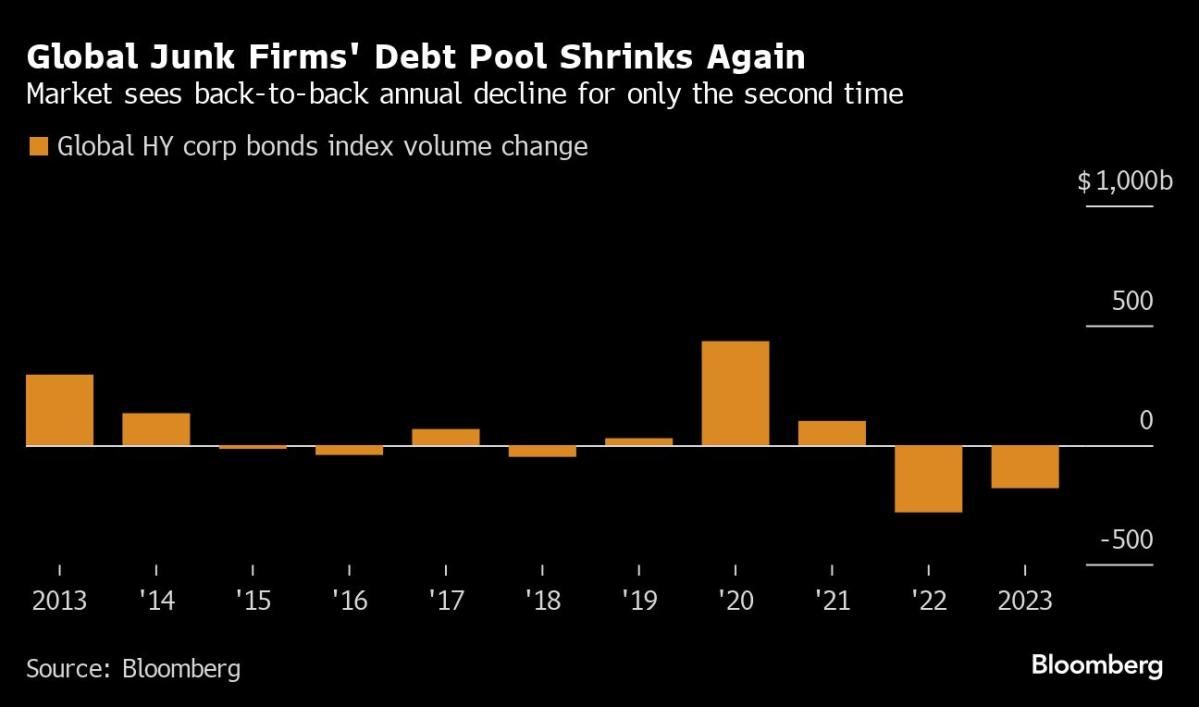

(Bloomberg) — The worldwide pile of junk-rated company debt is on observe to shrink for a second consecutive yr, with urge for food for the dangerous securities diminishing in a world the place 10-year Treasuries pay about 4.5%.

Most Learn from Bloomberg

As central banks have hiked rates of interest and refinancing has grown costlier, a minimum of some firms wish to reduce their debt hundreds. The high-yield market has shrunk by round 8% this yr to $1.94 trillion after shedding a file $281 billion in face worth in 2022, based on Bloomberg index knowledge. If the development continues, it could be simply the second time the junk universe has contracted in successive years.

“The high-yield market is getting smaller because it’s received too costly for issuers to make use of,” mentioned Barnaby Martin, a credit score strategist at Financial institution of America Corp. “The market at this time feels very totally different to 10 years in the past.”

After years of low charges and simple cash, junk-rated firms are discovering they will solely borrow sporadically, and infrequently the marketplace for promoting bonds is all however closed. A sequence of financial institution collapses in March tightened credit score availability, and extra not too long ago surging yields final month left some corporations both suspending or scrapping deliberate bond gross sales, contributing to the shrinking market.

Many firms will not have that choice going ahead. Goldman Sachs Group Inc. strategists calculate that the amount of excellent US junk bonds maturing in 18 to 36 months is at ranges final seen in 2007, which means debtors will quickly sufficient be pressured to refinance that debt.

