By Brynne Ramella, Content material Advertising and marketing Supervisor, ProNavigator —

Know-how is pushing the insurance coverage business ahead.

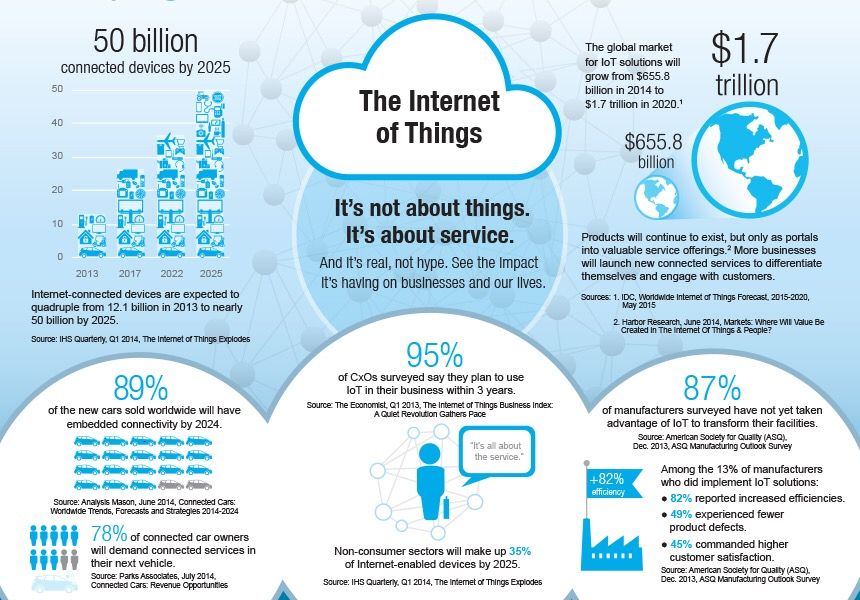

One such development is the Web of Issues (IoT). As NAIC says, IoT refers to a community of internet-connected units transmitting, amassing, and sharing information. The software program inside these purposes analyzes and sends information to cloud servers and enormous databases. These platforms analyze the info with a purpose to pull out essential information.

The most well-liked IoT purposes contain autos related with telematics, sensible residence units, and wearable units like smartwatches. IoT information is distributed again to customers by way of these units or a related web site. These consumer analytics have grow to be immensely helpful to insurance coverage professionals.

How Has IoT Remodeled the Insurance coverage Business?

Supply: The Digital Insurer

Insurance coverage professionals can use the info from IoT units to enhance the understanding of dangers. Beforehand, insurers needed to establish the danger of loss for an asset utilizing proxy information, comparable to administering a survey to prospects. However as Purple Slate states, IoT permits insurers entry to real-time, particular person, and observable information on an asset’s potential loss

Insurers can join with customers by including touchpoints in areas comparable to acquisitions and claims. By amassing this information from a lot of totally different sources, firms will have the ability to acquire a extra full image of their prospects.

This information also can help with elevated precision in assessing danger and pricing insurance policies, which means that brokers have the chance to offer extra personalised choices to prospects. Not solely does this imply extra focused insurance policies, however brokers can provide particular reductions primarily based on an insured’s utilization information.

Advances in know-how at all times include elevated danger. IoT units current new alternatives for cybersecurity threats and claims fraud. However the advantages outweigh the dangers. For instance, NAIC states that IoT might assist insurers lower the price of the claims course of by 30% and likewise decrease premiums for customers. The a number of use instances for the know-how have already begun to make it an asset to professionals within the business.

Advantages of IoT in Insurance coverage

New insurtech merchandise are being launched almost on daily basis. New know-how could also be overwhelming for conventional firms to maintain up with, however IoT is one to keep watch over. Listed below are some advantages insurance coverage professionals can anticipate when implementing IoT units:

- IoT information can be utilized to design insurance policies that match an insured’s way of life higher.

