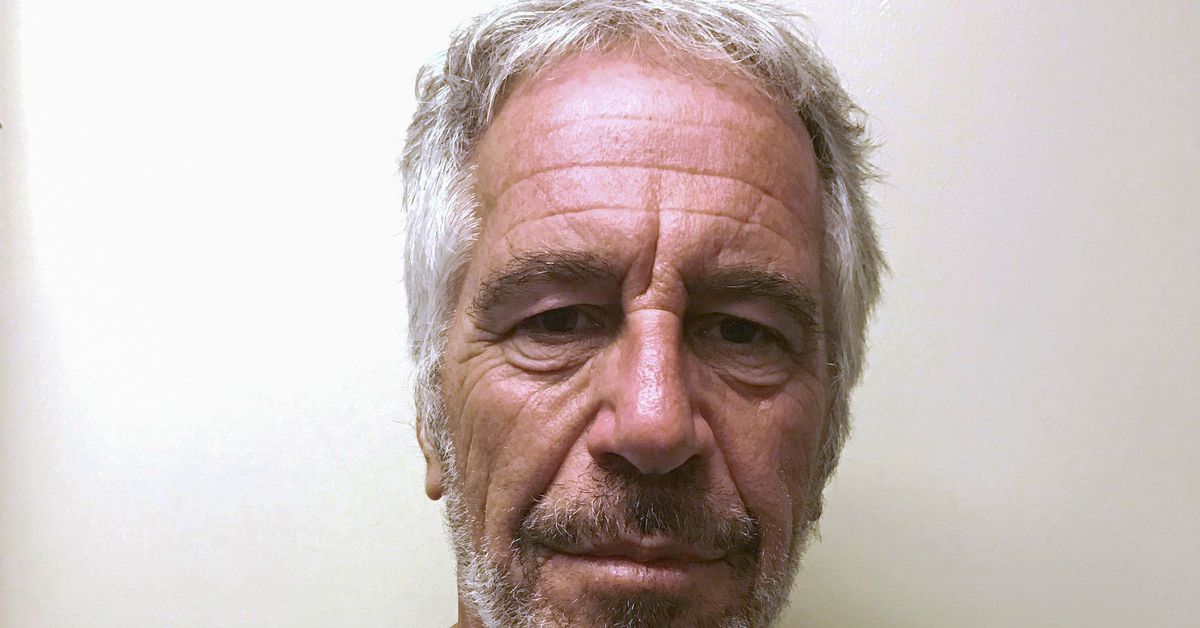

[1/2] U.S. financier Jeffrey Epstein seems in {a photograph} taken for the New York State Division of Prison Justice Providers’ intercourse offender registry March 28, 2017 and obtained by Reuters July 10,…

Might 17 (Reuters) – Deutsche Financial institution AG (DBKGn.DE) agreed to pay $75 million to settle a lawsuit by ladies who say they had been abused by the late financier Jeffrey Epstein, and accused the German financial institution of facilitating his intercourse trafficking.

The accord resolves a proposed class motion in Manhattan federal court docket, and was confirmed by the accusers’ legal professionals late on Wednesday.

Deutsche Financial institution was accused of lacking crimson flags in Epstein’s accounts that he was engaged in wrongdoing.

Epstein, who pleaded responsible in 2008 to a Florida prostitution cost and registered as a intercourse offender, was a Deutsche Financial institution consumer from 2013 to 2018.

He died in August 2019 in jail whereas awaiting trial for intercourse trafficking, in what New York Metropolis’s health worker referred to as a suicide.

Deutsche Financial institution’s settlement requires approval by U.S. District Choose Jed Rakoff, who on Thursday scheduled a June 1 preliminary listening to to contemplate its equity.

Two comparable lawsuits towards JPMorgan Chase & Co (JPM.N), the place Epstein was a consumer from 1998 to 2013, stay unresolved.

Deutsche Financial institution spokesman Dylan Riddle declined to debate the accord, however the financial institution has acknowledged error in making Epstein a consumer.

Riddle additionally mentioned Deutsche Financial institution has invested greater than 4 billion euros to bolster its controls, processes and coaching, and employed extra individuals to struggle monetary crime.

David Boies, one of many accusers’ legal professionals, in a press release mentioned Epstein’s abuses required “the collaboration and assist of many highly effective people and establishments. We admire Deutsche Financial institution’s willingness to take duty for its position.”

Boies Schiller Flexner and Edwards Pottinger symbolize Epstein’s accusers.

A trial had been scheduled for Sept. 5.

The Wall Avenue Journal reported the settlement earlier and mentioned Deutsche Financial institution didn’t admit wrongdoing, citing individuals acquainted with the matter.

JPMORGAN IMPACT

It was unclear how the settlement may have an effect on the 2 comparable, bigger lawsuits towards JPMorgan by Epstein’s accusers and by the U.S. Virgin Islands, the place the financier had a house.

Courtroom papers have outlined many particulars about that financial institution’s allegedly turning a blind eye to his actions.

JPMorgan spokeswoman Patricia Wexler on Thursday declined to debate these lawsuits.

She famous that JPMorgan has regretted its affiliation with Epstein and mentioned it didn’t imagine it violated any legal guidelines.

The financial institution is individually suing Jes Staley, a former non-public banking chief who had been pleasant with Epstein, to assist cowl its losses within the two lawsuits. Staley can also be a former Barclays Plc (BARC.L) chief government.

JPMorgan’s trials are scheduled for Oct. 23. Tesla Inc (TSLA.O) CEO Elon Musk is amongst those that have been subpoenaed.

The Deutsche Financial institution case was led by a lady, generally known as Jane Doe 1, who mentioned Epstein sexually abused her from 2003 to 2018.

A distinct Jane Doe 1, a former ballet dancer who mentioned Epstein trafficked her from 2006 to 2013, leads the accusers’ case towards JPMorgan.

In 2020, New York state’s monetary regulator fined Deutsche Financial institution $150 million over its work with Epstein.

Final September, Deutsche Financial institution agreed to pay $26.25 million to settle a U.S. shareholder lawsuit over its relationships with dangerous, ultra-rich shoppers like Epstein.

The case is Jane Doe 1 v Deutsche Financial institution AG et al, U.S. District Courtroom, Southern District of New York, No. 22-10018.

Reporting by Rahat Sandhu in Bengaluru; Enhancing by Jacqueline Wong

Our Requirements: The Thomson Reuters Belief Rules.