That is The Takeaway from as we speak’s Morning Temporary, which you’ll join to obtain in your inbox each morning together with:

The Fed has been the story of the yr for traders.

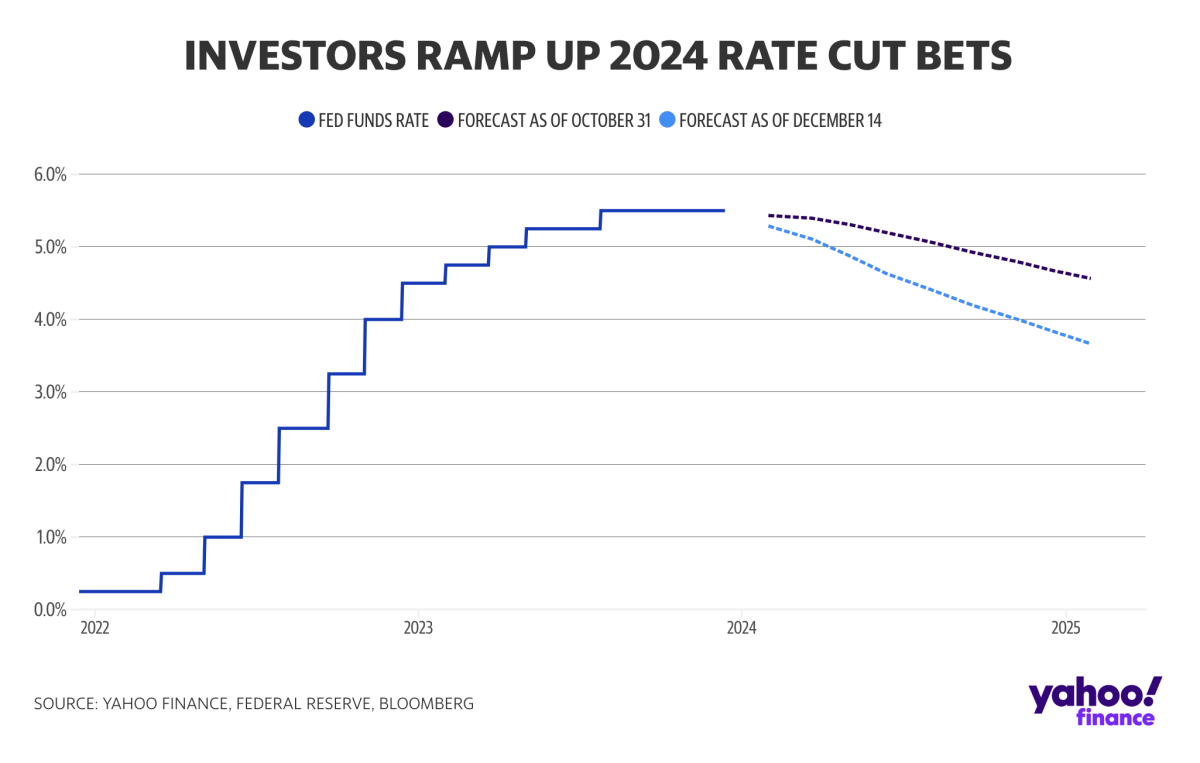

And this week, Jay Powell & Co. gave markets a preview of the story they anticipate to inform in 2024: decrease rates of interest.

After pushing rates of interest to 22-year highs this summer time, our Chart of the Week reveals decrease charges providing mild on the finish of the tunnel to traders by subsequent spring.

In so many quarters the astronomical charges — the very best in reminiscence for anybody below a sure age — have been a ball and chain. And naturally, this was by design. The Fed’s charges are supposed to assist sluggish an overheated financial system down.

However early this yr, traders started sniffing out the Fed’s future modifications.

The usually rate-sensitive tech sector — largely the megacap “Magnificent Seven” shares — shrugged off the Fed’s rising charges, climbing an AI-fueled rocket ship and anticipating what Powell confirmed this week.

With the Fed’s pivot now coming into clear focus, nevertheless, the Magnificent Seven now not must play Atlas to the index.

Reduction is on the best way. Even for these shares, sectors, and traders that doubted the sign markets had been sending for a lot of the yr.

The Fed is completed. The stress is off. A brand new chapter begins.

Click on right here for in-depth evaluation of the most recent inventory market information and occasions shifting inventory costs.

Learn the most recent monetary and enterprise information from Yahoo Finance