(Bloomberg) — China’s central authorities is borrowing extra to assist diffuse a $9.3 trillion time bomb in hidden native debt. The ensuing shift in fiscal energy has its personal threat: demotivating regional officers.

Most Learn from Bloomberg

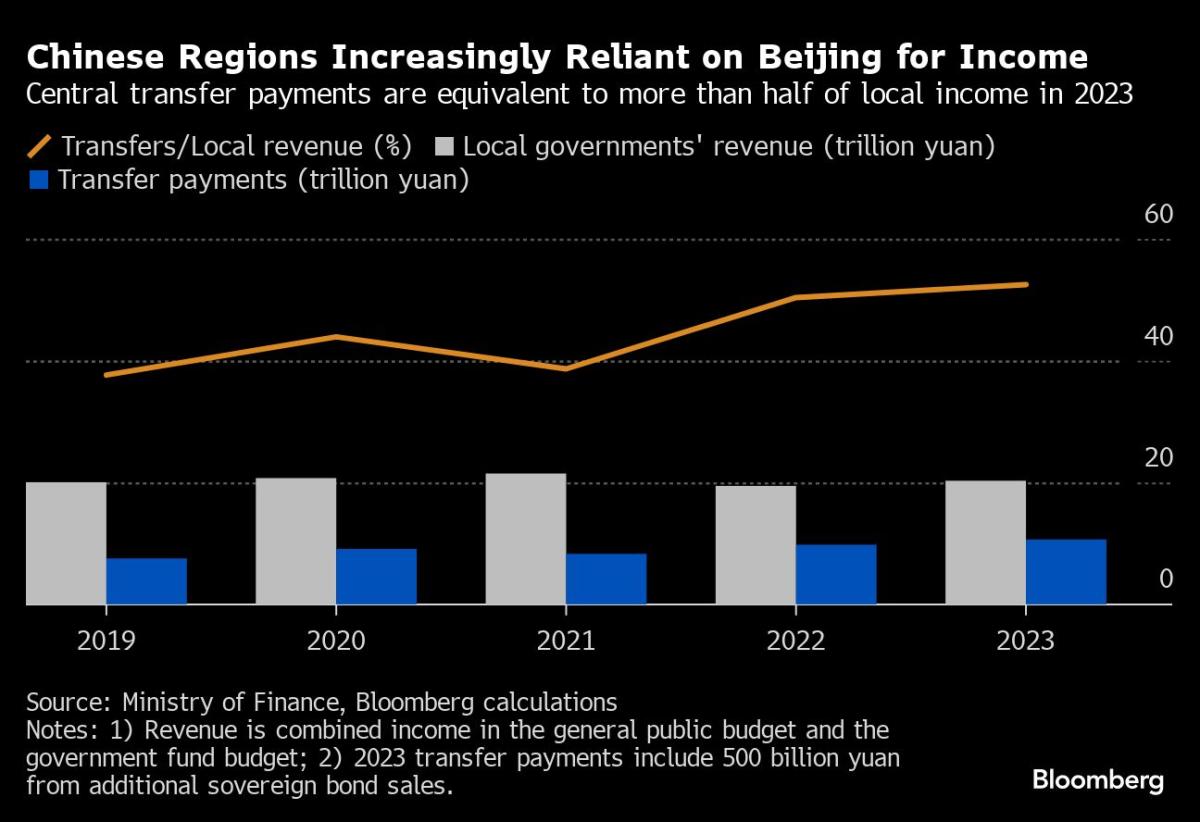

Beijing’s uncommon resolution to concern 1 trillion yuan ($137 billion) of central debt, and switch the funds to native governments, was hailed in October as a aid for struggling provinces.

That transfer got here as China clips the borrowing capability of native authorities, together with by banning the creation of the financing automobiles that allowed off-balance debt to spiral.

Some analysts see that technique as the start of a revamp of the inter-government debt construction. The general consequence might diminish the fiscal discretion of native leaders and weaken their drive to enact new insurance policies.

“Lengthy-term dependence on the central authorities will stifle native governments’ aspiration to develop the native financial system and society in progressive methods,” stated Le Xia, chief Asia economist at Banco Bilbao Vizcaya Argentaria SA. “That’ll do no good to the prosperity of the financial system.”

