(Bloomberg) — European central bankers’ worth stability mission is on a collision course with the aim of combating local weather change, until they modify their methods.

Most Learn from Bloomberg

The transition to a lower-carbon financial system could gas inflation — however elevating rates of interest in response to that might hinder funding in cleaner vitality. So financial coverage and efforts to avoid wasting the planet threat working towards one another, casting a shadow over the prevailing consumer-price-targeting philosophy of the previous three many years.

That augurs robust selections for the European Central Financial institution. Elevating borrowing prices means lifting the value of funding in combating local weather change. But when officers tolerate increased client costs as a substitute — an method aired throughout the ECB’s 2021 technique evaluate — they threat failing to meet their mandate.

Extra radically, policymakers might attempt to sq. the circle by revamping financial frameworks to include an until-now unpalatable pipe-dream of the area’s environmental activists that’s already embraced in Asia — inexperienced lending.

Local weather emergencies such because the Canada wildfires and southern Europe’s drought underscore the issue, and nevertheless central bankers reply, their arms-length method to aiding the transition is getting tougher to maintain. With the European Union dedicated to determine the world’s first climate-neutral continent by 2050, the area is on the vanguard of confronting the issue.

“In the event that they disincentivize investments, it may very well be counterproductive for the vitality transition,” stated Didier Borowski, head of macro coverage analysis at Amundi, which manages $2 trillion as Europe’s largest asset supervisor. “There’s a advanced trade-off between their actions and their mandate of worth stability.”

The urgency of motion is getting clearer by the day because the planet continues to expertise worrying extremes, from record-low Arctic ice ranges to record-high ocean temperatures.

The transition is more likely to enhance inflation due to impacts starting from extra carbon taxes to how high-emission workhorse applied sciences get changed by initially costlier however greener options.

BNEF Theme: Pathways to Web Zero by 2050

Associated spending reached a file $1.1 trillion final yr, in line with Bloomberg NEF, which reckons annual world investments of about $6.7 trillion shall be wanted to succeed in web zero by 2050. Central banks impression that as a result of debt prices have an effect on renewable tasks greater than fossil fuels, stated analyst Stephanie Muro.

Demand for metals enabling the shift from hydrocarbons is about to soar from 52 megatons at the moment to 242 megatons in 2050. Urge for food for lithium, a central part of batteries, is more likely to outrun provide.

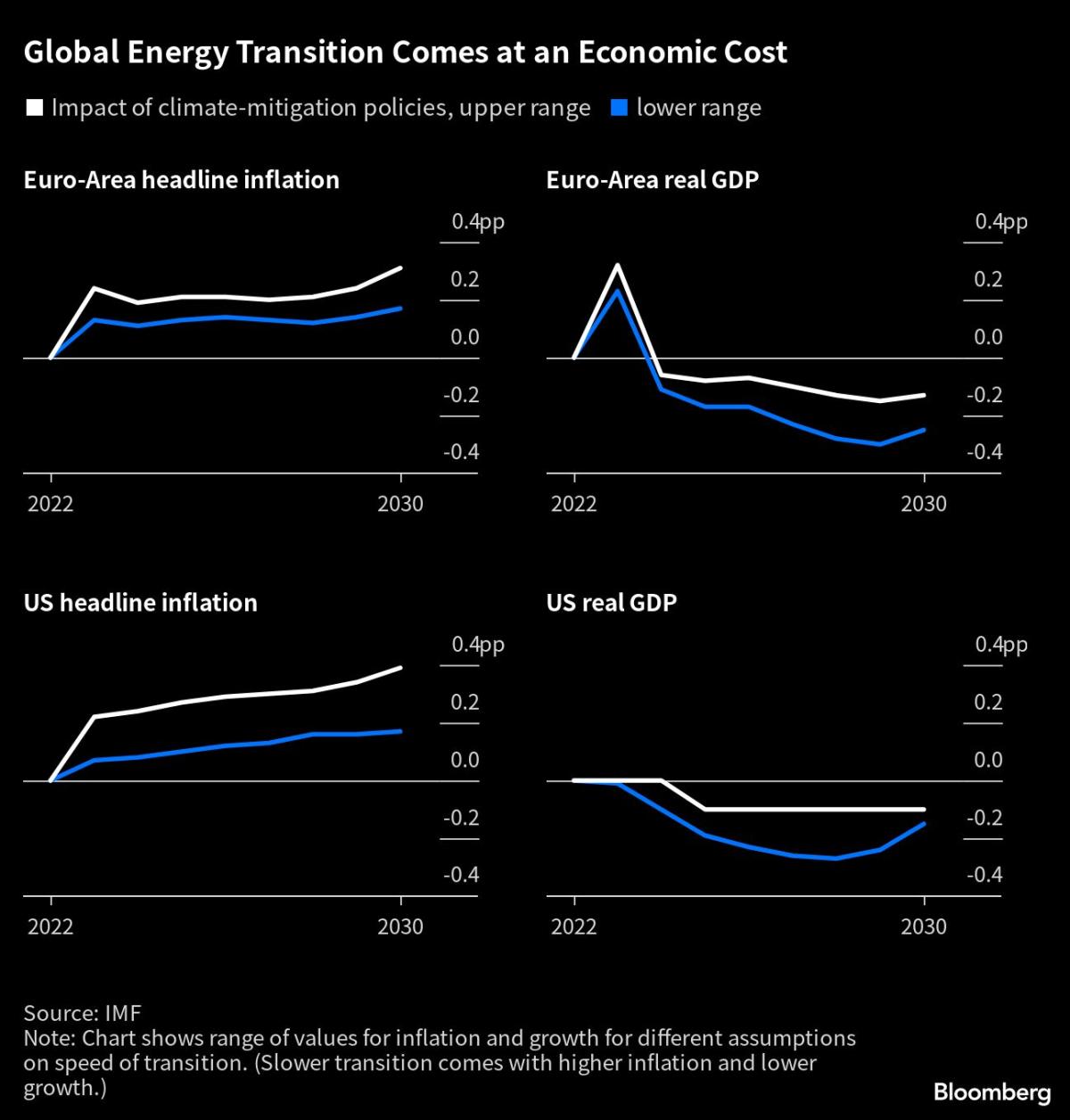

Euro-area inflation could also be as a lot as 0.3 proportion level increased by way of the tip of the last decade, in line with the Worldwide Financial Fund.

