(Bloomberg) — Battle over Taiwan would have a price in blood and treasure so huge that even these unhappiest with the established order have motive to not danger it. Bloomberg Economics estimate the worth tag at round $10 trillion, equal to about 10% of worldwide GDP — dwarfing the blow from the struggle in Ukraine, Covid pandemic and International Monetary Disaster.

China’s rising financial and navy heft, Taiwan’s burgeoning sense of nationwide id, and fractious relations between Beijing and Washington imply the situations for a disaster are in place. With cross-Strait relations on the poll, Taiwan’s Jan. 13 election is a possible flashpoint.

Most Learn from Bloomberg

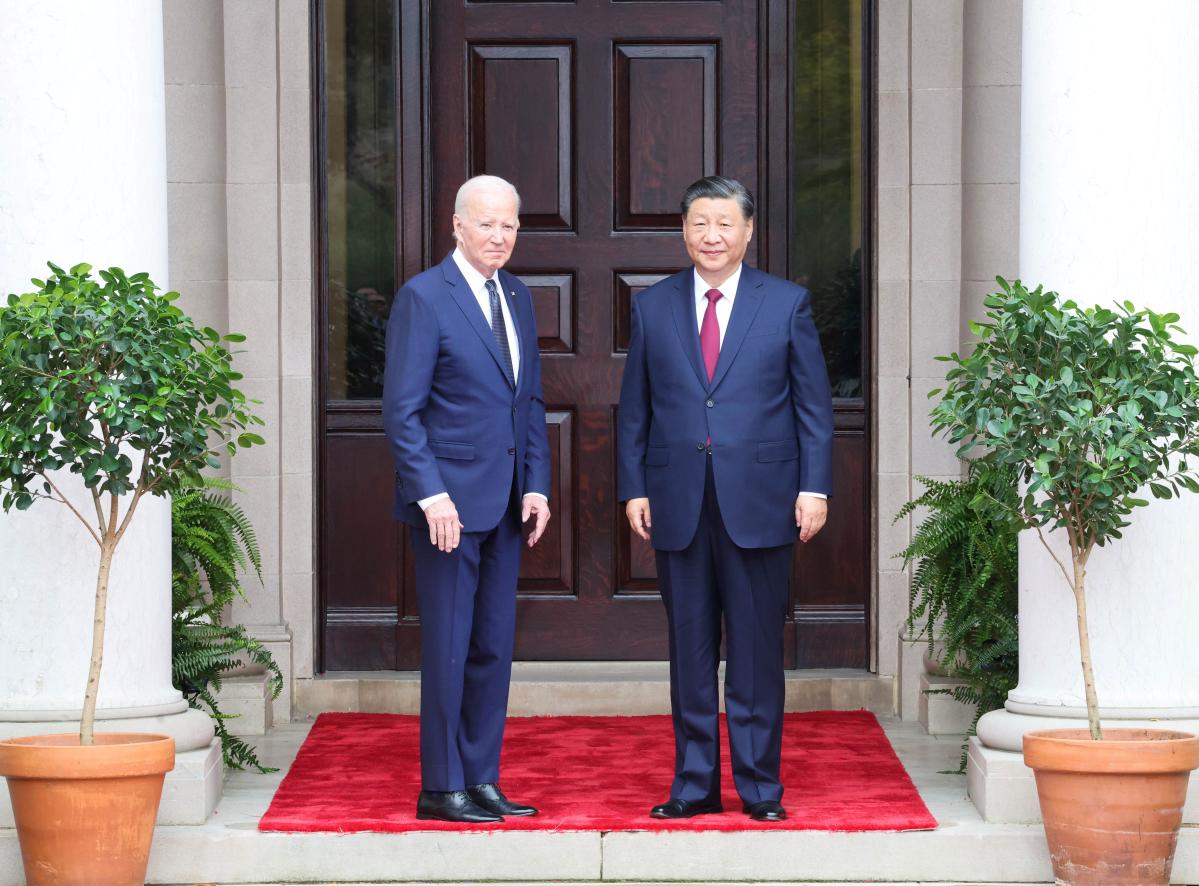

Few put a excessive likelihood on an imminent Chinese language invasion. The Individuals’s Liberation Military is not massing troops on the coast. Experiences of corruption in China’s navy forged doubts on President Xi Jinping’s potential to wage a profitable marketing campaign. US officers say tensions eased considerably on the November summit between President Joe Biden and Xi, who pledged “heart-warming” measures to woo international traders.

