Erik Bahnsen, Trade Analyst, CCC —

It’s no secret that we’re within the midst of a uniquely difficult time for private auto insurers attributable to a convergence of things together with dangerous driving and vital will increase in the price of auto restore/alternative, labor, and medical payments. The business has reacted to these challenges with unusually steep premium will increase. Within the final 12 months alone, the common auto premium price elevated by 17%. With the newest projections predicting profitability challenges to persist till no less than 2025, it’s cheap to count on this present exhausting market to proceed by no less than the identical time interval.

Some downstream impacts have already been articulated, together with elevated coverage buying and decrease buyer satisfaction scores. Others are beginning to creep in underneath the radar, but all have the potential to compound present challenges to insurers, in addition to create alternatives. It’s the much less instantly apparent downstream impacts which can be the main focus of this function, each for functions of elevating consciousness and getting ready insurers to take proactive measures. Confucius as soon as mentioned, “Plan forward or discover hassle on the doorstep.”

Let’s begin with the influence on drivers most weak to the monetary pressure of sustained premium will increase: Confronted with inflation on all fronts and incomes unable to maintain tempo, a subset of earlier “adequately insured” drivers shift into the class of “underinsured”, dropping and/or gutting wanted coverages as a cost-saving measure. The opposite at-risk subset, most of which had been beforehand insured at state-minimum ranges, now shift from “underinsured” to “uninsured”, electing to drop protection altogether and take their possibilities.

For reference, the most effective baseline (pre-pandemic) estimate of the proportion of uninsured drivers nationally was about 13%, with some states notably greater.

Taken as a complete, it’s cheap to count on substantial development within the proportion of BOTH uninsured and underinsured drivers on the roadways. This has the potential to shift a major further price burden to the usual guide of enterprise, as extra “normal guide” prospects who’re concerned in collisions with uninsured or underinsured drivers at the moment are pressured to file with their very own carriers, even when they aren’t liable. Moreover, the potential for subrogation and/or authorized actions to recoup prices towards this distressed subset could be very poor.

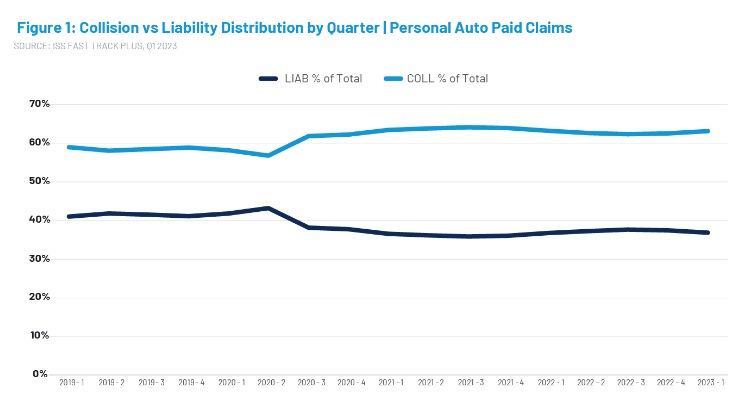

This speculation is rooted in current goal proof: A survey carried out by Policygenius shortly after the newest wave of premium will increase discovered that 26% of respondents had been at the moment contemplating driving with out insurance coverage altogether. That quantity rises to an alarming 54% for drivers aged 18 – 34. Inside CCC estimating knowledge, now we have noticed a notable change within the ratio of auto property harm collision to legal responsibility claims during the last 5 years, with collision rising and legal responsibility reducing (Determine 1). This pattern is constant throughout inside and exterior knowledge units, supporting the purpose a few rising variety of prospects submitting collision claims even when they aren’t liable.

Determine 1

On the casualty facet, we’re seeing frequency will increase within the proportion of third get together harm claims submitted underneath uninsured or underinsured motorist protection (Determine 2), which is just utilized when an insured driver and/or passengers maintain accidents because of the negligence of an uninsured or underinsured driver.

