(Bloomberg) — European actual property shares headed for his or her largest three-day advance since March, whereas oil climbed as merchants weighed provide cuts.

Most Learn from Bloomberg

International inventory market buying and selling was gentle on Tuesday, with US exchanges closed for the Independence Day vacation. Europe’s Stoxx 600 edged larger on buying and selling quantity that was a 3rd decrease than the 30-day common. US futures have been little modified, whereas Canada’s benchmark fairness gauge rose.

Actual property topped positive aspects amongst European trade teams as Swedish property supervisor Castellum AB jumped as DNB Financial institution ASA beneficial shopping for the inventory due to its enticing valuation. Belgium’s Warehouses de Pauw CVA rose after boosting its earnings outlook.

Deal exercise additionally sparked investor curiosity on Tuesday. Vienna-based OMV AG surged after Bloomberg Information reported the agency and Abu Dhabi are in talks to create a chemical compounds and plastics firm price greater than $30 billion.

In the meantime, On line casino Guichard-Perrachon SA shares have been suspended after surging 16%, because the French retailer acquired provides from Czech billionaire Daniel Kretinsky and a gaggle led by telecom billionaire Xavier Neil.

After shares rallied within the first half of the 12 months, buyers are fearful that larger charges and a worsening financial backdrop will restrict positive aspects from right here on. Friday’s nonfarm payrolls report shall be intently watched for clues on the trajectory of financial coverage, earlier than focus turns to the earnings season subsequent week.

In the meantime, strategists are more and more warning concerning the dangers to US shares after a steep first-half rally. Citigroup Inc.’s Chris Montagu mentioned positioning seems “very prolonged” and cited information displaying that buyers piled into bullish bets on US inventory futures towards the tip of June.

Amongst different notes of warning, Goldman Sachs Group Inc. strategists wrote that it’s too early to dismiss the chance of upper rates of interest weighing on shares. On Monday, a key phase of the Treasury yield curve approached its most inverted stage in a long time, with the two-year be aware yield exceeding the 10-year price by as a lot as 110.8 foundation factors.

“We stay cautious on equities amid a broadly muted financial backdrop,” mentioned Luca Paolini, chief strategist at Pictet Asset Administration. “A niche has opened up between earnings expectations and main financial indicators. In some unspecified time in the future, the hole should shut. Both the financial system will rebound — which we expect unlikely — or equities will reprice.”

Elsewhere, Brent crude traded close to $76 a barrel as oil merchants thought of the consequences of output cuts. On Monday, Saudi Arabia mentioned that it’ll delay a unilateral 1 million barrel-a-day provide discount into August, a transfer merchants had broadly anticipated. Russia introduced a discount in exports, whereas Algeria deliberate to make extra modest curbs.

In Asia, Sri Lankan shares jumped essentially the most in additional than a 12 months as a plan to revamp home debt eased concern over monetary sector stability. Japan’s Nikkei 225 fell from its highest stage since 1990.

Pakistan’s rupee rallied in opposition to the greenback on optimism the Worldwide Financial Fund’s bailout will increase demand for the nation’s belongings.

