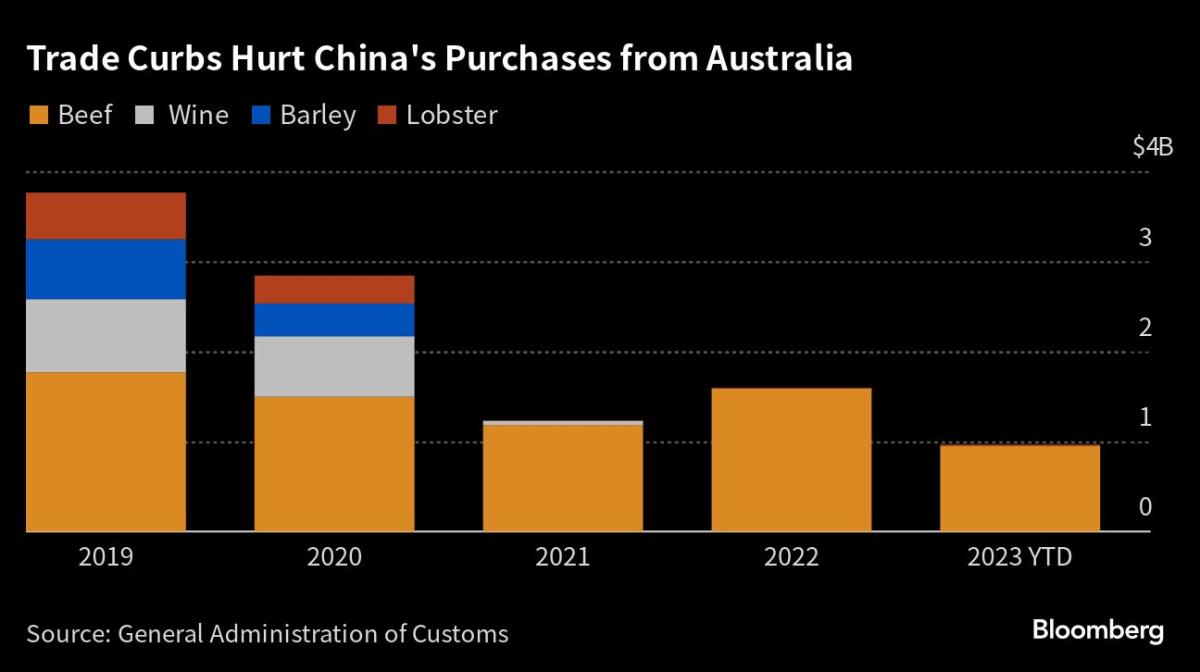

(Bloomberg) — Three years of commerce curbs have gutted Australia’s exports to China throughout a bunch of commodities, from luxurious gadgets like lobster to very important fuels like coal.

Most Learn from Bloomberg

Beijing imposed quite a lot of restrictions in 2020, from tariffs to unofficial bans, after Australia referred to as for a world investigation into the origins of Covid-19. It capped a souring of relations that started in 2018, when Canberra barred Huawei Applied sciences Co. from taking part in its 5G community.

Dropping their largest market has been exhausting to bear for a lot of exporters, however prospects have improved immensely this 12 months as a number of the restrictions have been rolled again. Barley gross sales are the most recent to learn from a thaw in political tensions after Beijing scrapped its duties on the Australian grain earlier this month.

It follows in all probability the most important breakthrough that got here at first of the 12 months, when China rescinded its ban on Australian coal. Controls on cotton and timber have additionally eased in latest months, whereas restrictions stay in place on wine, lobster and beef. Exports of copper ore have collapsed to negligible quantities since Chinese language merchants have been ordered to halt purchases on the finish of 2020.

Taking 2019 as a baseline, over the three years from 2020 to 2022, export income affected throughout these eight commodities totaled about $31 billion, in accordance with a calculation primarily based on Chinese language customs information. That’s not an unlimited amount of cash as a proportion of Australia’s general exports of products, which topped $400 billion final 12 months. And it counts for even much less in China’s vastly greater economic system. However some particular person industries have discovered it difficult to deal with the collapse in demand and discover new markets.

