(Bloomberg) — Warren Buffett’s Berkshire Hathaway Inc. is planning to promote yen bonds within the international markets, fueling hypothesis that the billionaire is weighing extra investments in Japan.

Most Learn from Bloomberg

The US conglomerate mandated banks for a possible benchmark SEC-registered bond providing, based on an individual acquainted with the matter. The deal could come within the close to future, topic to market situations.

Berkshire Hathaway can be the primary main non-financial abroad debt issuer to kick off a yen deal after the Financial institution of Japan final month scrapped the world’s final unfavorable rate of interest.

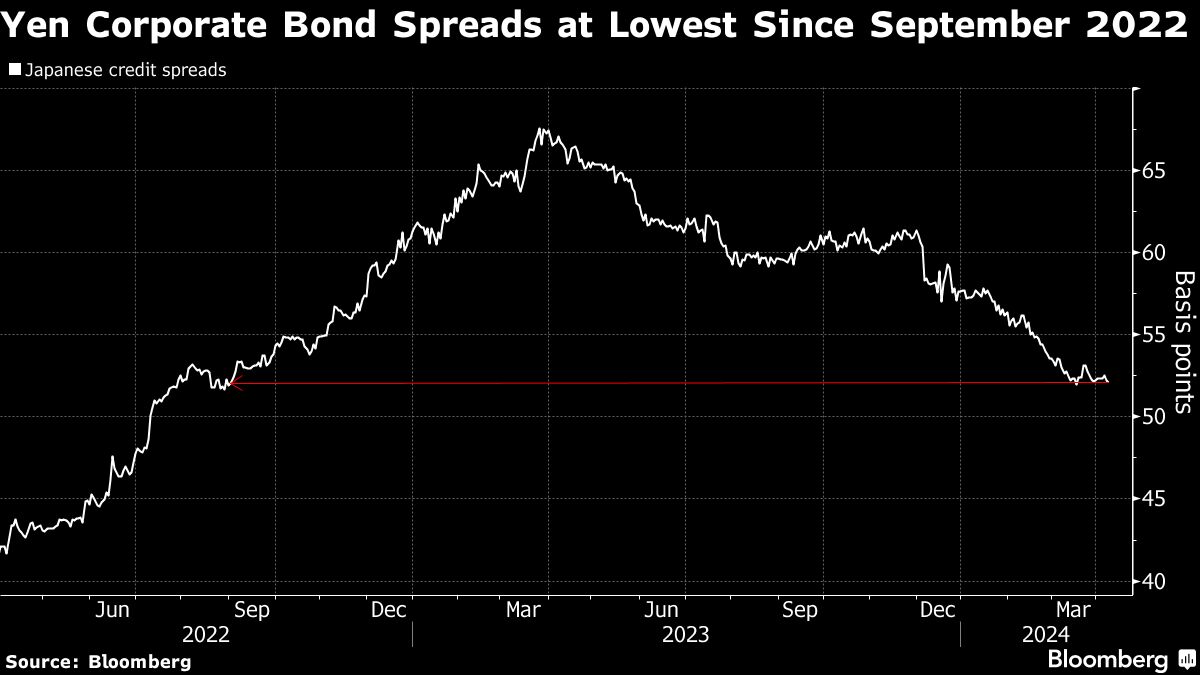

Spreads on yen-denominated bonds from each Japanese and abroad issuers have tightened to the bottom since September 2022 amid indicators BOJ Governor Kazuo Ueda gained’t rush to hike rates of interest once more. The additional yield traders look for company debt is about 52 foundation factors, down from 67 a yr in the past.

“Berkshire’s plan to promote a yen bond is spurring hypothesis that the corporate could purchase extra trading-house shares,” stated Atsuko Ishitoya, a strategist at Daiwa Securities Co.

Shares of Mitsubishi Corp. gained as a lot as 2.8%, Sumitomo Corp. jumped 2.3% and Marubeni Corp. rose 1.9%, whereas the Topix added 0.9%.

The purchases by the legendary US investor helped to propel good points within the Japanese inventory market final yr, with analysts attempting to scope out what his subsequent targets could be.

“There may be hope that undervalued shares, companies with model power in addition to financial-related corporations could also be purchased, too. It’s constructive for total Japanese shares,” Ishitoya stated.

The US firm final turned to the yen bond markets in November, with a ¥122 billion ($803 million) five-tranche deal. It’s a daily issuer of yen bonds, and sometimes faucets the market in April.

“The timing for foreigners to spend money on Japanese corporations couldn’t be higher,” stated Shunsuke Oshida, head of credit score analysis at Manulife Funding Administration Japan. “With the governance reforms and the Tokyo bourse’s message to the capital markets, it is smart that increasingly more corporations have gotten investor-friendly and so foreigners would wish to elevate funds to spend money on them.”

Buffett stated in his annual letter to traders in late February that Japanese buying and selling corporations are following investor-friendly insurance policies, driving hypothesis that he could enhance his stakes in these corporations. Berkshire Hathaway has funded most of its present Japanese funding by way of yen bonds, the letter stated.

“Berkshire has issued huge quantities up to now, surpassing ¥100 billion, which reveals that it’s been profitable in attracting a variety of traders,” stated Kazuma Ogino, senior credit score analyst at Nomura Securities Co.

–With help from Winnie Hsu and Naoto Hosoda.

(Updates with a touch upon buying and selling home shares)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.