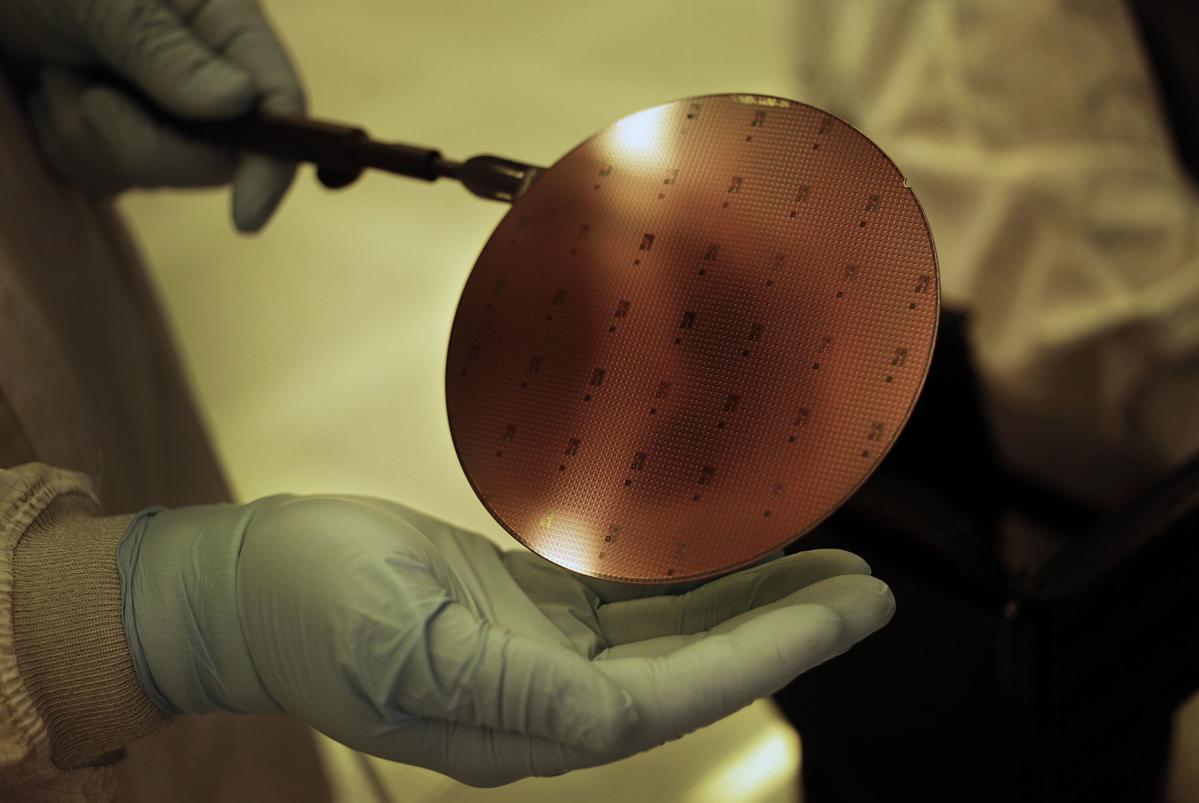

Shares of Chinese language non-ferrous metals corporations climbed after the federal government imposed restrictions on exports of gallium and germanium in an escalation of the commerce warfare on tech with the US and Europe. The metals are essential for the semiconductor, telecommunications and electric-vehicles sectors.

Key occasions this week:

-

China Caixin companies and composite PMI, Wednesday

-

Eurozone S&P International Eurozone companies PMI, PPI, Wednesday

-

OPEC Worldwide Seminar, audio system together with OPEC+ oil ministers, kicks off in Vienna, Wednesday

-

FOMC points minutes on June coverage assembly, Wednesday

-

New York Fed President John Williams in “hearth chat” at assembly of the Central Financial institution Analysis Affiliation on the New York Fed, Wednesday

-

US preliminary jobless claims, commerce, ISM companies, job openings, Thursday

-

Dallas Fed President Lorie Logan speaks on a panel concerning the coverage challenges for central banks at CEBRA assembly, Thursday

-

US unemployment price, nonfarm payrolls, Friday

-

ECB’s Christine Lagarde addresses an occasion in France, Friday

Among the foremost strikes in markets in the present day:

Shares

-

S&P 500 futures have been little modified as of 12:57 p.m. New York time

-

Futures on the Dow Jones Industrial Common fell 0.1%

-

The MSCI World index was little modified

-

S&P 500 futures have been little modified

-

Nasdaq 100 futures fell 0.1%

-

The MSCI Rising Markets Index rose 0.4%, climbing for the third straight day, the longest successful streak since June 16

Currencies

-

The Bloomberg Greenback Spot Index fell 0.1%, falling for the third straight day, the longest dropping streak since June 15

-

The euro fell 0.2% to $1.0895

-

The British pound rose 0.2% to $1.2719

-

The Japanese yen rose 0.1% to 144.52 per greenback

-

The offshore yuan surged 0.3%, greater than any closing achieve since June 15

-

The Mexican peso rose 0.2% to the best in additional than seven years

Cryptocurrencies

-

Bitcoin fell 0.6% to $30,946.32

-

Ether fell 0.2% to $1,955.54

Bonds

-

The yield on 10-year Treasuries was little modified at 3.85%

-

Germany’s 10-year yield superior two foundation factors to 2.45%

-

Britain’s 10-year yield declined two foundation factors to 4.42%

Commodities

-

West Texas Intermediate crude rose 2.1% to $71.29 a barrel

-

Gold futures rose 0.1% to $1,932.10 an oz.

This story was produced with the help of Bloomberg Automation.

–With help from Jason Scott, April Ma, Ruth Carson, John Viljoen, Tassia Sipahutar, Sagarika Jaisinghani and Sebastian Boyd.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.