manassanant pamai

Market contributors have recalibrated their expectations for future price cuts by the Federal Reserve’s financial coverage committee, information confirmed on Friday.

The debt ceiling standoff and talks between congressional leaders to achieve an settlement have taken over the highlight this week, however the way forward for the Fed’s financial coverage stays very a lot on traders’ minds.

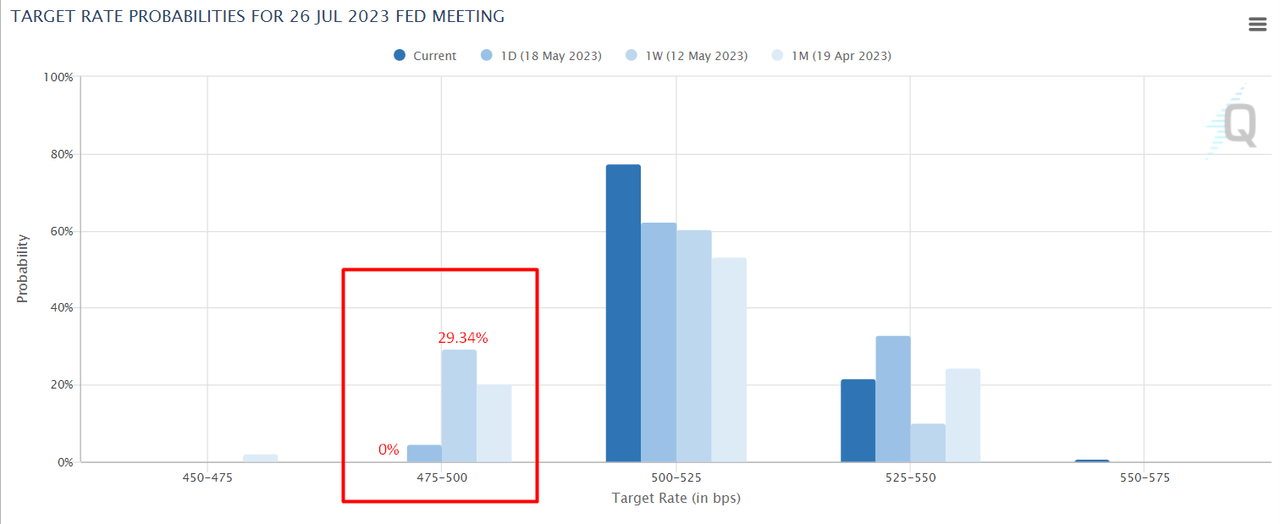

In response to the CME FedWatch instrument, up until even per week in the past on Might 12, markets had been pricing in an almost 30% probability of a 25 foundation level lower on the FOMC’s scheduled assembly in July. That likelihood right now has dropped to zero.

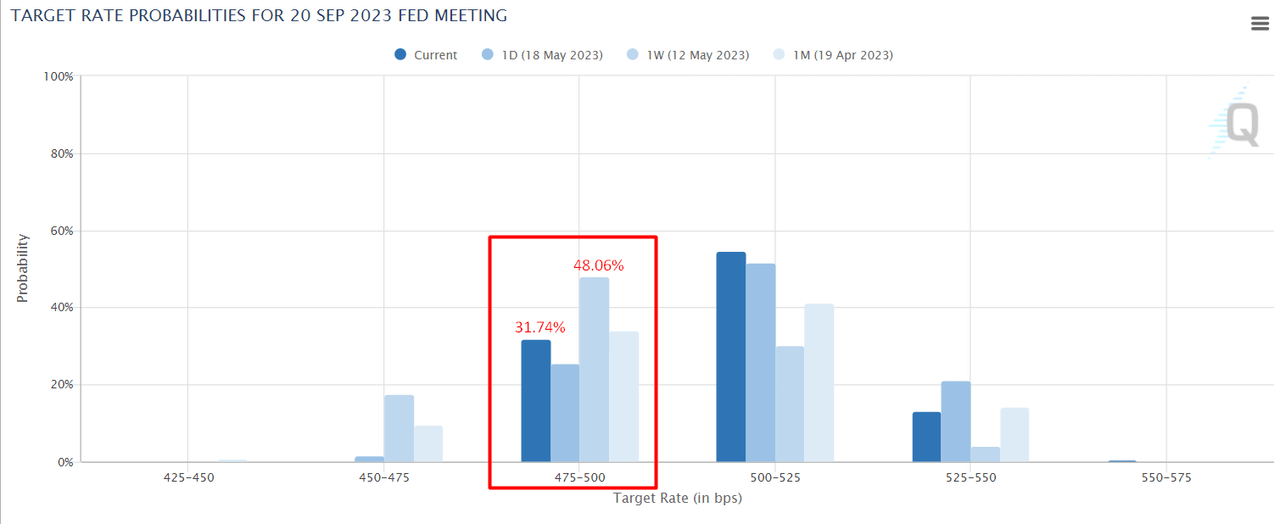

Equally, up until per week in the past on Might 12, markets had been seeing a ~48% likelihood of a 25 foundation level lower on the FOMC’s September assembly. That determine has fallen to about 32% right now.

Within the days after the FOMC’s final assembly on Might 3, traders ramped up their bets that the central financial institution was nearing an finish to its rate-hiking cycle, regardless of no such indication from Fed policymakers who continued to emphasize a “data-dependent” method to elevating charges and reiterated that bringing down inflation remained the final word aim.

A slew of financial information studies just lately have additionally pointed to moderating inflation and a cooling economic system, which added assist to the case for price cuts.

Nonetheless, because the month has progressed, market expectations have develop into extra in sync with Fedspeak.

“The market has rightfully repriced the anticipated Federal Funds price because the launch of the April labor report on Might fifth by slowly ruling out the cuts in 2023,” Macrotheme Capital Administration’s Damir Tokic advised In search of Alpha.

Trying on the expectations for a pause in rates of interest hike, as per the CME FedWatch instrument, up until per week in the past the likelihood of a pause on the FOMC’s June assembly was greater than 99%. That close to certainty has eroded, with the chances now at round 81%.

“The Fed will discover it troublesome to pause in June with the unemployment price at 3.4%, core PCE sticky at 4.6%, and S&P 500 (SP500) at 12% beneath the all-time highs and able to burst larger. Thus, the Fed is probably going not completed but, and the cuts will come solely when the intense financial and market injury turns into apparent,” Tokic added.

The FOMC’s subsequent assembly is scheduled to happen from June 13 to 14.