(Bloomberg) — Wholesome US employment positive aspects continued in March whereas wage progress moderated, indicating the nation’s labor market is poised to maintain stoking the economic system with restricted danger of an inflation resurgence.

Most Learn from Bloomberg

Payrolls on the planet’s largest economic system are seen rising by no less than 200,000 for a fourth straight month, in response to a Bloomberg survey of economists. Common hourly earnings are projected to climb 4.1% from the identical month final yr, the smallest annual advance since mid-2021.

Resilient hiring is conserving demand and the economic system shifting ahead on the similar time inflation is slowing, albeit erratically. It’s additionally permitting Federal Reserve policymakers to carry off lowering rates of interest as they await additional declines in value pressures.

Learn extra: Powell Says Newest Inflation Information ‘In Line With Expectations’

Fed Chair Jerome Powell, on Wednesday, headlines a big forged of Fed policymakers who’re as a consequence of converse this week. Amongst others showing are John Williams, Adriana Kugler, Mary Daly, Austan Goolsbee, Lorie Logan and Thomas Barkin.

A rise in labor provide helps to restrict wage pressures that in any other case would danger filtering by to a sustained pickup in inflation.

Friday’s payrolls report can be forecast to indicate the unemployment charge inched down to three.8%, slightly below a two-year excessive hit in February, suggesting the job market is dropping somewhat momentum.

What Bloomberg Economics Says:

“The 2 main surveys used to create the roles report seem to seize completely different points of the US economic system. Spending on providers by these benefiting from asset value appreciation — principally child boomers — has supported employment in leisure and hospitality and well being care.

On the similar time, diminished demand from the much less well-off a part of the inhabitants has translated to slowing enterprise gross sales, and diminished hiring or elevated layoffs in different sectors. We anticipate that dichotomy to as soon as once more present up within the March report, sending blended messages to policymakers.”

— Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For full evaluation, click on right here

February job openings information on Tuesday will provide a glimpse into labor demand. Whereas economists venture a decline, vacancies stay above their pre-pandemic stage.

Different stories within the coming week embody a pair of buying managers surveys from producers and repair suppliers.

Turning north, surveys from the Financial institution of Canada will provide insights into inflation expectations forward of its April 10 charge choice. Canada’s jobs information can be launched concurrently with the US numbers, and commerce information will even be revealed.

Elsewhere, a raft of key inflation numbers are due from the euro zone to Turkey to Colombia. Central banks from India to Chile will set rates of interest.

Click on right here for what occurred final week, and beneath is our wrap of what’s developing within the international economic system.

Asia

China’s official buying managers index, revealed Sunday, confirmed manufacturing exercise expanded in March for the primary time since September, an extra signal that the world’s second-largest economic system is stabilizing.

The Caixin manufacturing gauge the next day is seen displaying a smaller growth in its measure of exercise that focuses extra on the non-public sector.

PMIs from economies all through the Asia-Pacific area the identical day will give a really feel for the regional progress outlook.

The Financial institution of Japan’s quarterly Tankan survey will in all probability mirror a unbroken divergence in sentiment by trade. The gauge for giant producers is seen slipping for the primary time in a yr, whereas the studying for giant non-manufacturers could soar to a 32-year excessive.

Smaller companies will probably be pessimistic, an consequence that might jeopardize wage positive aspects at SMEs wanted to energy the virtuous cycle sought by the BOJ.