- Firms that use IoT can anticipate lowered prices — AWS stories that IoT in insurance coverage saves companies $9–$15 billion yearly.

- This know-how can be utilized to raised assess and forestall danger, due to alerts from IoT information that advises when and why injury might occur.

- Staff will not want to go to harmful websites in individual to evaluate injury or potential loss.

- Leverage IoT analytics to curb cybersecurity fraud.

- Present higher and extra frequent customer support by way of telematics in IoT units.

5 Use Circumstances for IoT within the Insurance coverage Business

Supply: AI A number of

Regardless of which line you promote, there’s an IoT use case for your small business. These purposes may help you enhance the insurance coverage buyer journey, create extremely, proficient groups, and extra. Listed below are some use instances to contemplate:

- Good homes — Web-powered residence units, comparable to sensible doorbells, smoke alarms, and safety techniques are shortly gaining reputation. Insurers would profit from having access to information from these units, as that data may help avert accidents and permit insurance coverage professionals to offer higher service to prospects. For instance, sensible doorbells may help to establish a theft earlier than it occurs, conserving an insured’s residence protected from catastrophe.

- Related vehicles — Telematics is now getting used to attach vehicles to IoT apps, which is a helpful asset for automotive insurance coverage firms. A driver’s routes, velocity, acceleration, seat belt detection, and extra can now be tracked in real-time. That enables insurers to measure how protected a driver’s journey is, present predictive upkeep, and scale back fraudulent claims.

- Improved healthcare techniques — Good bracelets and watches can entry a wearer’s sleep high quality, coronary heart fee, blood sugar, and extra. These units generally gamify train, which can encourage the wearer to steer a more healthy way of life. Medical insurance firms can use this information to personalize insurance policies and provide financial savings to these prospects with a more healthy way of life.

- A extra related building business — Insuring the development business is difficult. Job websites are sometimes harmful locations and a number of areas within the business have totally different merchandise. IoT units may help preserve building employees a bit safer on the job. For one, embedded sensors within the infrastructure of a home can detect smoke, mildew, and carbon dioxide after which regulate situations to forestall a dangerous occasion. Employees also can don a wearable gadget that might present a warning in the event that they get to shut to a harmful place.

- Improved underwriting course of — IoT units have considerably sped up the underwriting course of. Insurers can now create a greater shopper portfolio, analyze dangers upfront, scale back losses, and enhance total interactions with policyholders. A faster underwriting course of may help expedite different departments inside insurance coverage firms.

How IoT Will Change the Way forward for the Insurance coverage Business

The cutting-edge know-how powering insurtech startups might be intimidating to conventional firms. However implementing IoT purposes can provide stalwart organizations a aggressive edge towards newer firms. Customers admire the velocity and effectivity of insurtech firms. They will discover that with conventional insurance coverage firms that use IoT units.

Count on IoT to grow to be commonplace within the business within the coming years. A latest ACORD survey polled insurance coverage professionals about their outlook on the business over the following 20 years. Practically 50% of respondents mentioned that they anticipate that their biggest long-term supply of aggressive benefit might be how they leverage technological capabilities.

Digital transformation could also be a buzzy subject within the business proper now, however that doesn’t imply your staff must implement all trending software program and know-how without delay. Begin small and slowly start to introduce new items of know-how to your workers. As soon as you’re feeling snug, work your method as much as IoT. It could be a gradual course of, however you’ll really feel the advantages for years to come back.

To be taught extra about the way to construct out your organization’s tech stack, head over to the ProNavigator weblog for the most recent insights!

About ProNavigator

ProNavigator supplies a knowledge-sharing platform, Ask Sage, utilized by a number of the largest insurance coverage organizations in North America to save lots of time, present superior service, and seize income alternatives. The platform leverages the most recent developments in synthetic intelligence and pure language understanding to immediately, robotically, and precisely retrieve solutions to workers’ questions. For extra data, please go to pronavigator.ai.

SOURCE: ProNavigator