Learn Extra: Junk Companies ‘Chunk the Bullet’ as Maturity Wall Grows to ‘07 Highs

A few of these corporations have a minimum of three strikes towards them: excessive debt hundreds, a scarcity of entry to capital markets and weakening earnings. These elements mixed are likely to signpost a flip within the credit score cycle, Jim Cielinski, international head of fastened revenue at Janus Henderson Traders wrote per week in the past.

“Though the affect will likely be lagged, the staggering rise in rates of interest is predicted to have a domino impact on the present credit score cycle,” Cielinski wrote. “Refinancing debt hundreds at greater charges can result in decreased curiosity protection ratios and in the end extra defaults within the years forward.”

In the meantime, international junk bond yields have jumped in latest months, and even after declining in early November, are nonetheless properly above August ranges, Bloomberg index knowledge present, nearing the very best degree since early June. Financial institution finance can also be more durable to safe and the leveraged mortgage market stays gummed up, limiting different choices.

Different elements contributing to the shrinking of the high-yield market embrace firms shopping for again their very own debt at a reduction and the return of rising stars, largely firms which have pulled themselves out of the pandemic downturn and returned to funding grade. Ford Motor Co.’s improve to blue-chip standing alone pulled $46.8 billion of debt out of junk bond indexes final month — shrinking the scale of the Bloomberg international high-yield index by probably the most since 2005.

Learn Extra: Junk Market Shrinks Most in 18 Years After Ford Wins Improve

The one different time the worldwide pool of riskier corporations’ debt suffered back-to-back annual declines was 2015 by 2016, when the Fed kicked off a rate-hiking cycle after years of straightforward cash following the 2008 international monetary disaster.

The market grew once more the next yr when the financial system strengthened and defaults fell. This time, debtors is probably not so fortunate.

Week in Evaluate

-

JPMorgan Chase & Co. is looking for a possible companion to develop its non-public credit score enterprise and speed up its push into one of many hottest areas in leveraged finance.

-

Dangers are constructing contained in the $1.6 trillion non-public credit score market and regulators aren’t doing sufficient, based on two Pimco executives.

-

A Blackstone Inc. and Permira-led consortium are aiming for personal credit score financing for his or her potential buyout of Adevinta because of the weak state of the European leveraged mortgage market.

-

Non-public lending funds are engaged on early-stage plans to supply as a lot as €1 billion ($1.1 billion) to finance the potential buyout of German insurance coverage dealer Gossler, Gobert & Wolters.

-

Non-public credit score funds raised $38.8 billion globally within the third quarter, a 43% drop from the earlier three months, based on knowledge from Preqin.

-

An improve of Ford Motor Co.’s credit standing to funding grade pulled $46.8 billion of debt out of junk bond indexes final month — serving to to shrink a worldwide benchmark of the asset class by probably the most since 2005.

-

Elevating Cane’s Eating places LLC bought $500 million of junk bonds after receiving sturdy demand from buyers that permit it reduce the yield it’s paying on the debt.

-

WeWork Inc. is making ready to file for chapter as quickly as subsequent week.

-

Company lending has made up the majority of exercise within the booming non-public credit score market, however now buyers are starting to pour cash into different niches — notably asset-based debt, based on KKR & Co.

-

China Evergrande Group gained a closing likelihood to repair its restructuring plan that’s on the verge of a collapse. A Hong Kong courtroom pushed again a winding-up listening to, giving the developer extra time to draft a brand new plan after the earlier one hit roadblocks.

-

Chinese language junk greenback bond merchants had been watching China Vanke Co., the nation’s second-largest builder by contracted gross sales, after its observe climbed following a biggest-in-a-year selloff.

-

On the Transfer

-

Vincent Lu, an alum of JPMorgan Chase & Co., Wells Fargo & Co. and Blackstone Inc., joined asset-management agency Lord, Abbett & Co.

-

Centerview Companions has employed Morgan Stanley managing director Brendan MacBride for its debt advisory arm.

-

Financial institution of Nova Scotia’s fastened revenue dealer Chris Thomas is retiring after 42 years on the Canadian lender.

-

Anne-Marie Peterson has joined Intermediate Capital Group as a managing director in non-public credit score.

-

BNP Paribas has recruited Tomas Lundquist to move its Capital Markets, Transaction Banking and Company Protection staff within the Nordics.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.