(Bloomberg) — Markets took a breather on Friday as traders assessed the outlook for equities after benchmarks from the US to Europe and Japan hit all-time highs within the wake of Nvidia Corp.’s blockbuster earnings.

Most Learn from Bloomberg

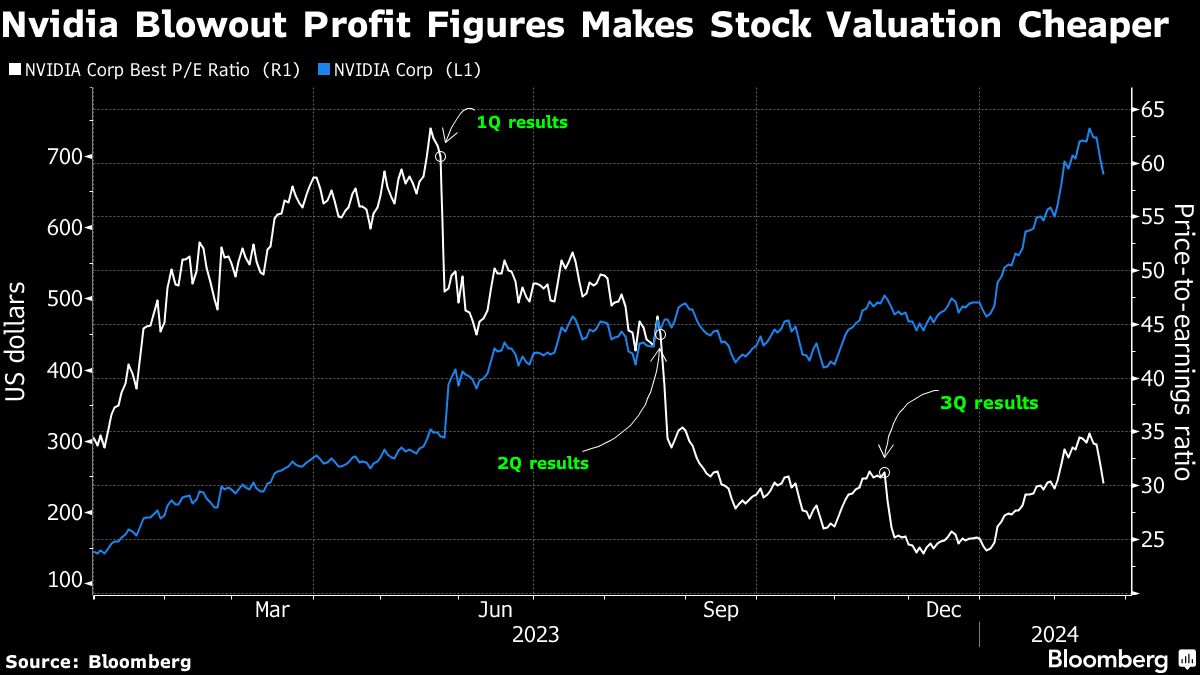

US futures have been little modified after good points in a single day pushed the S&P 500 and Nasdaq 100, together with MSCI’s all-county index, to new data. Nvidia is on monitor to scale $2 trillion in market worth for the primary time ever after shares climbed as a lot as 2.7% in premarket buying and selling, including to Thursday’s meteoric rise.

Nvidia’s $277 billion one-day enhance to its market capitalization on Thursday was the most important single-session improve in worth ever — eclipsing a latest $197 billion achieve by Meta Platforms Inc. The query is whether or not the tech rally might be sustained and broadened to different sectors, at the same time as bets on Federal Reserve fee cuts wane amid knowledge displaying the world’s largest economic system continues to be going sturdy.

“The pace of the tech rally has left traders questioning whether or not to take earnings,” mentioned Mark Haefele, chief funding officer at UBS World Wealth Administration. “Whereas we see benefit in rebalancing portfolios, we consider that retaining strategic publicity to US large-cap expertise is essential, and the rise in tech shares might go additional nonetheless.”

The Stoxx Europe 600 index erased an early achieve amid blended earnings to hover across the document closing stage it reached on Thursday.

UK-based lender Commonplace Chartered Plc climbed greater than 8% after unveiling a revenue beat and share buyback. German insurer Allianz SE declined after non-life insurance coverage earnings missed analysts’ expectations. Deutsche Telekom AG, Europe’s largest telecommunications operator, slipped after a miss in non-US earnings.

European inventory good points have been largely spurred by megacaps ASML Holding NV, SAP SE, LVMH and Novo Nordisk A/S. Identical to the US, Europe now has its personal focus threat, with these 4 shares accounting for greater than half of the Stoxx 600’s advance of three% in 2024, towards a mixed weighting within the benchmark of solely about 10%.

Nonetheless, world fairness returns ought to broaden, although inventory efficiency in 2024 is prone to be about earnings supply, in keeping with Citigroup Inc. strategists. The AI rally and optimism about financial progress at a time of easing financial coverage are a “magic sauce” for extra good points in fairness markets, in keeping with Financial institution of America Corp.’s Michael Hartnett.

Haefele at UBS concurred: “Past expertise, we expect traders must also put together for a possible broadening of the fairness market rally, which might materialize with a mixture of Fed rate of interest cuts, nonetheless sturdy progress, and falling inflation,” he mentioned.

In Asia, China’s benchmark index CSI 300 prolonged its good points to a ninth session, whereas Hong Kong shares have been regular. Australian, Taiwanese and South Korean equities superior. Japanese markets have been closed Friday for a public vacation.

Hawkish Fed

The ten-year Treasury yield rose about two foundation factors after high Fed officers hammered house the message Thursday that the US central financial institution continues to be on monitor to chop rates of interest this yr — simply not anytime quickly. A gauge of the greenback was regular.

In commodities, oil slipped as traders weighed indicators of a tightening market towards persistent issues round demand. Gold fluctuated. Nickel and copper climbed, however iron ore headed for the most important weekly drop in virtually a yr amid issues that Chinese language metal demand could disappoint.

A number of the fundamental strikes in markets:

Shares

-

S&P 500 futures have been little modified as of 5:57 a.m. New York time

-

Nasdaq 100 futures fell 0.1%

-

Futures on the Dow Jones Industrial Common have been little modified

-

The Stoxx Europe 600 was little modified

-

The MSCI World index was little modified

Currencies

-

The Bloomberg Greenback Spot Index was little modified

-

The euro was little modified at $1.0824

-

The British pound rose 0.1% to $1.2675

-

The Japanese yen fell 0.1% to 150.72 per greenback

Cryptocurrencies

-

Bitcoin fell 1% to $51,157.76

-

Ether fell 1.5% to $2,941.06

Bonds

-

The yield on 10-year Treasuries superior two foundation factors to 4.34%

-

Germany’s 10-year yield superior two foundation factors to 2.46%

-

Britain’s 10-year yield superior two foundation factors to 4.13%

Commodities

This story was produced with the help of Bloomberg Automation.

–With help from Michael Msika and Subrat Patnaik.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.