mesh dice

For the week ending April 28, the Industrial Choose Sector (XLI) fell (-0.61%) and was among the many 5, out of the 11 S&P 500 sectors, which closed the week in crimson. The SPDR S&P 500 Belief ETF (SPY) gained (+0.90%) amid the First Republic Financial institution disaster and a busy earnings week. The approaching week will see a give attention to the Fed meet, the place a 25 foundation level hike is anticipated.

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +11% every this week. YTD, all these 5 shares are within the inexperienced.

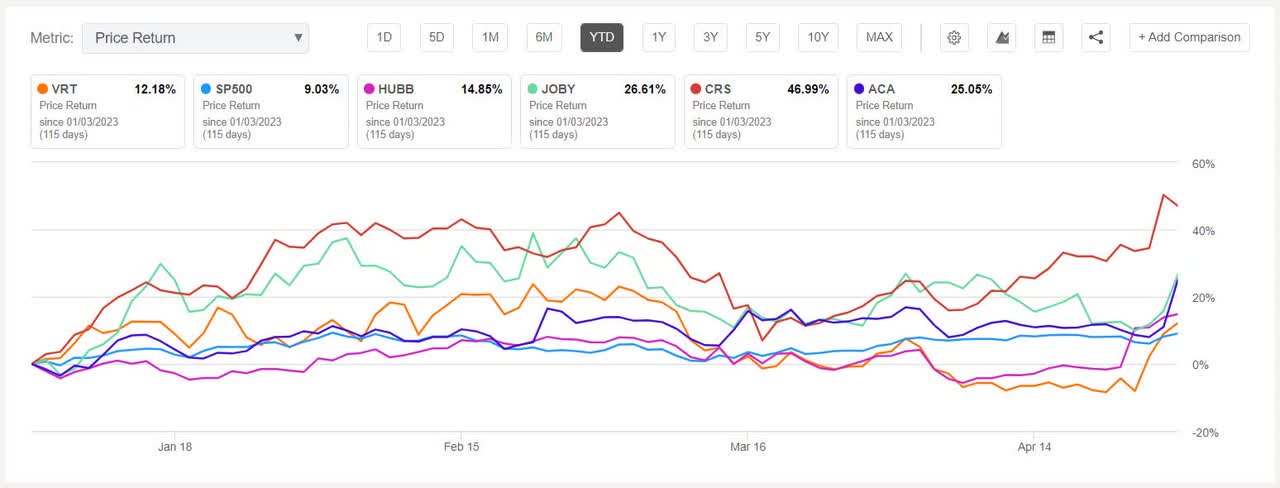

Vertiv (NYSE:VRT) +22.50%. The Ohio-based firm, which offers companies for information facilities, noticed its inventory soar +11.12% on Wednesday after Q1 outcomes beat estimates and raised its working revenue steerage.

VRT has a SA Quant Ranking — which takes under consideration components similar to Momentum, Profitability, and Valuation amongst others — of Robust Purchase. The inventory has an element grade of A- for Progress and C- for Profitability. The typical Wall Avenue Analysts’ Ranking is Purchase, whereby 6 out of 10 analysts see the inventory as Robust Purchase. YTD, +9.22%.

Hubbell (HUBB) +16.78%. Shares acquired a lift of +11.63% on Tuesday after Q1 earnings surpassed estimates and the Shelton, Conn.-based firm elevate its FY23 Adjusted EPS outlook.

The SA Quant Ranking on HUBB is Maintain with rating of A for Momentum however D- for Valuation. The typical Wall Avenue Analysts’ Ranking agrees with a Maintain ranking of its personal, whereby 6 out of 10 analysts tag the inventory as such. YTD, +14.76%.

Joby Aviation (JOBY) +12.76%. The week noticed the electrical air taxi maker announce the extension of a contract with the U.S. Air Pressure and a long-term settlement with Toyota Motor.

The SA Quant Ranking on JOBY is Promote with a rating of D- for Profitability and C- for Momentum. In the meantime, the common Wall Avenue Analysts’ is Maintain, whereby 3 out of 6 analysts view the inventory as Maintain. YTD, +29.25%.

Carpenter Expertise (CRS) +12.52%. First quarter outcomes of the metal maker despatched the inventory hovering +11.80% on Thursday after Q3 outcomes beat analysts’ expectations. YTD, the shares have gained +42.77%, essentially the most amongst this week’s prime 5 gainers. The SA Quant Ranking on CRS is Maintain, which is in distinction to the common Wall Avenue Analysts’ Ranking of Purchase.

