Kiyoshi Tanno/iStock by way of Getty Photos

Congress appears to be like set to vote for the debt ceiling settlement that will put U.S. default within the rearview mirror for one more two years. However the aftermath may nonetheless spell bother.

The Treasury’s subsequent transfer will probably be to refill the Treasury Normal Account, or TGA, on the New York Fed. It would promote T-bills that may result in a “potent liquidity squeeze,” based on T.S. Lombard. (Here is a nice graphic of how refilling the TGA drains liquidity by decreasing financial institution reserves.)

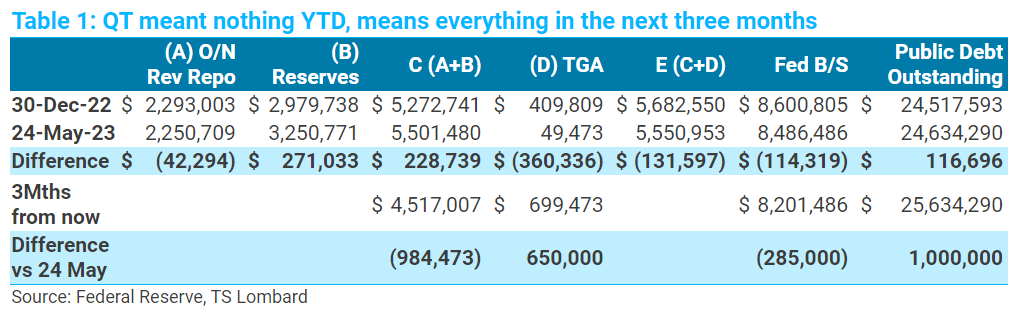

“The Treasury TGA account is under $50bn and Treasury will certainly look to get again to $650b, the extent round which deposits appeared centered in early 2022,” T.S. Lombard Steven Blitz wrote in a notice.

On the similar time, the Fed’s quantitative tightening, or QT, will go from having no affect to this point this yr to an enormous chunk.

“YTD, the Fed steadiness sheet is simply $114bn decrease, with Treasury balances down by extra” and “QT consequently swiftly swings from no impact to effecting sizable will increase in charges to tug within the mandatory funds,” Blitz mentioned.

How will this affect shares and the economic system?

“A number of the fairness market response (throughout this time) will rely upon actual time knowledge on the economic system, and past the rate of interest impact, Treasury will probably be draining deposits from the economic system the other of the primary 5 months of the yr,” Blitz mentioned. “The reason being that Treasury is promoting debt to boost money and never spend it, however put it on deposit on the Fed. Extra so, the Fed shouldn’t be, in impact, financing the elevated borrowing by advantage of its QT.”

“In these previous 5 months, TGA dropped $360bn is precise, not annualized {dollars}, that implies that $360bn was spent that, on this interval, was neither taxed nor borrowed – this quantities to 3.3% of 5 months of nominal GDP. One good motive why development appeared ‘resilient.'” (Emphasis added.)

“Trying ahead, assuming Treasury raises $650bn to placed on deposit on the Fed within the subsequent three months, that will quantity to a drain equal to 9.8% of three months of nominal GDP,” Blitz mentioned. “There are, after all, a complete lot of ‘different issues being equal’ on this math, however the swap from add to empty is significant.”

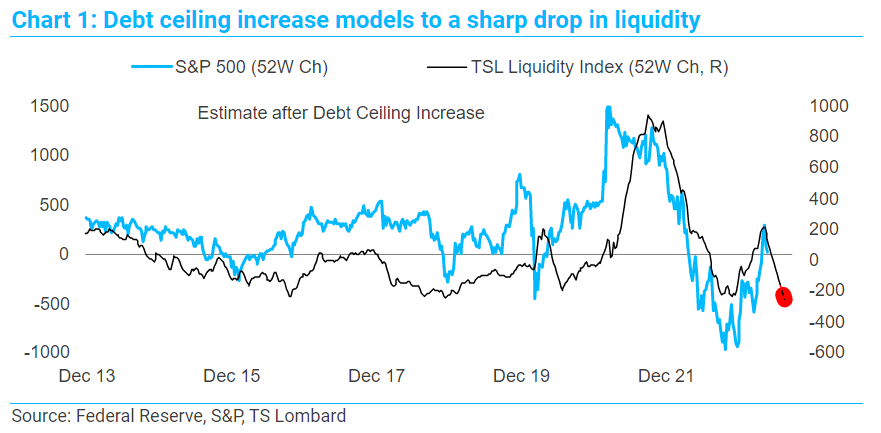

On equities, T.S. Lombard calculated a liquidity index primarily based on the weekly dynamics of financial institution reserves, in a single day repo reverses, TGA and Treasury financing wants beginning in 2012.

“Critically,” the chart proven under “dovetails effectively with Y/Y adjustments within the S&P 500 (SP500) (NYSEARCA:SPY) (IVV) (VOO) and its (speculation test-stat) significance stands up even when S&P is regress in opposition to itself with a lag,” Blitz famous.

Liquidity “has improved because the finish of 2022 and the fairness market responded in sort (regardless that the efficiency skewed to a couple tech shares),” he mentioned. “Utilizing this mannequin and the forecast in (the desk additionally under) liquidity shortly drops again to under the place it was 5 months in the past, and one would anticipate an fairness market reversal as effectively. The connection is way from 1:1, so the downdraft may very well be worse, or not as unhealthy.”

Extra on the debt ceiling