Determine 2

Lastly, we are also seeing will increase within the proportion of 1st get together harm claims exhausting advantages (Determine 3), which means the policyholder’s private harm safety or med pay protection is more and more insufficient to cowl medical payments incurred.

Determine 3

In conclusion, one can fairly count on a bigger monetary burden to shift to the usual guide of enterprise and/or usually much less dangerous policyholders as continued fee will increase push increasingly more drivers to “uninsured” and “underinsured” standing.

Info is energy, which is why these factors are raised for consciousness, however what about mitigation and proactive measures? Alternatives abound to leverage know-how to enhance accuracy and effectivity throughout the declare cycle. For instance, as now we have beforehand reported, speedy medical billing inflation, getting older inhabitants, and shifting remedy patterns have solely strengthened the necessity for strong medical invoice evaluate engines, worth benchmarking, and medical skilled evaluations to make sure accidents of questionable causation and/or remedy of questionable necessity are recognized and addressed. Indemnity for unsupported accidents or remedy can rapidly add as much as tons of of tens of millions of {dollars}, in the end harming shoppers. These instruments, when mixed with automation and know-how akin to straight by processing, photograph estimating, and built-in funds can enhance loss adjustment expense and guarantee quicker, extra correct indemnity.

Together with improved, clever buyer and adjuster experiences, the insurer can worth competitively with decreased necessity for continued aggressive fee will increase. As all the time, we’ll proceed to investigate, monitor, and report on these developments as additional info turns into out there.

About CCC

CCC Clever Options Inc. (CCC), a subsidiary of CCC Clever Options Holdings Inc. (NYSE: CCCS), is a number one SaaS platform for the multi-trillion-dollar P&C insurance coverage financial system powering operations for insurers, repairers, automakers, half suppliers, lenders, and extra. CCC cloud know-how connects greater than 35,000 companies digitizing mission-critical workflows, commerce, and buyer experiences. A trusted chief in AI, IoT, buyer expertise, community and workflow administration, CCC delivers improvements that preserve folks’s lives transferring ahead when it issues most. Study extra about CCC at cccis.com.

Ahead-Trying Statements

This press launch incorporates forward-looking statements which can be primarily based on beliefs and assumptions and on info at the moment out there. In some instances, you possibly can determine forward-looking statements by the next phrases: “might,” “will,” “may,” “would,” “ought to,” “count on,” “intend,” “plan,” “anticipate,” “imagine,” “estimate,” “predict,” “challenge,” “potential,” “proceed,” “ongoing” or the detrimental of those phrases or different comparable terminology, though not all forward-looking statements include these phrases. These statements contain dangers, uncertainties and different components that will trigger precise outcomes, ranges of exercise, efficiency or achievements to be materially totally different from the data expressed or implied by these forward-looking statements. Ahead-looking statements on this press launch embody, however are usually not restricted to, statements concerning future use and efficiency of CCC’s digital and AI options. Such variations could also be materials. We can’t guarantee you that the forward-looking statements on this press launch will show to be correct. These ahead trying statements are topic to a lot of dangers and uncertainties, together with, amongst others, competitors, together with technological advances and new merchandise marketed by opponents; modifications to relevant legal guidelines and rules and different dangers and uncertainties, together with these included underneath the header “Danger Elements” within the definitive proxy assertion/prospectus filed by Dragoneer Development Alternatives Corp. with the Securities and Alternate Fee (“SEC”) on July 6, 2021, which might be obtained, with out cost, on the SEC’s web site (www.sec.gov). The forward-looking statements on this press launch signify our views as of the date of this press launch. We anticipate that subsequent occasions and developments will trigger our views to vary. Nonetheless, whereas we might elect to replace these forward-looking statements in some unspecified time in the future sooner or later, now we have no present intention of doing so besides to the extent required by relevant legislation. It’s best to, subsequently, not depend on these forward-looking statements as representing our views as of any date subsequent to the date of this press launch.

SOURCE: CCC Clever Options Inc.