Straightforward Claims Submission Course of

Clients count on digital experiences — the insurance coverage buyer expertise isn’t any completely different. Your insureds need to have the ability to simply file their claims. Prioritize choosing a software with an intuitive, mobile-friendly buyer portal that makes this course of seamless for customers.

Threat Evaluation & Fraud Detection

This can be a vital perform in a claims administration resolution. A danger evaluation and fraud detection options allow adjusters to conduct an intensive danger evaluation and handle fraudulent claims by verifying particulars from varied sources of knowledge. That can permit your clients to be reimbursed sooner.

Automated Workflow

Go together with an answer that automates the spreadsheets and handbook work related to conventional claims processing. A claims administration resolution with automation powered by synthetic intelligence can velocity up the doc processing timeline for present circumstances. Adjusters may also have the ability to overview info from a previous declare multi functional safe location.

Improved Reporting Capabilities

Claims administration and administration is a data-heavy course of to your adjusters. However with the appropriate software program, you need to use that info to your benefit. Choose a software that gives thorough reporting and analytics that you may leverage to enhance processing time, customer support, and your corporation’s backside line.

Claims Monitoring

A claims monitoring characteristic permits you to standardize the information workflow administration for all incoming claims. You’ll have the ability to observe the outline and reason for the loss, outline claims varieties, and provide client-specific information fields. When you might have a stable understanding of claims information, you’ll have higher perception into the danger your group faces.

Cost Processing

Whereas the insurance coverage business at massive is going through strain to digitize, there’s no division extra impacted than claims. Insurance coverage customers need the power to be reimbursed for his or her claims digitally. Search for a system that gives a number of cost choices and boasts top-notch security measures. Practice your name heart brokers on the platform to allow them to provide a human touchpoint to claimants when essential.

Enhance the Worker Expertise and Buyer Satisfaction with Claims Administration Software program

Go to our weblog to study extra about the advantages of bettering your organization’s tech stack.

About ProNavigator

ProNavigator supplies a knowledge-sharing platform, Ask Sage, utilized by among the largest insurance coverage organizations in North America to avoid wasting time, present superior service, and seize income alternatives. The platform leverages the most recent developments in synthetic intelligence and pure language understanding to immediately, robotically, and precisely retrieve solutions to workers’ questions. For extra info, please go to pronavigator.ai.

SOURCE: ProNavigator