(Bloomberg) — Asian shares face headwinds Monday after the rally in US bonds and shares hit a wall Friday amid concern that the Federal Reserve can’t declare victory over inflation but.

Most Learn from Bloomberg

Fairness futures for Australia have been little modified whereas these for Hong Kong dropped 0.7% and an index of US-listed Chinese language shares fell greater than 2%. Japanese markets shall be closed for a vacation and buying and selling in Hong Kong shall be delayed because of a storm.

China’s central financial institution is anticipated to maintain its medium-term lending facility unchanged as authorities proceed to under-deliver on market requires extra stimulus. Merchants can even be parsing gross home product figures that shall be muddied by the bottom results of Shanghai’s lockdown final yr. Bloomberg Economics sees GDP progress slowing after “chopping via the statistical noise.” The tempo of retail gross sales and industrial manufacturing are additionally projected to ease.

Contracts for the S&P 500 and Nasdaq 100 have been marginally decrease as buying and selling received underway in Asia on Monday. The underlying indexes posted delicate losses Friday as merchants cited consolidation after an advance that also drove the S&P 500 to its finest week since mid-June.

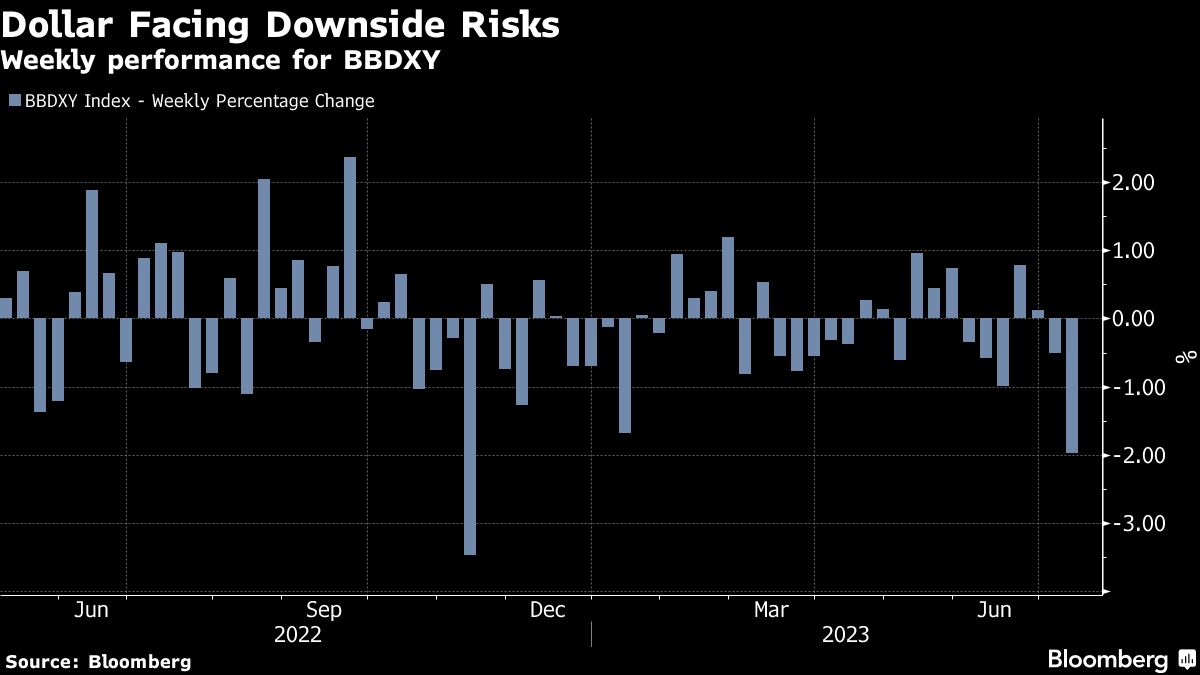

The greenback was combined and inside tight ranges after a gauge of dollar energy snapped a five-day shedding streak Friday. Its weekly slide has the index again close to ranges final seen in April 2022 as some strategists and traders counsel its lengthy bull run is over.

The yen was regular after Financial institution of Japan Governor Kazuo Ueda mentioned uncertainty stays excessive over the US and world economies. He additionally mentioned the on the finish of a Group-of-Seven assembly that there was not a lot change in Japan’s bond-market performance from the final financial coverage assembly in June.

Yields on Australia’s policy-sensitive three-year authorities bond rose three foundation factors and the speed on the 10-year maturity edged up by one foundation level.

Within the US bond market on Friday, Treasuries reacted instantly to a report displaying client sentiment soared to an nearly two-year excessive — whereas short-term worth expectations rose. The entrance finish of the yield curve took the brunt of the promoting, with the speed on two-year Treasuries rising by 14 foundation factors. That was a stark distinction to the slide in charges over the previous few days.

“We expect it’s untimely to declare victory on inflation and anticipate volatility to stay elevated over the close to time period,” JPMorgan Chase & Co. strategists led by Phoebe White wrote in a observe, even after different information final week “revived the market narrative surrounding immaculate disinflation and a gentle touchdown.”

Fed officers continued to sound cautious.

Late Thursday, Governor Christopher Waller mentioned he anticipated two extra fee will increase this yr to carry inflation right down to the two% purpose, although extra good information on costs might obviate the necessity for the second hike.

Swaps pricing present expectations that the Fed is nearly sure to boost its benchmark fee by one other 25 foundation factors when it meets later this month, with a roughly one-third probability that the central financial institution will make another such transfer earlier than stopping its cycle.

Traders additionally sifted via outcomes from JPMorgan, Wells Fargo & Co. and Citigroup Inc., which simply beat lowered analyst estimates. UnitedHealth Group Inc. surged as income allayed fears of runaway medical prices.

Key occasions this week:

-

China key coverage fee determination, retail gross sales, industrial manufacturing, funding and GDP, Monday

-

G-20 finance ministers and central bankers are assembly in India, Monday

-

European Central Financial institution President Christine Lagarde speaks, Monday

-

US empire manufacturing, Monday

-

US retail gross sales, industrial manufacturing, enterprise inventories, cross-border funding, Tuesday

-

Eurozone, UK CPI, Wednesday

-

US housing begins, Wednesday

-

China mortgage prime charges, Thursday

-

US preliminary jobless claims, present house gross sales, Conf. Board main index, Thursday

-

Japan CPI, Friday

Among the foremost strikes in markets:

Shares

-

S&P 500 futures fell 0.1% as of 8:06 a.m. Tokyo time. The S&P 500 fell 0.1% Friday

-

Nasdaq 100 futures fell 0.1%. The Nasdaq 100 was little modified Friday

-

Australia’s S&P/ASX 200 Index futures have been little modified

-

Cling Seng Index futures fell 0.7%

Currencies

-

The Bloomberg Greenback Spot Index was little modified

-

The euro was little modified at $1.1225

-

The Japanese yen was little modified at 138.78 per greenback

-

The offshore yuan was unchanged at 7.1584 per greenback

-

The Australian greenback fell 0.1% to $0.6831

Cryptocurrencies

-

Bitcoin rose 0.2% to $30,336.72

-

Ether rose 0.2% to $1,933.57

Bonds

Commodities

-

West Texas Intermediate crude fell 0.8% to $74.81 a barrel

-

Spot gold fell 0.2% to $1,952.23 an oz

This story was produced with the help of Bloomberg Automation.

–With help from Rita Nazareth.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.