The chart under reveals YTD price-return efficiency of the highest 5 gainers and SP500:

Arcosa (ACA) +11.86%. The Dallas-based development merchandise maker’s shares rose +12.66% on Friday after Q1 income and adjusted EPS exceeded expectations. The SA Quant Ranking and the common Wall Avenue Analysts’ Ranking, each, have a Purchase ranking on ACA. YTD, +24.29%.

This week’s prime 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -8% every. YTD, 2 out of those 5 shares are within the crimson.

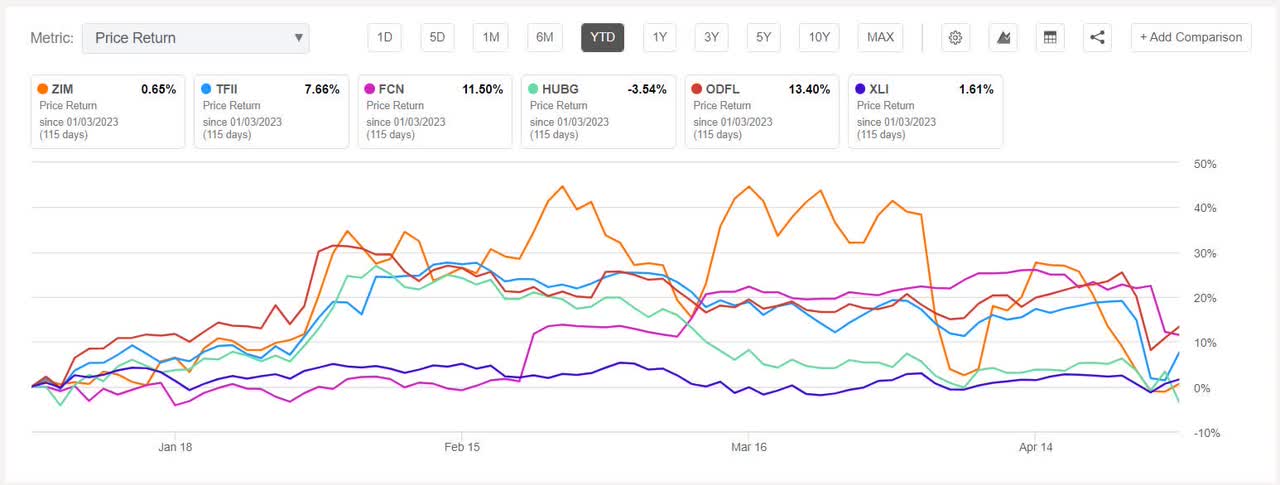

ZIM Built-in Delivery Companies (NYSE:ZIM) -11.32%. The Israeli delivery firm was among the many worst 5 performers for the second week in a row. The inventory fell all through the week, barring Friday. The SA Quant Ranking on ZIM is Maintain with an element grade of A+ for Profitability however F for Progress. Nonetheless, the common Wall Avenue Analysts’ Ranking a Promote, whereby 4 out of seven analysts see the inventory as Maintain. YTD, -0.70%.

TFI Worldwide (TFII) -9.50%. The Canadian logistics companies supplier’s inventory slumped -11.33% on Wednesday after Q1 outcomes couldn’t breach estimates.

The SA Quant Ranking on TFII is Purchase with an element grade of A- for Profitability and B for Momentum. The typical Wall Avenue Analysts’ Ranking concurs with a Purchase ranking of its personal, whereby 8 out of 21 analysts tag the inventory as Robust Purchase. YTD, +7.54%.

The chart under reveals YTD price-return efficiency of the worst 5 decliners and XLI:

FTI Consulting (FCN) -8.30%. The shares fell -8.39% on Thursday after blended quarterly outcomes. The Washington, D.C.-based firm’s income surpassed estimates however the GAAP EPS missed out.

The SA Quant Ranking on FCN is Purchase, with a rating of A for Momentum and B- for Profitability. The typical Wall Avenue Analysts’ agrees with its personal Purchase ranking, whereby 2 out of three analysts view the inventory as Robust Purchase. YTD, the inventory has risen +13.66%, essentially the most amongst this week’s prime 5 decliners.

Hub Group (HUBG) -8.18%. The transportation and logistics companies supplier reported blended outcomes and offered a FY23 income outlook which was seen under expectations. The SA Quant Ranking on HUBG is Maintain, which differs from the common Wall Avenue Analysts’ Ranking of Purchase. YTD, -5.15%.

Previous Dominion Freight Line (ODFL) -8.16%. Thomasville, N.C.-based firm’s shares dipped -9.97% on Wednesday after Q1 outcomes upset. However the inventory picked up a bit on Friday after Deutsche Financial institution upgraded the shares on potential for earnings doubling. The SA Quant Ranking and the common Wall Avenue Analysts’ ranking, each, on ODFL is Maintain. YTD, +12.90%.