(Bloomberg) — Europe’s financial system is predicted to avert a recession, however getting inflation again to regular ranges might take a number of years, in keeping with the Worldwide Financial Fund.

Most Learn from Bloomberg

The expansion outlook in Asia seems bitter as China struggles to lure international funding, Hong Kong progress lags behind and Indonesian exports deteriorate.

Within the US, inflation expectations continued to climb as customers anticipated larger gasoline costs. Separate knowledge from the Census Bureau present how inflation continues to be inflicting vital monetary stress for a lot of Individuals.

Listed here are a number of the charts that appeared on Bloomberg this week on the most recent developments within the international financial system:

Europe

Europe’s financial system is unlikely to crash — at the same time as a more-than yearlong bout of interest-rate will increase tames inflation, in keeping with the IMF. Whereas rising wages are aiding Europe’s financial restoration, additionally they threat stoking additional inflationary pressures — particularly in the event that they aren’t matched by enhancements in productiveness, the IMF stated.

Lower than a month after the opposition gained a parliamentary election, Poland’s central financial institution is once more nervous about inflation. The U-turn is about to fan hypothesis concerning the position of politics within the governor’s coverage calculus.

Asia

China is struggling in its try to lure foreigners again as knowledge reveals extra direct funding flowing in a foreign country than coming in, suggesting corporations could also be diversifying their provide chains to scale back dangers. Overseas direct funding fell $11.8 billion within the July-to-September interval, marking the primary contraction since information began in 1998.

Hong Kong lowered its financial progress forecast for this yr in an indication that powerful instances are nonetheless forward for the monetary hub amid a muted post-pandemic restoration. The revision comes after town reported weaker-than-expected third-quarter GDP progress, highlighting vital challenges to the financial system regardless of a lift from the tourism revival.

Indonesia will ramp up the disbursement of social help within the coming months after authorities underspending halted seven straight quarters of above-5% progress. Indonesia’s slowest progress tempo in two years underscores the headwinds to restoration for Southeast Asia’s largest financial system. Exports, a key progress driver, shrank by essentially the most since 2020.

US

US customers’ long-term inflation expectations elevated to the best since 2011, whereas considerations about excessive borrowing prices and the financial system’s prospects mounted in a recent blow to sentiment. The report confirmed expectations for gasoline costs over the quick and future elevated to the best this yr. That’s at odds with the present development in costs on the pump, which have steadily fallen since late September.

US households tapped their bank cards extra within the third quarter, when robust spending helped to energy blockbuster financial progress. However Millennials and other people with scholar debt and auto loans are falling additional behind on funds.

Inflation might have light however the pressure it’s imposed on American households has not, in keeping with Census Bureau polling. Southern states have the best incidence of inflation stress.

Rising Markets

Brazil’s retail gross sales rose extra forecast after policymakers dedicated to sustaining their present tempo of rate of interest cuts for the approaching months.

The world’s largest oil producer is now additionally aiming to change into a key hub for making batteries for electrical automobiles, as authorities in Saudi Arabia search for new methods to diversify the financial system and develop a home auto business.

World

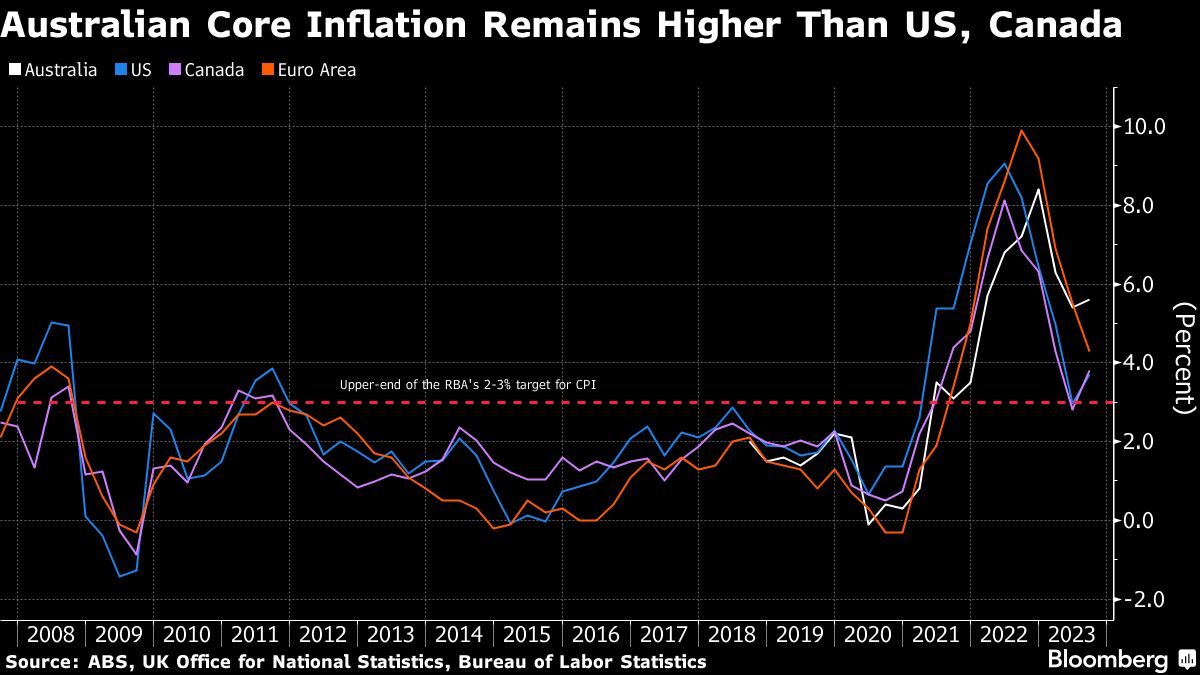

Australia’s central financial institution resumed elevating rates of interest in a extensively anticipated transfer, whereas signaling the next hurdle to additional tightening. Poland’s central financial institution unexpectedly halted its easing cycle, whereas Mexico saved charges at a report excessive for a fifth straight assembly. Peru lower rates of interest for a 3rd straight month.

China is overhauling the best way it lends to creating nations, a technique which will assist their largest official creditor preserve a narrowing lead over the US and its Group of Seven allies. Beijing has begun shifting away from the massive bilateral offers it was desperate to strike a decade in the past — when it first launched its flagship Belt and Highway Initiative that primarily lends to infrastructure initiatives.

–With help from Rebecca Choong Wilkins, Shawn Donnan, Claire Jiao, Francine Lacqua, John Liu, Xinyi Luo, Mirette Magdy, Jonnelle Marte, Reade Pickert, Andrew Rosati, Zoe Schneeweiss, Grace Sihombing, Alex Tanzi, Fran Wang and Alexander Weber.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.