Nonetheless, the outbreak of struggle in Ukraine and Gaza are reminders of how long-simmering tensions can erupt into battle. Everybody from Wall Avenue traders to navy planners and the swathe of companies that depend on Taiwan’s semiconductors are already transferring to hedge towards the danger.

Nationwide safety specialists within the Pentagon, suppose tanks within the US and Japan, and international consulting corporations are gaming out eventualities from a Chinese language maritime “quarantine” of Taiwan, to the seizure of Taiwan’s outlying islands, and a full-scale Chinese language invasion.

Jude Blanchette, a China knowledgeable on the Middle for Strategic and Worldwide Research, says curiosity in a Taiwan disaster from multinational corporations he advises has “exploded” since Russia’s 2022 invasion of Ukraine. The topic comes up in 95% of conversations, he stated.

Russia’s invasion of Ukraine, and the semiconductor scarcity because the world reopened from Covid lockdowns, present a small glimpse of what’s at stake for the worldwide economic system. The impression of struggle within the Taiwan Strait could be far greater.

Taiwan makes many of the world’s superior logic semiconductors, and loads of lagging edge chips as effectively. Globally, 5.6% of whole worth added comes from sectors utilizing chips as direct inputs — practically $6 trillion. Complete market cap for the highest 20 clients of chip big Taiwan Semiconductor Manufacturing Co. is round $7.4 trillion. The Taiwan Strait is among the world’s busiest transport lanes.

Modeling the price of a disaster

Bloomberg Economics has modeled two eventualities: a Chinese language invasion drawing the US into a neighborhood battle, and a blockade chopping Taiwan off from commerce with the remainder of the world. A set of fashions is used to estimate the impression on GDP, taking account of the blow to semiconductor provide, disruption to transport within the area, commerce sanctions and tariffs, and the impression on monetary markets.

For the primary protagonists, different main economies, and the world as an entire, the most important hit comes from the lacking semiconductors. Manufacturing unit strains producing laptops, tablets and smartphones — the place Taiwan’s high-end chips are the irreplaceable “golden screw” — would stall. Autos and different sectors that use lower-end chips would additionally take a big hit.

Limitations to commerce and a big risk-off shock in monetary markets add to the prices.

Within the case of a struggle:

-

Taiwan’s economic system could be decimated. Primarily based on comparable current conflicts, Bloomberg Economics estimates a 40% blow to GDP. A inhabitants and industrial base targeting the coast would add to the human and financial value.

-

With relations to main commerce companions turned off and no entry to superior semiconductors, China’s GDP would undergo a 16.7% blow.

-

For the US, farther from the middle of the motion however nonetheless with lots at stake — via the reliance of Apple on the Asian electronics provide chain, for instance — GDP could be down 6.7%.

-

For the world as an entire, GDP could be down 10.2%, with South Korea, Japan and different East Asian economies most impacted.

A key assumption on this state of affairs is that the US would achieve enlisting allies in concerted and extreme financial sanctions towards China.US officers say that the Chinese language response to then-US Home Speaker Nancy Pelosi’s go to to Taipei in August 2022 helped persuade different Group of Seven nations that the danger of battle is actual. Beijing noticed it as a shift in the established order that made Xi seem weak, notably after home commentators recommended that China would be capable of cease her from touchdown in Taipei.

The fallout from the Pelosi go to, which noticed China conduct large-scale naval drills seen as observe runs for a blockade, helped construct diplomatic muscle reminiscence for concerted reactions, the US officers stated.