Hopes are working excessive that wine is perhaps the following export to see duties lifted. “There isn’t any market or assortment of markets that may substitute the China market,” mentioned Lee McClean, chief government officer of trade physique Australian Grape and Wine.

That mentioned, the connection between the commerce companions is unlikely to return to the way it was, McClean mentioned. “Some Australian companies will probably be considerably cautious of their return to the market following the impacts the import duties had on many companies,” he mentioned.

Earlier than the tariffs, China accounted for 18% of Australia’s wine export quantity, however 40% of its worth, in accordance with Rabobank analyst Pia Piggot. “China was a high-value marketplace for Australian business wine and tariffs have brought about a lack of premium,” she mentioned. “The premium loss has had a big impression on the trade.”

Australia’s Prime Minister Anthony Albanese mentioned earlier this month he plans to convey up the commerce impediments that stay on wine, lobster and a few beef exporters when he subsequent meets together with his Chinese language counterpart Xi Jinping. The Australian chief is weighing a visit to Beijing to carry talks earlier than the tip of the 12 months.

China is the most important purchaser of Australian commodities, which has allowed Beijing to make use of commerce as a instrument to amplify its diplomatic efforts, or as a cudgel to attain political factors, relying in your viewpoint. On the identical time, the federal government has prevented concentrating on Australia’s high export earners, like iron ore and pure fuel, in all chance as a result of these are commodities on which its economic system depends.

Arguably, China solely started letting in Australian coal as a result of it was frightened of gaps in provide rising that might harm energy technology and metal manufacturing as its economic system reopened after the pandemic. In any case, Australia’s coal trade in all probability higher weathered the ban higher than different sectors.

The primary six months have been troublesome, not least for Chinese language steelmakers who needed to discover new provide at increased costs or decrease high quality, mentioned Gerhard Ziems, chief monetary officer at metallurgical coal producer Coronado World Sources Inc.

China ended up shopping for extra from the US and Russia, whereas European consumers shifted to Australia. “It took about six months, after which costs climbed up,” he mentioned, leaving Coronado in a “a lot stronger” place than earlier than the embargo.

Coronado is now not promoting any Australian cargoes to China, regardless of the lifting of the ban, as markets like India at the moment are extra profitable. BHP Group Ltd., a long-time main provider of metallurgical coal to China, has additionally mentioned Indian steelmakers have picked up a lot of the slack.

The Week’s Diary

(All occasions Beijing until famous.)

Monday, Aug. 21

-

China units month-to-month mortgage prime charges, 09:15

-

EARNINGS: Tongwei, Goldwind, Anhui Conch

Tuesday, Aug. 22

Wednesday, Aug. 23:

-

CCTD’s weekly on-line briefing on Chinese language coal, 15:00

-

EARNINGS: China Oilfield, Yunnan Vitality

Thursday, Aug. 24:

-

Energy System and Inexperienced Vitality Convention in Shanghai, day 1

-

EARNINGS: China Coal, ENN Vitality, Eve Vitality, Sungrow

Friday, Aug. 25:

-

China weekly iron ore port stockpiles

-

Shanghai alternate weekly commodities stock, ~15:30

-

Energy System and Inexperienced Vitality Convention in Shanghai, day 2

-

EARNINGS: Shenhua, CMOC, Jiangxi Copper, Tongling Metals, Zijin Mining, Huayou Cobalt

Saturday, Aug. 26

Sunday, Aug. 27

On the Wire

Chinese language banks made a smaller-than-expected minimize to their benchmark lending fee and prevented trimming the reference fee for mortgages, regardless of the central financial institution placing strain on lenders to spice up loans.

Xi Jinping’s quest to rewrite the playbook that drove China’s financial miracle for a technology is going through its sternest take a look at but.

–With help from Dennis Ting, James Fernyhough and Keira Wright.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.