Equally, Sweden’s Riksbank discovered that vitality costs will enhance throughout the transition as phasing out carbon-intense applied sciences squeezes combination provide, and funding in new ones bolsters demand.

“In response to our analyses, the vitality transition implies reasonably increased inflationary pressures” stated Bundesbank official Sabine Mauderer, the vice chair of the Community for Greening the Monetary System who will quickly lead that group of financial and supervision authorities. “Central bankers should think about this improvement. On the identical time, worth stability is the most effective contribution we are able to make to make sure the transition shall be profitable.”

Local weather change itself is stoking costs as shifting climate patterns undermine pure techniques that fashionable economies are constructed on, from droughts ravaging agriculture to produce disruptions brought on by rivers operating dry.

Pure disasters may have “vital optimistic results” on inflation, making the ECB’s job more and more tough, economists at SOAS in London wrote in 2021.

“Inflation in the meanwhile is already pushed by local weather change in a manner that I discover personally very scary,” stated Jens van ‘t Klooster, an assistant professor on the College of Amsterdam.

Whereas central banks have embraced a job in preventing local weather change, many together with the ECB cite their inflation mandates as a brake to that.

However Borowski at Amundi says that whereas it’s clear the job of policymakers to anchor inflation expectations, financial regimes would possibly must adapt and be prepared to allow some worth progress stemming from the transition.

“Central bankers can’t simply say, ‘nicely, this course of is inflationary within the brief run, I’ll hike charges,’” he stated, describing that response as “counterproductive.”

The ECB has claimed the impression of an orderly transition on its insurance policies needs to be restricted, whereas suggesting some coping methods. They embrace emphasizing inflation gauges excluding vitality, and focusing on an extended time horizon.

That might imply a divergence lasting 20 years, exceeding the phrases of two ECB presidents.

Former IMF Chief Economist Olivier Blanchard argues that such a time interval remains to be finite. An advocate of elevating inflation targets, he reckons the climate-change shift doesn’t justify such adjustments.

“That is only a transition concern,” he stated. “If we’re considering of upper inexperienced funding as a 10-year, 20-year mission, this transition concern is minor.”

Whereas the ECB has proved open to evolving, and guarantees one other technique evaluate in 2025, officers are nervous about diverging from their mandate, not least at a time of excessive inflation. For ECB Government Board member Isabel Schnabel, nothing needs to be allowed to supersede its core mission.

“Our greatest contribution to fostering funding — within the inexperienced transition but in addition in different areas — is to get again to cost stability and create, so far as we are able to, a secure macroeconomic surroundings,” she informed Bloomberg this yr.

Guntram Wolff, who leads the German Council on Overseas Relations and frequently advises European governments, agrees.

“It’s the job of finance ministries, taxpayers and politicians to cushion the prices and results of local weather change,” he stated. “It’s not the job of a central financial institution to simply accept increased inflation and contain sure components of society extra intently into stemming the prices.”

The political tensions are evident. The Swiss Nationwide Financial institution, which is reluctant to embrace a job within the transition, confronted protests at its shareholder assembly in April.

ECB President Christine Lagarde has sought to prioritize the problem, and may very well be uncomfortable that delivering worth stability would possibly harm transition funding.

That’s why inexperienced lending could be an answer. Favored by activists however resisted by officers reluctant to subsidize any particular person sector of the financial system, the coverage would possibly truly be self-serving to assist assist their core job.

The NGFS has additionally checked out focused credit score operations as one instrument central banks might think about.

Just like previous ECB choices that gave banks an interest-rate low cost in the event that they used funds to increase credit score, such a measure might present new loans costing much less if deployed to battle local weather change.

“The concept shouldn’t be that central banks go off by themselves making all this local weather coverage as a result of elected officers aren’t doing issues,” stated Klooster, a key proponent of the instrument. “However possibly stopping some investments that aren’t actually aligned with the transition, or possibly selling some funding that for some cause aren’t made, needs to be OK.”

Asian central banks have used such devices for some time to assist the transition.

The Individuals’s Financial institution of China has provided low cost funding to banks which lend to companies which can be serving to scale back carbon emissions since November 2021. The identical yr, the Financial institution of Japan launched its personal lending scheme.

Lagarde has signaled openness to the thought. Schnabel has additionally cited it for when there’s room to ease coverage once more. Neither have linked it with inflation focusing on.

European state-backed lenders might do the job. However inexperienced lending additionally falls inside a central financial institution’s price-stability mission, since extra renewable vitality may have a “vital dampening impact on inflation,” stated John Beirne, vice chair of analysis on the Asian Growth Financial institution Institute and a former ECB economist.

“I don’t assume there needs to be main issues round explaining why these kind of applications could be happening throughout the total context of the central-bank mandate,” he stated.

Policymakers have been sluggish to agree with that, having lengthy argued that it’s the federal government’s job to determine which industries to assist. However former Financial institution of England chief Mark Carney insists that perspective must shift.

“Local weather change is macro essential,” he stated in a latest speech. “Local weather coverage and the tempo of the transition instantly impression the efficacy of fiscal and financial insurance policies.”

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.