(Bloomberg) — Beneath the adrenaline rush of November’s stock-market surge is an eerie calm that factors to extra good points for equities buyers, at the least by way of the top of the 12 months.

Most Learn from Bloomberg

The S&P 500 Index posted a mean day by day transfer of 0.3% in both path final week, its tamest swings in half a 12 months, because the market misplaced some momentum towards the top of its second-best November since 1980. The Cboe Volatility Index, also referred to as the VIX, fell towards the 12 months’s lowest ranges Friday, and shares rose after Federal Reserve Chair Jerome Powell gave his clearest sign but that officers have completed elevating rates of interest.

“The market can work off overbought circumstances by both declining worth motion or by way of time, and to this point, the S&P has digested the large advance by slowing down over time,” stated Frank Cappelleri, founding father of CappThesis LLC. “The slowdown after such a powerful first half of November needs to be thought of constructive.”

To fairness bulls, the worth motion exhibits that risk-on spirits haven’t generated the type of euphoria that always precedes routs. And it demonstrates how reluctant buyers are to money out with the broad equities benchmark roughly 4% from a document excessive.

The S&P 500 Index climbed 0.8% final week, the slimmest acquire in its five-week successful streak. What occurred? Merely put, a flurry of huge periods within the first half of November gave option to a comparatively quiet stretch, because the gauge went 11 days and not using a 1% transfer in both path, the calmest finish to a month since July.

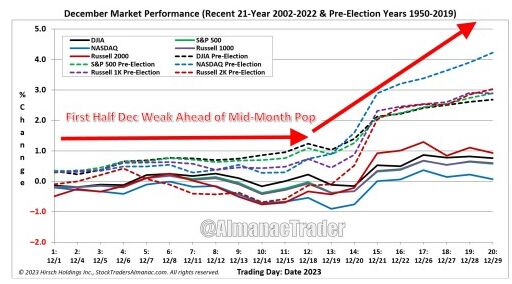

If historical past is any information, December is unlikely to carry heavy promoting. Since 1950, it’s the third-best month of the 12 months for the S&P 500, averaging a 1.4% acquire, information compiled by The Inventory Dealer’s Almanac present.

Portfolio managers’ tendency to spice up their funds’ standing towards the top of the 12 months by shopping for outperforming shares helps drive this seasonality. Shares additionally sometimes have a powerful run within the interval spanning December’s final 5 periods and the beginning of the brand new 12 months.

Nonetheless, there are many dangers on the desk proper now. Markets are positioned for a comfortable touchdown within the financial system, however there’s no assure that development will stay resilient after the Fed’s tightening takes full impact. In a single ominous signal, a measure of US manufacturing facility exercise shrank for a thirteenth straight month in November.

One other concern is that the majority of this years good points have been pushed by a sliver of the market. It’s the narrowest group of drivers ever for a rally exceeding 15%, information compiled by Societe Generale present. A popular measured of momentum can also be flashing a warning signal: The benchmark’s 14-day relative energy index jumped from beaten-down ranges to overbought in lower than a month.

That’s partly why Brian Frank, portfolio supervisor of the Frank Worth Fund, is cautious of the market’s advance.

“US shares simply went from massively oversold to massively overbought in such a brief interval,” he stated. “So November’s sturdy run might find yourself stealing a few of December’s historic energy.” In response, Frank is shopping for shares of small- and mid-cap staples corporations which can be identified for his or her dividends.

Execs Shopping for

Nevertheless, bulls are getting reassuring indicators from company executives, who purchased extra of their companies’ shares in November, pushing the ratio of patrons to sellers to the best degree in six months, information compiled by the Washington Service present.

The choices market is also giving off a way of confidence. The VIX futures curve — a device usually used as a information for speculative positioning within the months forward — exhibits an absence of crash-protection demand. It’s now decrease than it was at the beginning of November in a slew of maturities.

Whereas there could also be minimal suspense across the Fed’s Dec. 13 coverage resolution, the place the central financial institution is broadly anticipated to carry charges regular, there’s nonetheless potential for turbulence from the financial projections it releases that day and Powell’s press convention. On Friday, the Fed chair disregarded bets on charge cuts by mid-2024 — however bond merchants solely doubled down on wagers that the Fed will ease subsequent 12 months.

“A dovish pivot eases a number of the near-term market and longer-term recessionary tail dangers,” stated Dennis Debusschere, founder and chief market strategist of 22V Analysis. “A extra dovish Fed is much less more likely to push again in opposition to the latest easing of monetary circumstances. That ought to profit riskier elements of the market.”

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.