(Bloomberg) — Observe Bloomberg India on WhatsApp for unique content material and evaluation on what billionaires, companies and markets are doing. Enroll right here.

Most Learn from Bloomberg

Abroad traders are displaying such eager curiosity in India property that they’re taking proxy publicity to the nation even when they don’t have the license or bodily presence to commerce there.

Overseas funds missing direct entry to India’s $1 trillion authorities debt market are growing their publicity by way of devices corresponding to supranational bonds and swaps forward of the nation’s upcoming inclusion in international bond indexes.

There’s an “elevated engagement from international traders, with momentum selecting up this 12 months,” mentioned Siddharth Bachhawat, head for markets at Barclays Financial institution India. “Along with curiosity from index-tracking managers forward of the inclusion, discretionary exercise from a wider investor base has additionally been notable.”

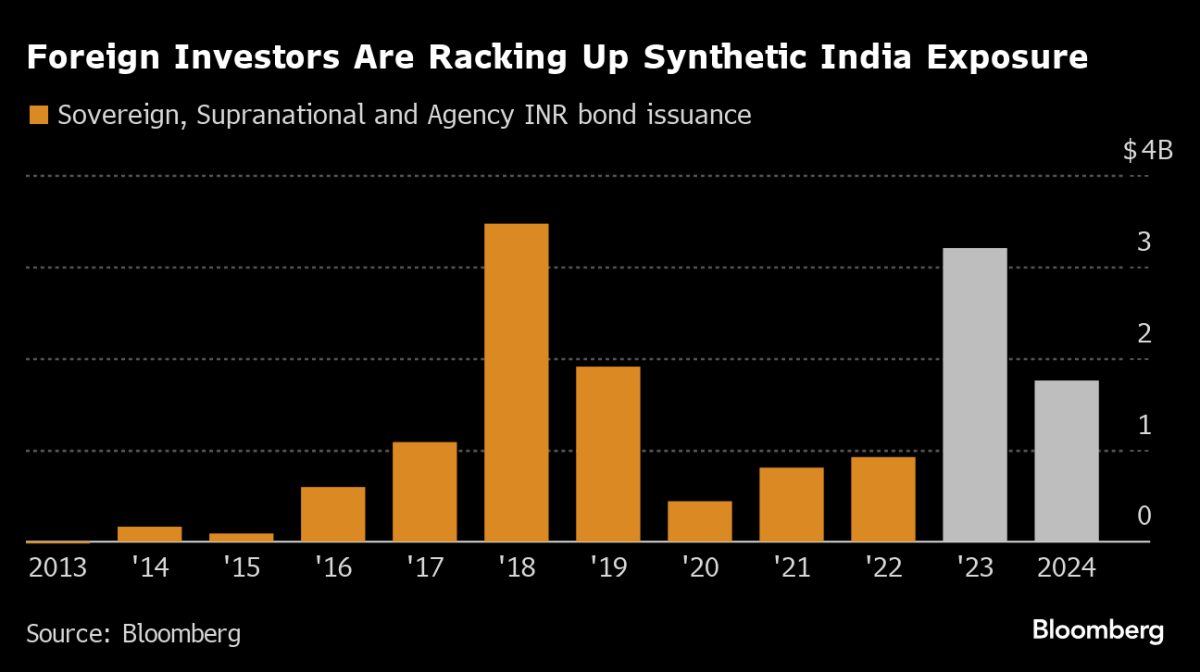

Indian sovereign bonds have gained prominence after JPMorgan Chase & Co.’s transfer so as to add them to its international debt indexes from June. Sovereign, supranational and company entities are promoting extra debt denominated in rupees, with the scale of such gross sales reaching a five-year excessive of $3.2 billion in 2023, in line with information compiled by Bloomberg.

“There’s been a marked enhance within the gross sales of rupee-denominated SSA debt,” mentioned Wontae Kim, analysis analyst at Western Asset Administration.

Buyers corresponding to William Blair Investments and M&G Investments are venturing into supranational bonds. Issued by multilateral companies just like the World Financial institution and denominated in Indian rupees, these triple-A rated notes give abroad traders publicity to native debt with out having to safe a license to function onshore.

“Given India’s disinflation pattern and improved technical outlook with impending index inclusion, we favor length in India,” mentioned Johnny Chen, fund supervisor at William Blair in Singapore.

Additionally, consumers don’t need to pay 20% withholding tax as these securities are settled offshore, which ends up in greater yields, in line with Claudia Calich, head of emerging-market debt at M&G Investments in London.

“Even when the pretax yield on supranational bonds tends to be decrease than on India authorities debt, the yield is greater on an after-tax foundation,” she mentioned.

Bonds Rally

The inclusion is extensively anticipated to lure as much as $40 billion of inflows. International funds have begun to spice up their holdings of index-eligible bonds since JPMorgan’s September announcement, including over $8 billion of holdings.

The purchases have helped make Indian bonds the second-best performers in native forex rising market debt up to now in 2024, in line with Bloomberg information. Yields are down 12 foundation factors up to now this 12 months, a interval during which Treasury yields have climbed 44 foundation factors.

Fund managers are additionally turning to derivatives corresponding to complete return swaps to faucet native debt. The instrument offers abroad traders the identical payoff they’d get by proudly owning native securities with out having to open a home account or cope with native investing laws.

“The exercise in complete return swaps will choose up meaningfully when you find yourself sitting near the cutoff date in June,” mentioned Ashhish Vaidya, head of treasury at DBS Financial institution Ltd. in Mumbai. That’s as a result of traders want time to safe approval for organising operations onshore, he mentioned.

–With help from Ayush Damani.

(Updates bond yields in eleventh paragraph)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.