“China’s rhetoric and the Individuals’s Liberation Military response to Pelosi’s go to triggered a wave of quiet company contingency and state of affairs planning,” stated Rick Waters, managing director of the China observe at Eurasia Group and previously the highest China coverage official on the State Division.

Bloomberg Economics additionally modeled what a yearlong blockade of Taiwan by mainland China would imply for the worldwide economic system:

-

For Taiwan, a small, open economic system that has thrived via commerce, GDP within the first 12 months could be down 12.2%.

-

For China, the US, and the world as an entire, GDP within the first 12 months could be down 8.9%, 3.3% and 5% respectively.

The rationale for the smaller impression relative to the struggle state of affairs is that whereas the worldwide economic system nonetheless loses entry to all of Taiwan’s chips, different shocks — together with tariffs between the US and its allies and China, the disruption to Asian transport and monetary market fallout — are scaled down.The Bloomberg Economics train is — so far as we’re conscious — distinctive in bringing collectively geopolitical and financial modeling experience. Nonetheless, the outcomes are considerably pushed by the state of affairs assumptions, and the band of uncertainty is large. A struggle or blockade of shorter period, and with much less important disruptions to semiconductor provide and commerce, would have a smaller impression.

A consequential election

Even when the result of Taiwan’s election doesn’t set off an instantaneous disaster, it’s going to outline the course of cross-Strait relations.

Lai Ching-te — at present serving as vp within the Democratic Progressive Social gathering administration — has been at pains to current himself as a continuity candidate, with no plans to disturb relations with Beijing.

Up to now, although, he described himself as a “pragmatic employee for Taiwanese independence.” For Beijing, which views the island as a part of its territory, any formal push for independence would cross a crimson line. At his assembly with Biden, Xi expressed deep concern about the potential for a Lai win, in accordance with a senior administration official.

The DPP counterpoint, which aligns with the evaluation in Washington, is that Beijing’s belligerence is the issue — not Taiwan’s need for continued autonomy.

Lai’s opponents — Hou Yu-ih of the Kuomintang and Ko Wen-je of the Taiwan Individuals’s Social gathering — are each promising pragmatic steps to enhance relations with Taiwan’s big neighbor, with out sacrificing the island’s de facto independence.

US officers say China could also be planning a multipronged response to the election, with navy incursions, financial sanctions and gray zone ways like cyber-attacks.

Officers in Washington and Taipei say the interval from the election in January to inauguration of the brand new president in Could is a hazard zone for Chinese language actions geared toward hemming in Taiwan’s subsequent president.

Straitened circumstances

Whoever wins must cope with a modified, and difficult, set of cross-Strait realities.

In 1979, when the US switched diplomatic recognition from Taipei to Beijing, US GDP was ten occasions that of China, China’s navy was within the early phases of modernization, and Taiwan was nonetheless underneath single-party rule.

Quick ahead to immediately and China’s GDP has closed a lot of the hole with the US, its navy boasts near-peer standing — particularly near residence — and Taiwan’s liberal democracy is a visual distinction to China’s authoritarian system.

Statements by leaders in Beijing and Washington have added to the stress.

Xi has stated greater than as soon as that Taiwan isn’t a problem that may be “handed down era after era.” Alongside along with his efforts to modernize the navy, these statements have spurred hypothesis he desires to ship unification on his watch, with 2027 cited as a hazard 12 months by US intelligence and navy officers.

At his assembly with Biden, Xi vented frustration with the view that China’s forces are aiming at readiness for an invasion by 2027, which he stated was mistaken, in accordance with a senior US official.

For his half, Biden has stated the US would come to Taiwan’s help within the occasion of a Chinese language invasion. That bluntness eroded layers of fastidiously crafted ambiguity concerning the US place, stoking anger in China and issues the US is emboldening pro-independence boisterousness.

Bloomberg Economics’ Taiwan stress index — based mostly on warning phrases utilized by China’s Ministry of Overseas Affairs and navy incursions in Taiwan’s air protection identification zone — exhibits the temperature over the past 12 months and a half elevated.

