Relating to what you’ll pay for the king’s automotive insurance coverage, the precise quantity is calculated utilizing a mixture of private particulars and data concerning the automotive you wish to insure. These particulars make up your distinctive profile, which helps us work out the chance that we’d be taking to cowl your automotive, and that is what we use to calculate your premium.

Look, there are some particulars which you can’t do something about, like your gender and age. The actual fact is, in case you’re beneath 25, you’re going to pay extra since you’re thought-about riskier to insure. However there are different elements that may very well be inflicting you to pay greater than you should for automotive insurance coverage. Components that you would probably change to deliver your premium down.

- The way you drive

We have a look at the way you’ve been driving to get a way of how dangerous you might be on the street. The final rule is that in case you’ve been in a number of accidents or claimed a bunch of occasions inside a brief timeframe, you’ll pay extra.

Added to this, in case you drive longer distances or are simply on the street extra typically, it tells us that you simply’re extra uncovered to issues going fallacious since you’re behind the wheel extra typically. And this could additionally result in larger premiums.

There are 2 potential options. Firstly, you would take a sophisticated driving course and produce your danger down as a driver, and secondly, you would drive much less through the use of public transport or becoming a member of a elevate membership.

- Your credit score historical past

This can be a bit bizarre as a result of it doesn’t actually appear tied to the automotive itself, however a poor credit score rating could make you pay extra. A foul rating is actually because you haven’t paid your payments on time, you’ve missed funds, you’ve bought excessive bank card balances, and also you’ve saved previous, unused credit score accounts open. That form of factor. A foul rating tells us that you would be an unreliable payer, which makes you dangerous to insure… Which is why you would pay extra.

The excellent news is which you can enhance your credit score rating by paying your payments on time, decreasing your bank card balances, closing unused accounts, and even getting an expert to provide you recommendation on further enhancements.

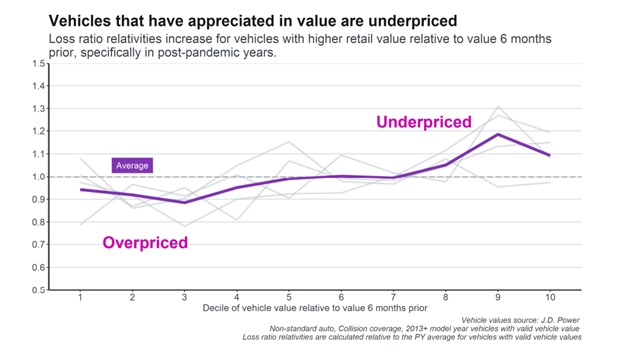

- Your automotive is pricey to insure

The make, mannequin and 12 months of your automotive is a big issue that we use to work out how a lot you’ll pay. Basically, in case you’ve gone with one thing that’s costly to restore or substitute, it prices extra to insure.

We’re undoubtedly not saying that it is best to instantly promote the one you love wheels and get one thing you don’t wish to drive simply because it’s cheaper to insure. However there are occasions in life the place you could have to relook your decisions. You may be within the sort of monetary hassle the place promoting your high-risk and costly Toyota Fortuner in favour of one thing related however much less dear is sensible.

After all, there’s a much less dramatic answer. You may additionally add security options to your automotive to assist decrease your premiums, like a monitoring system, an immobiliser, anti-smash-and-grab, and even window tints.

- You’ve gone for the costliest coverage

Some insurance policies value greater than others, which isn’t information. Our complete automotive insurance coverage coverage is the king’s most costly choice, as a result of it covers essentially the most danger, together with harm to your individual automotive. It’s additionally often obligatory in case your automotive is financed, but when your automotive isn’t financed and is older, paid off, and cheaper to repair, then you would think about a less expensive coverage.

The king’s cheaper automotive insurance coverage choices:

- Theft and write-off: You’re lined for the entire lack of your automotive (like if it’s stolen, hi-jacked, or in an accident and written off).

- Third get together, fireplace and theft: You’re lined for theft and hi-jacking, plus legal responsibility to different folks and their property.

- Third get together solely: You’re lined for legal responsibility for unintentional damage to different folks or harm to their property.

- The surplus quantity in your coverage

The surplus famous in your coverage could cause the price of your insurance coverage to skyrocket, as a result of the decrease the surplus you select, the upper your automotive insurance coverage premium (and vice versa).

We’re undoubtedly not saying that it is best to select an excellent excessive extra as a way to make your premium the bottom of the low. However you would select an extra quantity that makes your premium extra inexpensive, whereas nonetheless being cheap to pay in case you declare.

- The kind of driver’s licence that you’ve got

Maybe this can be a unusual issue, however the truth is that your driver’s licence can have an effect on how a lot you pay for canopy. For example, in case your licence is new, it says that you simply’re an inexperienced driver, even in case you’ve been (illegally) driving for years. It additionally tells us that you simply most likely haven’t had steady automotive insurance coverage, which once more might make your automotive insurance coverage value extra.

One other element that may make your cowl costlier is your licence code. You see, a Code 10 (C, C1) licence = larger premiums than a Code 8 (B, EB) licence, which is essentially as a result of the Code 10 licence isn’t as thorough as a Code 8.

The king creates a holistic image

We don’t simply have a look at 1 element after we create your profile and calculate your premium. This can be a good factor, as a result of particulars like the kind of licence you will have can’t simply be modified… Fortunately, there are issues which you can both change or do in a different way which might make a distinction and make your insurance coverage cheaper.

In the end, you’ll be able to discuss to us. We’re not simply concerning the enjoyable. We’re concerning the (enjoyable)ctional aspect of automotive insurance coverage, too, and we may help you get a easy, low cost automotive insurance coverage quote in minutes.

WhatsApp us on 0860 50 50 50 or click on right here to get a easy low cost, commitment-free quote.

Abstract

Article Title

6 Errors that make you pay extra for automotive insurance coverage

Description

Insurance coverage errors you’re making that trigger your automotive insurance coverage premiums to be far more costly. Right here’s what to do about it.

Creator

The king

Writer Title

King Value Insurance coverage

Writer Brand