Bureaucratic inaction would make it more durable for President Xi Jinping to attain his objective of rising China right into a “medium-developed nation” by 2035. Some economists estimate that requires the financial system to develop 4.7% on common every year till then — an formidable goal.

Protracted Wrestle

The steadiness of fiscal energy has oscillated between the central and native governments for many years. Within the mid-Nineties, then-Vice Premier Zhu Rongji reined in provinces’ ample taxation powers — which had earlier been given as an incentive to develop their economies — in a bid to replenish central coffers.

After the worldwide monetary disaster hit in 2008, Beijing was compelled to pivot, calling on regional officers to fund a large stimulus program reliant on infrastructure funding. That led to a giant enhance in off-balance sheet debt by the businesses that borrow on behalf of provinces and cities to finance such campaigns.

That development mannequin has change into unsustainable: Native governments can now not rely upon land gross sales to service their money owed — each official and hidden — because the nation’s property market disaster deepens. LGFVs in some areas have teetered on the verge of default lately.

Swinging the pendulum again within the central authorities’s favor, nevertheless, dangers stripping company from native officers who know their economies finest. An inclination to do much less to keep away from making errors is already a problem in China’s huge paperwork as Xi’s anti-corruption marketing campaign rolls on.

Final yr, then-Premier Li Keqiang warned annual development risked slipping out of an affordable vary if officers didn’t take decisive actions to repair Covid Zero-related issues, reminiscent of provide chain blockages.

A county in Lishui metropolis in east China gave three authorities companies a “Mendacity Flat Award” at an official gathering final yr, shaming them for administrative inaction, native media reported. Interior Mongolia’s agriculture and husbandry division is handing out “Snail Awards” to officers who flunk efficiency evaluations.

Assist Wanted

Beijing’s pledge to unleash extra sovereign bonds to fund catastrophe aid — in impact, an infrastructure spending program — indicated the federal government’s efforts to create extra sustainable sources of native earnings could have stalled.

A nationwide property tax might change land gross sales as a significant supply of native income. However that levy is deeply unpopular with the nation’s highly effective center class, and weak client demand dragging on development makes it unlikely such a coverage will likely be carried out anytime quickly.

Discussions on revamping consumption taxes to permit provinces to take a share have additionally resulted in little change.

“Reforms to extend the principle kinds of taxes for native governments have hit snags,” stated Jia Kang, a former head of a analysis institute beneath the Ministry of Finance. “It’s at present inconceivable for the native tax regime to supply a steady supply of earnings for areas to kind out their issues.”

High leaders at a significant annual financial convention final week referred to as for “reform of the fiscal and tax system,” with out elaborating. That assertion stoked expectations Beijing could possibly be mulling plans to restructure the central-local relationship.

“A key a part of the brand new spherical of fiscal system reform could possibly be for the central authorities to bear a bigger share of the price range deficit, in addition to extra spending tasks,” stated Jacqueline Rong, chief China economist at BNP Paribas SA.

China could must set its price range deficit at a degree above 3% of gross home product subsequent yr, the state-run Securities Occasions reported Thursday, citing economists. The central authorities could must tackle extra of the borrowing, the report stated, including that the quota for native governments to concern debt by means of particular bonds could stay unchanged from 2023 at 3.8 trillion yuan.

Beijing’s elevated sway might assist it drive by means of huge reforms, beforehand held again by regional resistance. Bringing provincial pension methods right into a nationwide pool, for instance, would serve Xi’s frequent prosperity push to slim the wealth hole.

“The central authorities can use switch funds to handle uneven developments and monetary energy amongst areas,” stated Ding Shuang, chief economist for Better China and North Asia at Commonplace Chartered Plc.

Beijing might additionally push regional leaders to unravel issues reminiscent of weak client spending at their very own expense.

Whereas native governments face huge money circulate pressures, they nonetheless maintain belongings value as a lot as 20% to 30% of China’s GDP, in line with Michael Pettis, a finance professor at Peking College.

Transferring a few of these funds to households, reminiscent of by utilizing land to construct low-cost housing reasonably than promoting to the best bidder, could be “the least painful” solution to enhance consumption and rebalance the financial system, he stated.

“However these transfers will likely be politically contentious,” he stated. “Within the subsequent few years, we are able to anticipate a battle between Beijing and native governments over who will soak up the prices.”

(Updates with state media report on 2024 deficit forecasts.)

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.