(Bloomberg) — The US financial system is testing bond merchants’ religion that the Federal Reserve will ship a collection of interest-rate cuts this yr.

Most Learn from Bloomberg

The surprising surge in hiring in January confirmed there’s little strain on the central financial institution to begin easing financial coverage simply but, giving it time to see if inflation is headed sustainably towards its 2% goal.

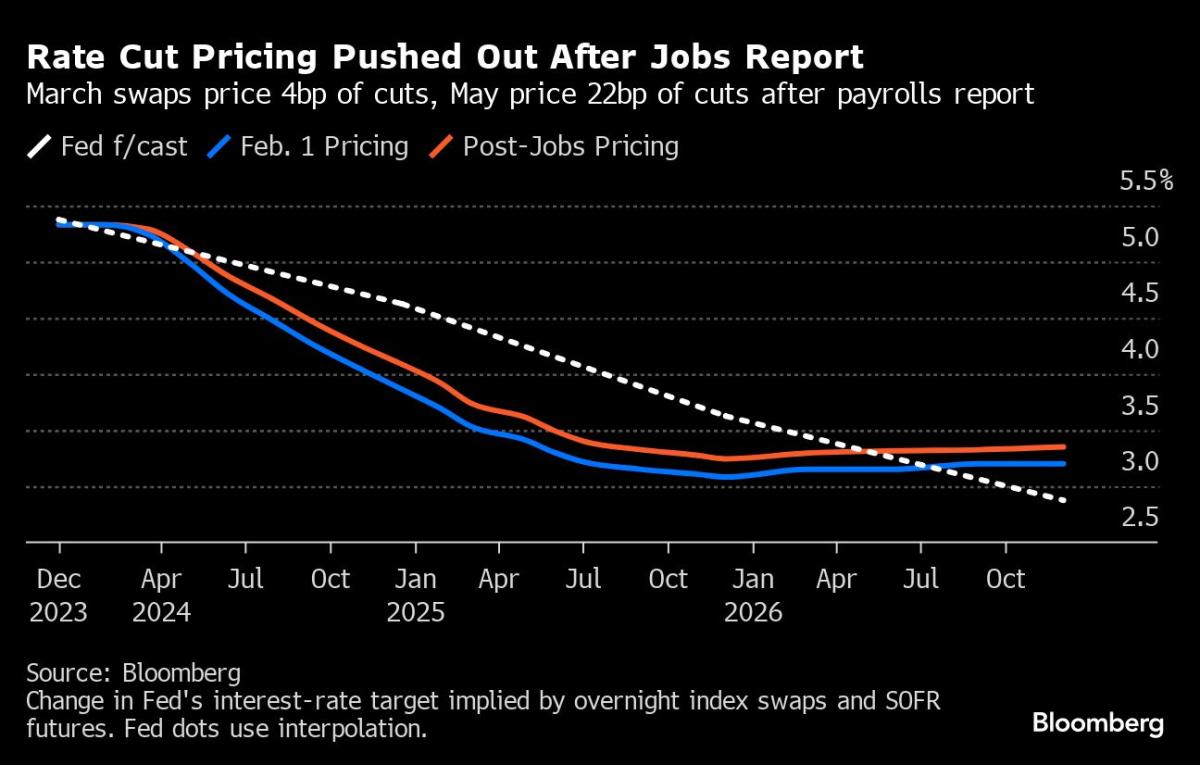

Fed Chair Jerome Powell reiterated such a wait-and-see method from final week — which drove merchants to slash bets on a primary fee minimize earlier than Might — in an interview on CBS’s 60 Minutes Sunday night.

The “hazard of shifting too quickly is that the job’s not fairly achieved, and that the actually good readings we’ve had for the final six months one way or the other end up to not be a real indicator of the place inflation’s heading,” Powell mentioned within the interview.

However Powell left little doubt that the central financial institution will begin loosening this yr because the post-pandemic inflation surge subsides. That’s left bond merchants satisfied charges are coming down in some unspecified time in the future — whilst questions mount about how far the central financial institution will go.

“The Fed can ship three to 4 fee cuts as the speed of inflation retains coming down,” mentioned Kevin Flanagan, head of fastened earnings technique at Knowledge Tree Investments. However he mentioned the soar in job progress and wages in January do “problem the Treasury market’s narrative that the labor market goes to melt to the purpose the place you’re going to have aggressive Fed easing.”

