(Bloomberg) — Firms storming the bond market at record-breaking tempo made one factor clear: They don’t anticipate charges to remain elevated for lengthy.

Most Learn from Bloomberg

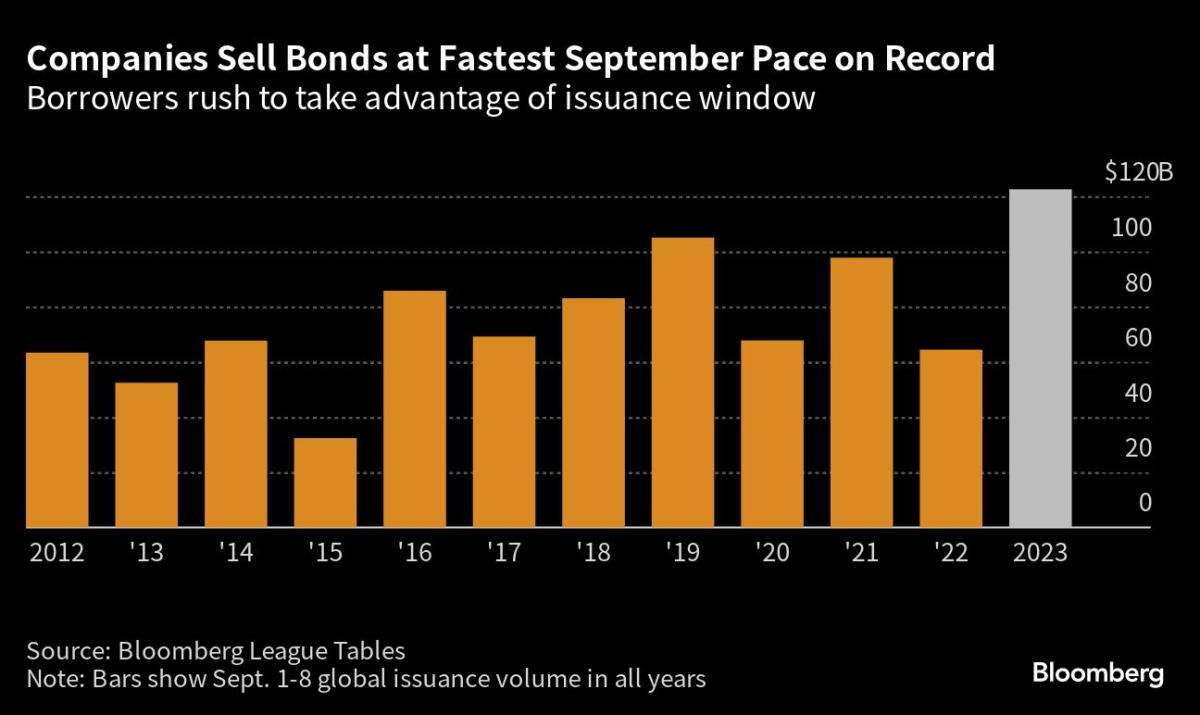

Greater than $110 billion in bonds offered globally this week, the busiest begin to September on file, with issuance closely skewed to debt due in below 10 years. The barrage was led by investment-grade issuers, teeing up a wave of junk, together with billions of {dollars} in buyout funding.

“Firms don’t actually wish to lock in these excessive yields for a really very long time if they will keep away from it,” stated Matt Brill, head of North America investment-grade credit score at Invesco Ltd., which manages $1.5 trillion in property.

Prospects of a tender touchdown within the US and hopes that central banks will quickly have the ability to sluggish their tightening campaigns make longer-dated debt extra engaging to buyers. However corporations are as a substitute opting to borrow for shorter intervals, hoping the cash will get cheaper quickly.

“Many issuers are reluctant to lock in these increased absolute charges for long term,” stated Dan Mead, head of the investment-grade syndicate at Financial institution of America Corp., the largest underwriter of company bonds, in keeping with present Bloomberg rankings.

The share of US high-grade company bond issuance with a maturity of 10 years or longer was simply 10% within the month to Sept. 6, the bottom since at the least 2010, in keeping with strategists at Financial institution of America.

The September rush to boost debt is pretty typical of the company bond market, which normally sees issuers benefit from pent-up demand after a seasonal summer time slowdown. It’s not anticipated to proceed on the similar tempo, or shift credit score spreads a lot from present compressed ranges.

“Buyers had been arrange for this,” stated Steven Boothe, head of worldwide investment-grade fastened earnings at T. Rowe Worth Group Inc, which manages about $1.4 trillion. “As soon as we get by means of this wave, there’s not going to be a lot remaining provide for the remainder of the 12 months.”