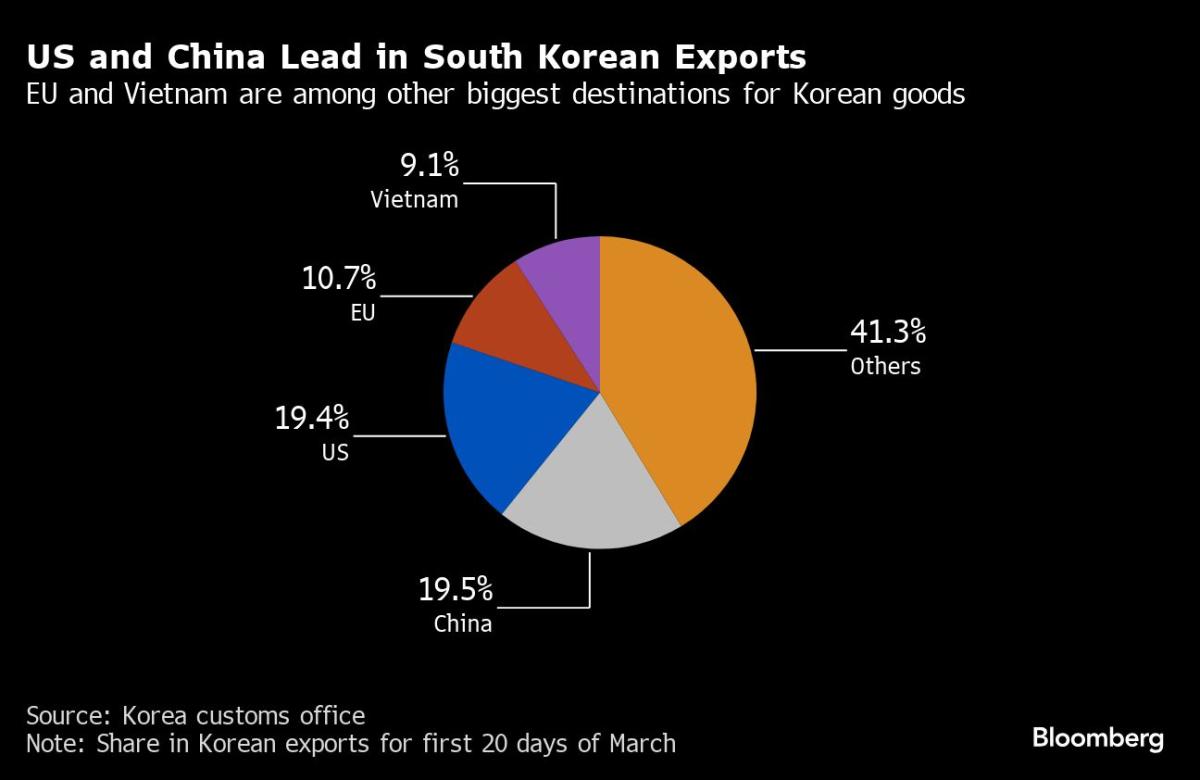

South Korean export progress is forecast to chill in March, whereas client inflation information out Tuesday in all probability eased a tick there.

Worth positive aspects could pace up reasonably in Indonesia and the Philippines. Declines in Thai costs are predicted to ease.

The Reserve Financial institution of Australia releases minutes from its March assembly on Tuesday, with two board members as a consequence of converse through the week. The Reserve Financial institution of India is predicted to maintain its important coverage charges regular on Friday.

Europe, Center East, Africa

After final week’s consumer-price stories from France, Italy and Spain, and following a region-wide vacation on Monday, additional puzzle items will emerge revealing the energy, or in any other case, of euro-area pressures.

German inflation on Tuesday is anticipated to indicate additional weakening towards the two% goal. The European Central Financial institution will unveil its survey of client expectations the identical day.

The euro-zone inflation quantity can be revealed on Wednesday. Outcomes anticipated by economists at 2.5% — and three% for the underlying gauge that strips out risky vitality and meals objects — could maintain officers solely inching towards slicing charges within the coming months as they gauge how their coverage is constricting progress.

Governing Council members have till the tip of day Wednesday to share their views earlier than a blackout interval kicks in forward of their April 11 choice. Additional clues about their pondering could emerge the next day, when an account of their final assembly is revealed.

On Thursday, Sweden’s Riksbank will launch minutes of its March choice, shedding mild on an consequence that noticed officers agency up plans to chop charges sooner or later within the second quarter.

Switzerland will launch inflation numbers on Thursday. Whereas an acceleration is predicted, if it is available in as forecast at 1.4% that might nonetheless be nicely beneath the ceiling focused by the Swiss Nationwide Financial institution, which not too long ago reduce charges.

And in Turkey, the place the central financial institution has been aggressively tightening, information on Wednesday could present one other acceleration in consumer-price progress towards 70%.

A number of financial conferences will happen this week in Europe and Africa:

-

In Sierra Leone, with inflation nonetheless above 40%, officers is perhaps persuaded to boost borrowing prices once more on Tuesday.

-

The identical day, Lesotho, which pegs its foreign money to the South African rand, could comply with its neighbor and maintain the important thing charge at 7.75% to assist its economic system.

-

In East Africa, Kenya’s financial authority can be set to go away its benchmark on maintain on Wednesday after a foreign money rally helped mood costs.

-

Additional east, Mauritian officers could hike borrowing prices after inflation hit an eight-month excessive amid current heavy rains from tropical cyclones.

-

Again to Europe, Poland’s central financial institution is poised to maintain its benchmark at 5.75% on Thursday towards the backdrop of a standoff with the federal government.

-

Romania’s central financial institution could think about the timing for its first charge reduce after inflation began to ebb. That’s additionally on Thursday.

Latin America

Chile on Monday posts February GDP-proxy information, probably cementing the view that its economic system is on the rebound.

The central financial institution on Tuesday is all however sure to trim borrowing prices for a sixth straight assembly, with an early consensus forecasting a 75 basis-point reduce to six.5%, although an uptick in client costs and wobble in inflation expectations could put a smaller discount in play.

Brazil releases a raft of knowledge, together with month-to-month commerce, industrial manufacturing, present account, overseas direct funding and first and nominal finances figures.

The week’s spotlight in Mexico comes with the posting of the minutes of Banxico’s March 21 choice to chop the important thing charge to 11%. Whereas the post-meeting communique tilted hawkish, the minutes could push that vibe up a notch or two.

Peru’s inflation information on Monday could present the annual print falling beneath 3%, sufficient to influence financial institution President Julio Velarde and colleagues to get again to slicing borrowing prices at their April 11 assembly.

Colombia’s central financial institution posts the minutes of its March 22 choice, when it doubled the tempo of easing and lowered its charge to 12.25%.

With March client value information on Friday anticipated to indicate a twelfth straight month of disinflation, the chances are stacked in favor of one other half-point transfer at BanRep’s April assembly.

–With help from Zoe Schneeweiss, Robert Jameson, Patrick Donahue, Brian Fowler, Laura Dhillon Kane and Molly Smith.

(Updates with China PMIs in Asia part)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.