Traders and companies are already getting ready for the worst. Kirk Yang, chairman of fairness funding fund Kirkland Capital and an knowledgeable on Asia expertise corporations, says the fund’s place in Taiwan is now near zero. Geopolitical tensions have “added incentive to reduce investments at a sooner tempo” he stated. He’s in good firm. Legendary investor Warren Buffett offered down his stake in TSMC within the first quarter of 2023, citing geopolitical danger as the rationale.

Companies and governments are additionally making preparations. Greenfield funding in electronics and electrical tools rocketed to $181 billion in 2022 from $48 billion in 2020 as governments within the US, Japan and Germany opened their wallets to diversify sources of semiconductor provide.

If there’s an upside from the Bloomberg Economics evaluation, maybe it’s this: The $10 trillion value of a disaster could be so excessive for all gamers that the motivation to keep away from it’s sturdy.The established order could be nobody’s very best consequence, however for Taipei, Beijing and Washington the options are worse. That’s a motive Taiwan’s ambiguous autonomy would possibly stay an equilibrium consequence, even because the situations that make it so shift.

Methodology

For the struggle and blockade eventualities, Bloomberg Economics use a collection of fashions to evaluate the impression of disruptions to semiconductor provide, commerce obstacles, and monetary market shocks.

Provide chain disruptions are assessed utilizing OECD Commerce in Worth Added knowledge for 2018. OECD input-output knowledge are used to estimate the direct disruptions to sectors utilizing semiconductors as an enter (laptop, electronics and optical merchandise; electrical tools; equipment and tools; motor autos, trailers and semi-trailers; different transport tools), and to evaluate the spillover impression onto different sectors – for instance the impression on steel output if manufacturing of vehicles slows.

Commerce shocks are assessed utilizing the WTO International Commerce Mannequin (GTM) (Aguiar et al, 2019). The GTM is a recursive computational common equilibrium mannequin based mostly on the GTAP mannequin (model 7) (Corong et al, 2017). We shock tariffs and non tariff measures, together with as a proxy for sanctions and export controls.US allies are outlined based mostly on commerce shares, treaty relationships, and Bloomberg Economics’ judgement. Australia, Canada, the European Free Commerce Affiliation, the European Union, Japan, Mexico, South Korea and the UK are outlined as US allies.

Monetary shock impacts are estimated following a structural strategy based mostly on the Bayesian International VAR mannequin (Bock, Feldkircher and Huber, 2020). The mannequin is amended barely by including log actual fairness costs for every nation as in Mohaddes and Raissi (2020).

Uncertainty within the monetary markets is modeled as a world shock to the VIX.

A key uncertainty within the evaluation is the extent to which lacking semiconductor output from Taiwan may very well be changed by output in different areas, labored round by manufacturing corporations, or backstopped from inventories.

The Bloomberg Economics eventualities assume that every one manufacturing utilizing semiconductors as inputs must be lowered according to the discount in semiconductors availability.

For superior electronics comparable to smartphones utilizing cutting-edge logic chips, this interprets right into a 60% discount in manufacturing within the blockade state of affairs, rising to 85% within the struggle state of affairs when entry to South Korean manufacturing can be severely curtailed.

For sectors utilizing lagging-edge logic chips, like these utilized in autos and residential electronics, which means 35% within the blockade state of affairs when Taiwan’s output goes offline, and 62% within the struggle state of affairs when output from China, Japan, and South Korea can be misplaced.

Actuality might find yourself being higher. For instance, different nations might amp up chip manufacturing, or auto corporations and different producers would possibly discover work arounds for lacking inputs.

It may be worse. For instance, if Taiwan’s chips are usually not replaceable and use of them is distributed extensively throughout merchandise. If manufacturing for all sectors utilizing main and lagging edge chips goes to zero, the blow to international GDP within the struggle state of affairs will increase from 10.2% to 14%.

—With help from Betty Hou, Eleonora Mavroeidi, Jennifer Creery, Bhargavi Sakthivel, Sam Dodge and Nick Hallmark.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.