Issuance will doubtless taper after the primary two weeks of September as corporations enter earnings blackout intervals, in keeping with Financial institution of America’s Mead. “There’s definitely the power for this market to tackle extra provide however I additionally don’t suppose we are going to proceed at this run price,” stated Mead in an interview.

The US debt market is already exhibiting some indicators of indigestion, with some issuers struggling to generate sufficient demand to get offers achieved. Regardless of this, September gross sales already exceed $55 billion, almost half approach to the forecasted $120 billion whole for the month — with one other $30 billion anticipated within the week forward.

Even then, demand is anticipated to outstrip provide, as the expected September whole would fall in need of most prior years, and year-to-date US high-grade gross sales are down 4%. And even after leaping 14% this 12 months, international issuance remains to be operating behind 2020 and 2021 ranges, information compiled by Bloomberg present.

“Firms don’t wish to challenge as a lot, which goes to make life a bit of tougher for the patrons,” stated Invesco’s Brill. “There gained’t be the concessions that we had form of hoped for and thought there could be.”

In Europe, debt gross sales are additionally anticipated to decelerate later this month. Firms had accelerated issuance to get forward of central financial institution conferences and blackouts, in keeping with Tom Moulds, senior portfolio supervisor at BlueBay Asset Administration.

“This seasonal interval of exercise has been nicely obtained,” stated Moulds.

Week in Overview

-

Firms with leveraged loans and junk bonds coming due quickly are more and more turning to non-public credit score to refinance.

-

A bunch of lenders led by corporations together with Blue Owl Capital Inc. and Blackstone Inc. is offering $2.7 billion of financing to assist fund BradyIFS’s acquisition of competitor Envoy Options.

-

Personal credit score lenders are simply getting began on the planet of shopper and asset primarily based finance, in keeping with Rob Camacho, Blackstone’s co-head of asset primarily based finance.

-

Dwight Scott, Blackstone’s international head of credit score, talked with Bloomberg Information about what he sees because the benefit that non-public lending funds have over funding banks when funding take-private transactions.

-

In the meantime, Blackstone’s almost $50 billion non-public credit score fund for prosperous people attracted probably the most capital in additional than a 12 months.

-

-

Armen Panossian, considered one of Oaktree Capital Administration’s two incoming co-chief govt officers, stated the demand for personal credit score is tempting buyers who may in any other case have positioned funds with non-public fairness corporations.

-

In rising markets, non-public credit score offers are selecting up once more as corporations search extra versatile, longer-term financing in an unsure financial surroundings, in keeping with the World Personal Capital Affiliation.

-

Barclays Plc is finalizing a personal credit score partnership with AGL Credit score Administration.

-

US regional banks may have to boost vital quantities of extra debt to adjust to new regulatory necessities, however the additional capital may not be sufficient to stop future failures.

-

After bouncing again from Credit score Suisse’s AT1 writedown debacle, the marketplace for European banks’ riskiest debt is ready to be examined once more, with $84 billion notes going through calls within the subsequent two years.

-

AB CarVal Buyers LP and Serone Capital Administration LLP are becoming a member of a rising roster of hedge funds making an attempt to carve out their first slice of Europe’s marketplace for collateralized mortgage obligations.

-

China’s housing disaster has engulfed the nation’s non-public builders, producing file waves of defaults and leaving a shrinking group of survivors.

-

Taiwanese banks are quick disappearing from mortgage offers with Chinese language corporations, the most recent indication of a collective effort to chop publicity to the world’s second-biggest economic system.

On the Transfer

-

Judith Fishlow Minter, co-head of US mortgage capital markets at RBC Capital Markets, is retiring on the finish of October.

-

Deutsche Financial institution AG has employed Saju Georgekutty to guide investment-grade money buying and selling within the US. Georgekutty beforehand led the investment-grade bond buying and selling desk at Morgan Stanley.

-

26North Companions, the funding agency began by Apollo World Administration Inc. co-founder Josh Harris, named seven new companions for an array of roles because it begins a direct-lending enterprise.

-

Dan Loeb’s Third Level recruited Chris Taylor, a former New York Life Investments govt, to move the hedge fund agency’s new direct-lending technique.

-

Canadian Imperial Financial institution of Commerce employed Andras Gajdos as a director to construction collateralized mortgage obligations. Gajdos beforehand labored at Morgan Stanley.

-

Swedish lender SEB AB has appointed Karl-Johan Nystedt to guide a debt capital markets staff targeted on monetary establishments in Stockholm.

-

Sumitomo Mitsui Monetary Group’s US arm recruited Chris Castelli and Miguel Freyre as administrators in its rising markets fastened earnings gross sales and buying and selling staff.

–With help from Ronan Martin, Taryana Odayar and Andrew Monahan.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.