Learn extra: Powell Says Fed More likely to Wait Past March to Minimize

For Priya Misra, portfolio supervisor at J.P. Morgan Asset Administration, the uncertainty concerning the Fed’s timing has elevated the attraction of five-year notes, which she sees as doubtless benefiting from an extended rate-cutting marketing campaign.

“The later the Fed begins the method of normalization, the extra it is going to doubtless should do as a result of lags,” she mentioned.

The financial system has constantly defied fears that the Fed’s fee hikes — which stopped in July — would set off a recession. As an alternative, it has continued to develop at a stable tempo, and employers added 353,000 jobs to their payrolls in January, the most important month-to-month soar in a yr and practically twice what economists anticipated.

The figures unleashed a contemporary selloff within the bond market Friday, pushing up yields throughout the board. These on two-year Treasuries jumped as a lot as 20 foundation factors to over 4.4%, the most important one-day spike since March.

Treasuries slid on the open in Asia as Powell’s feedback underscored the chance that bond buyers had overshot in pricing for fast fee cuts. Treasuries fell, with benchmark 10-year yields climbing 4 foundation factors to 4.06% as of 8:04 a.m. in Hong Kong. The dollar held features over all Group-of-10 friends with Bloomberg Greenback Spot Index rising as a lot as 0.2%.

What Bloomberg’s Stategists Say…

“The panopoly of labor market figures in January have been tremendous sturdy. Evidently, that is bearish the bond market and 2024 Fed pricing, at the very least within the first half of the yr.”

— Cameron Crise, MLIV macro strategist

Click on right here to learn extra

But the still-widespread conviction that the Fed will begin easing coverage by mid-year is setting a form of ground underneath the bond market. Every time yields spike, consumers have tended to flood again in, in search of to lock within the comparatively excessive payouts earlier than they disappear.

Furthermore, there’s a report $6 trillion stashed in money-market funds, which can begin to be shifted towards bonds as soon as short-term charges begin coming down.

Whereas the present energy of the financial system has meant there’s little urgency, policymakers are aware of the danger of preserving rates of interest too excessive for too lengthy. The speed is now in a band of 5.25% to five.5%, greater than twice the extent that’s seen as impartial to progress. As inflation comes down, that leaves loads of room to make coverage much less restrictive.

Powell on Wednesday mentioned that the central financial institution is “in a danger administration mode” earlier than altering course. Furthermore, he mentioned officers welcome a powerful labor market so long as inflation continues to recede.

Learn Extra: Goldman, BofA Throw within the Towel on March Price Minimize From Fed

That messaging is a motive why the futures market continues to cost in about 5 quarter-point cuts this yr and nonetheless put some odds on a primary transfer in March, even after Powell mentioned that was unlikely.

So there could also be room for bonds to rally. Bruno Braizinha, charges strategist at Financial institution of America Corp., suggested buyers to arrange for the danger that 10-year Treasury yields — now simply over 4% — may fall to three% this yr.

“If the market begins to carry down their pricing of the Fed’s impartial coverage fee that would pull yields decrease,” he mentioned. “Additionally, there nonetheless stays danger for a shock to the financial system that may consequence available in the market’s present expectation for a soft-landing not occurring. Moreover, inflation might start to fall extra aggressively.”

What to Watch

-

Financial knowledge:

-

Feb. 5: S&P International US Companies PMI; ISM companies index; Senior mortgage officer survey

-

Feb. 7: MBA mortgage functions; commerce steadiness; client credit score

-

Feb. 8: Preliminary jobless claims; wholesale commerce gross sales and inventories

-

-

Fed calendar:

-

Feb. 5: Atlanta Fed President Raphael Bostic

-

Feb. 6: Cleveland Fed President Loretta Mester; Minneapolis Fed President Neel Kashkari; Boston Fed President Susan Collins; Philadelphia Fed President Patrick Harker

-

Feb. 7: Federal Reserve Governor Adriana Kugler; Richmond Fed President Tom Barkin; Fed Governor Michelle Bowman; Collins

-

Feb. 8: Barkin

-

Feb. 9: Dallas Fed President Lorie Logan

-

-

Public sale calendar:

-

Feb. 5: 13-, 26-week payments

-

Feb. 6: 42-day money administration payments; three-year notes

-

Feb. 7: 17-week payments; 10-year notes

-

Feb. 8: 4-, 8-week payments; 30-year bonds

-

–With help from Garfield Reynolds and Michael G. Wilson.

(Updates with Powell’s feedback on CBS interview in third and fourth paragraph. Provides Treasuries, greenback index costs in eleventh paragraph.)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.