(Bloomberg) — US inventory futures retreated after a sequence of file highs on Wall Road, as traders waited for reassurance that central banks are on observe to chop rates of interest within the coming months.

Most Learn from Bloomberg

Contracts on the S&P 500 and Nasdaq 100 edged decrease, although chipmakers — on the forefront of the current rally — rose in premarket buying and selling. Western Digital Corp., Micron Know-how Inc. and Nvidia Corp. added greater than 1%. Apple Inc. dropped about 1% after being hit with a €1.8 billion ($2 billion) penalty by the European Union, Tesla Inc. fell after Elon Musk’s pay package deal was struck down by a Delaware choose.

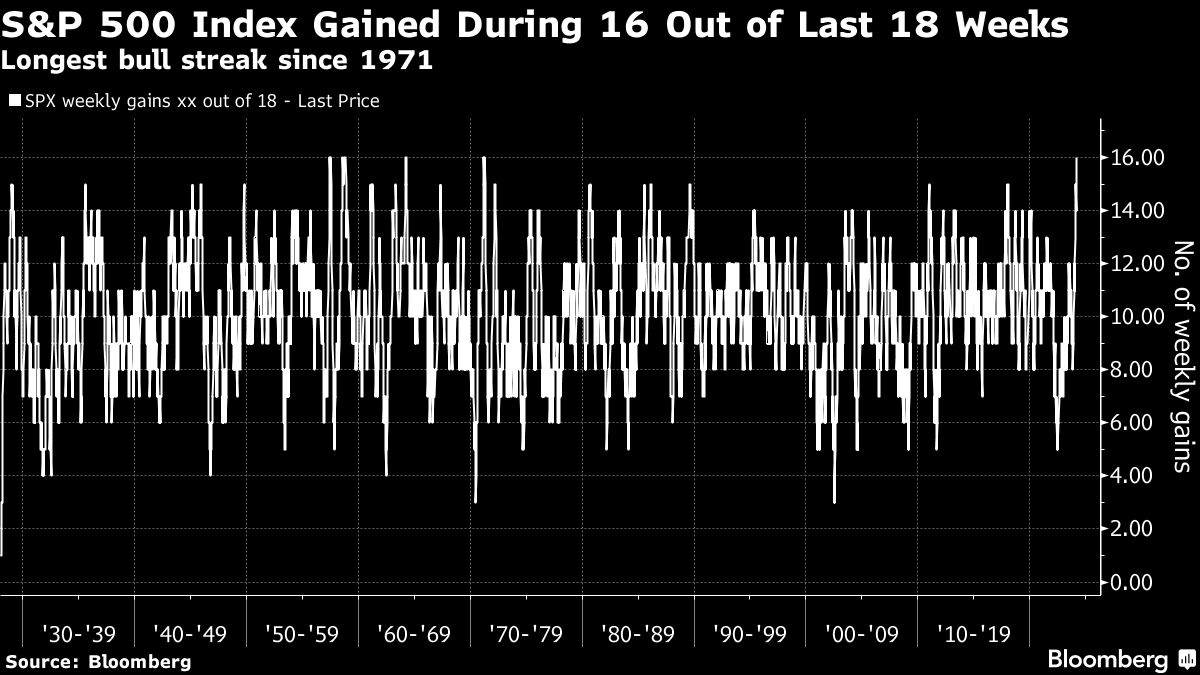

Each US indexes ended Friday at all-time highs, with the S&P 500 having superior in 16 of the final 18 weeks, a run not seen since 1971, Deutsche Financial institution AG analysts identified. That rally was fanned additional final week by US knowledge that bolstered bets the Federal Reserve would have the ability to minimize charges later this yr. The earnings season, in the meantime, confirmed firms averaging 8% earnings progress.

“Higher financial outlook, bullish investor sentiment and a few higher earnings have supported the fairness markets,” Jefferies strategist Mohit Kumar wrote in a notice. “Whether or not it’s the financial outlook or the central financial institution ‘put’ being again on the desk, traders are very optimistic on dangerous property.”

