(Bloomberg) — China’s financial restoration weakened in Could, elevating contemporary fears in regards to the progress outlook and prompting requires extra central financial institution motion to counter the downturn.

Most Learn from Bloomberg

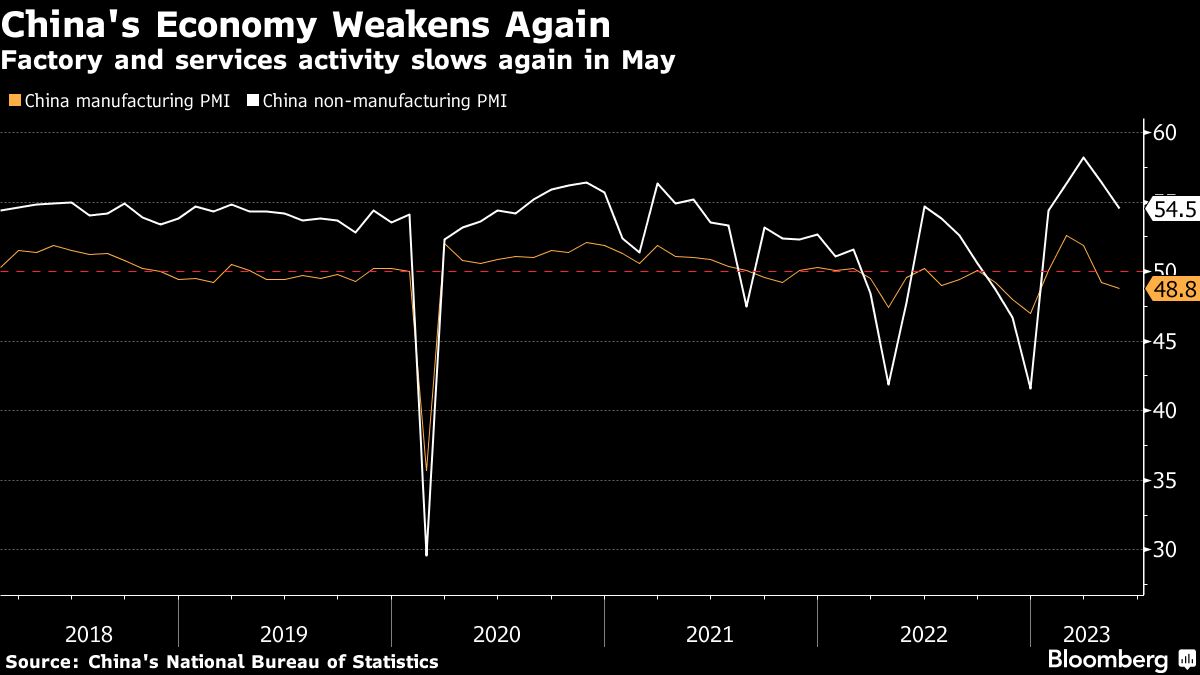

Manufacturing exercise contracted at a worse tempo than in April, whereas providers growth eased, official knowledge confirmed Wednesday, suggesting the post-Covid rebound had misplaced momentum. Traders bought off all the pieces from Chinese language shares and the yuan to copper and iron ore.

China’s financial restoration from the pandemic has been led by client spending on providers, akin to journey and consuming out, whereas manufacturing has lagged. The most recent figures from the buying managers surveys underscore that uneven sample, whereas additionally elevating questions in regards to the energy of consumption within the economic system.

“The sharper contraction within the manufacturing PMI means that the chance of a downward spiral, particularly within the manufacturing sector, is changing into extra actual,” Lu Ting, chief China economist at Nomura Worldwide (Hong Kong) Ltd., and his colleagues wrote in a notice.

Calls are getting louder for the central financial institution to take motion, together with slicing rates of interest or the reserve requirement ratio for banks. Whereas that will give monetary markets a raise, it’s unlikely to offer a significant increase to client and enterprise confidence, which stays subdued. Industrial firm income proceed to plunge and world demand is weak.

What Bloomberg Economics Says …

The weak knowledge underline a insecurity within the personal sector, and strengthen the case for additional coverage easing, significantly on the financial aspect.

– Chang Shu, chief Asia economist

Learn the total report right here.

A stronger restoration in China will even depend upon a turnaround within the property market, which makes up a few fifth of the economic system when together with associated sectors. Residence gross sales have slowed after an preliminary rebound, whereas actual property builders proceed to face monetary troubles.

Monetary markets have been roiled by China’s faltering restoration. A gauge of the nation’s equities listed in Hong Kong slid 1.9% on Wednesday to be the second-worst performer in Asia after the town’s benchmark index. The offshore yuan weakened 0.46% to 7.1239 in opposition to the greenback as of 4:14 p.m. native time, extending its loss in Could to 2.9%, essentially the most in three months.

Copper futures in London slid, leaving the metallic poised for its worst month-to-month loss in practically a 12 months. The sharp contraction in China’s metal PMI, which recorded a studying of simply 35.2 — the bottom since July 2022 — noticed iron ore in Singapore drop as a lot as 3.3%. Costs of the steelmaking staple recovered later within the session, though they continue to be beneath $100 a ton and have unwound the entire positive aspects made since China’s economic system reopened.

“We reckon that the Chinese language economic system could possibly be on the verge of a self-fulfilling confidence lure and imagine decisive coverage actions are wanted,” Citigroup Inc. economists led by Xiangrong Yu wrote in a report after the PMI knowledge launch.

The Folks’s Financial institution of China will doubtless minimize the rate of interest on its medium-term lending facility — a coverage mortgage for industrial banks — by 20 foundation factors within the the rest of the 12 months, in response to Citi, and scale back the reserve requirement ratio for banks by 50 foundation factors. Fiscal stimulus is proscribed, although, and “structural” easing measures could also be taken by the central authorities and through state coverage banks, the economists mentioned.

The federal government set a reasonably conservative goal of round 5% for this 12 months, suggesting it sees restricted scope for main stimulus. Economists surveyed by Bloomberg predict progress will attain 5.5% this 12 months.

“There have been lots of pledges on supporting the economic system earlier within the 12 months, however none of that’s coming to fruition, which is what’s most irritating to me,” mentioned Yang Zhiyong, government director of Beijing Gemchart Asset Administration Co.

Chinese language state media on Wednesday cited analysts saying extra pro-growth coverage measures could also be on the playing cards, together with rate of interest cuts and extra bond gross sales.

Beijing might additionally take focused steps to spice up the economic system. Officers are contemplating new tax incentives value tons of of billions of yuan for high-end manufacturing corporations, in response to an individual accustomed to the discussions.

“China could also be heading to a Okay-shaped restoration, with uneven rebound of producing and non-manufacturing actions within the close to time period,” mentioned Bruce Pang, chief economist for Better China at Jones Lang LaSalle Inc. “Sluggish home demand might weigh on China’s sustainable progress, if there aren’t any environment friendly and efficient coverage strikes to engineer a broad-based restoration.”

–With help from Chester Yung, Shikhar Balwani, April Ma and Jason Rogers.

(Updates with further particulars.)

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.