New SMA Weblog by Mark Breading, Accomplice, Technique Meets Motion —

We are saying it usually right here at SMA – the private traces phase regularly leads the insurance coverage trade with deploying new improvements, notably inside distribution. Over the subsequent 5 years, insurers targeted on private traces will possible proceed to spearhead the distribution revolution via new applied sciences and channel methods. The place insurers make investments immediately to help distributors will set the stage for his or her channel partnerships sooner or later, both constructing stable bonds with brokers/brokers and others or de-emphasizing some channel companions.

SMA’s new analysis report, Distribution Applied sciences for Private Traces: Service Plans in 2023 and Past, particulars findings from a survey of executives on the present state of digital capabilities supplied to distribution companions, an evaluation of the challenges and obstacles to deploying new capabilities, and carriers’ plans to place new digital gross sales and servicing capabilities into the market.

Two key themes emerge when analyzing carriers’ prime investments in digital gross sales applied sciences for private traces: rising automation and enhancing efficiencies between insurers and distributors. Seven out of ten insurers recognized information pre-fill as one in every of their prime investments for gross sales, enabling them to collect extra dependable info for quoting whereas additionally minimizing the backwards and forwards between underwriters and brokers. The second-highest funding space, e-Signature capabilities, additionally improves efficiencies by streamlining the binding and coverage issuance course of. In distinction, the analysis additionally reveals the place insurers are investing the least. Within the space of digital gross sales capabilities, insurers are focusing the least on proposal instruments, which solely 6% of insurers say they prioritize immediately.

Inside digital servicing investments, analysis reveals self-service capabilities are main insurers’ precedence lists. Most insurers say they’re investing in servicing portals for brokers and over half are additionally investing in capabilities comparable to on-line file-a-claim or pay-a-bill capabilities. However, no insurer indicated investing in an agent cell app.

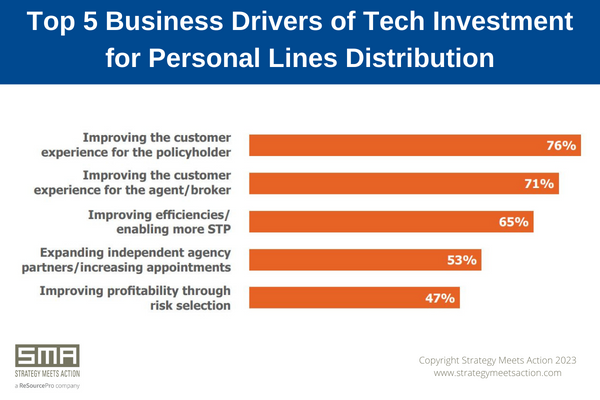

In a market comparable to private traces the place prospects and brokers anticipate on-demand service, it’s crucial for insurers to repeatedly put money into digital choices and preserve nimble expertise roadmaps. Understanding the wants of stakeholders and allocating investments accordingly to boost digital capabilities not solely improves the client expertise of brokers and policyholders but in addition delivers larger efficiencies internally.

For extra info on private traces distribution expertise methods and investments, see our current analysis report, Distribution Applied sciences for Private Traces: Service Plans in 2023 and Past. This report is a part of SMA’s analysis sequence based mostly on surveys and interviews of insurers, businesses, brokers, MGAs, and others within the distribution channel, together with insights from ReSource Professional’s in depth footprint of distribution purchasers. Contact the creator for extra info on this new analysis and advisory companies for distribution.

Contact the creator for extra info.

About The Creator

Mark Breading is understood for his insights on the way forward for the insurance coverage trade and progressive makes use of of expertise. Mark consults with insurers and expertise corporations on forward-thinking methods for achievement within the digital age. His ingenious methodologies, recent concepts, artistic conceptualizations, and talent to include InsurTech and transformational tech in enterprise methods are unparalleled. He additionally leads SMA’s analysis program, publishing 25-30 analysis experiences per yr and conducting numerous customized analysis initiatives for insurer and vendor purchasers. His thought management within the areas of InsurTech, transformational applied sciences, buyer expertise, and digital methods has earned him a rating of one of many “High World Influencers in InsurTech” by InsurTech Information and Onalytica and a spot within the ten finalists for the “High World IoT in Insurance coverage Influencer Award.”

Earlier than becoming a member of SMA in 2009, Mark spent 25 years with IBM in roles together with the World Insurance coverage Strategist and Director of World Monetary Providers Govt Conferences along with management roles in consulting and advertising. Mark co-developed IBM’s Account Primarily based Advertising program and led the worldwide mission workplace to implement ABM throughout all trade verticals worldwide. Mark has held each technical and enterprise roles in gross sales, consulting, advertising, and enterprise technique and has suggested insurers world wide for nearly 30 years.

About SMA, a ReSource Professional firm

At Technique Meets Motion, our purchasers advance their strategic initiatives and speed up their transformational journeys by leveraging our forward-thinking insights, deep vendor data, and huge trade experience. Technique Meets Motion is an advisory agency that works solely with insurers, MGAs, and distributors within the P&C market. For extra info, go to www.strategymeetsaction.com.

About ReSource Professional

ReSource Professional brings built-in operational options to insurance coverage organizations to enhance progress, profitability and insurance coverage outcomes. Headquartered in New York, ReSource Professional’s international service facilities deal with consumer operational wants across the clock. Acknowledged as an trade thought chief and listed as one in every of Inc. 5000 Quickest Rising Personal Firms yearly since 2009, the corporate is famend for its deal with innovation, service excellence and trusted partnerships, and its distinctive productiveness platform for insurance coverage operations. Greater than 5,000 ReSource Professional workers present devoted help to a whole bunch of insurance coverage organizations, constantly attaining a +97% consumer retention price over a decade. For extra info, go to www.resourcepro.com.

SOURCE: Technique Meets Motion (SMA)

Tags: carriers, Mark Breading, private traces, Technique Meets Motion (SMA), expertise funding