European shares additionally paused close to a file excessive after six weeks of beneficial properties, although the tech subindex outperformed. Treasuries slipped, whereas oil costs steadied close to the very best stage this yr after OPEC+ prolonged manufacturing cuts.

Whereas markets have broadly pushed Fed policy-easing expectations to July, from the beforehand anticipated Might, Kumar nonetheless expects 75-100 foundation factors price of charge cuts this yr.

Some hints might come this week from Fed Chair Jerome Powell’s congressional testimony, whereas the European Central Financial institution will maintain a coverage assembly on Thursday. A raft of financial knowledge can be due, together with US month-to-month payrolls figures on Friday.

In Europe, Supply Hero SE rose after saying the launch of a financing transaction to amend and prolong its financing amenities. Earlier in Asia, the world’s prime chipmaker, Taiwan Semiconductor Manufacturing Co., rose to its highest-ever stage.

Elsewhere, Bitcoin topped $65,000, main merchants to wager the cryptocurrency will surpass the file worth of just about $69,000, hit throughout the pandemic.

Key occasions this week:

-

ECB Governing Council member Robert Holzmann speaks, Monday

-

Fed’s Patrick Harker speaks, Monday

-

Japan’s Tokyo CPI, Tuesday

-

BOJ Governor Kazuo Ueda speaks, Tuesday

-

China Caixin providers PMI, Tuesday

-

China kicks off its 14th Nationwide Individuals’s Congress, Tuesday

-

Eurozone S&P World Providers PMI, PPI, Tuesday

-

US manufacturing facility orders, ISM providers, S&P World Providers PMI, Tuesday

-

Greater than a dozen US states maintain Republican and Democratic primaries, Tuesday

-

Australia GDP, Wednesday

-

UK Chancellor Jeremy Hunt unveils annual finances, Wednesday

-

Eurozone retail gross sales, Wednesday

-

Fed Chair Jerome Powell testifies earlier than Home committee, Wednesday

-

Fed points Beige Guide survey of regional financial circumstances, Wednesday

-

Fed’s Neel Kashkari, Mary Daly communicate, Wednesday

-

China commerce, foreign exchange reserves, Thursday

-

BOJ board member Junko Nakagawa speaks, Thursday

-

ECB charge resolution, Thursday

-

US preliminary jobless claims, commerce, Thursday

-

Fed Chair Jerome Powell testifies earlier than Senate committee, Thursday

-

Fed’s Loretta Mester speaks, Thursday

-

US President Joe Biden delivers the State of the Union tackle, Thursday

-

Eurozone GDP, Friday

-

US nonfarm payrolls, unemployment, Friday

-

Fed’s John Williams speaks, Friday

A few of the foremost strikes in markets:

Shares

-

The Stoxx Europe 600 fell 0.1% as of 12:55 p.m. London time

-

S&P 500 futures fell 0.1%

-

Nasdaq 100 futures had been little modified

-

Futures on the Dow Jones Industrial Common fell 0.3%

-

The MSCI Asia Pacific Index rose 0.4%

-

The MSCI Rising Markets Index rose 0.7%

Currencies

-

The Bloomberg Greenback Spot Index was little modified

-

The euro was little modified at $1.0846

-

The Japanese yen fell 0.2% to 150.40 per greenback

-

The offshore yuan was little modified at 7.2109 per greenback

-

The British pound rose 0.2% to $1.2675

Cryptocurrencies

-

Bitcoin rose 3.7% to $65,155.02

-

Ether rose 0.9% to $3,509.6

Bonds

-

The yield on 10-year Treasuries superior two foundation factors to 4.20%

-

Germany’s 10-year yield declined two foundation factors to 2.40%

-

Britain’s 10-year yield was little modified at 4.11%

Commodities

This story was produced with the help of Bloomberg Automation.

–With help from Aya Wagatsuma, Winnie Hsu, Tassia Sipahutar and Jan-Patrick Barnert.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.