Savvy insurers will seize the gen AI alternatives that intrigue their prospects —

By Christian Bieck, IBM Institute for Enterprise Worth, et al —

For the insurance coverage {industry}, is generative AI extra of a danger or a possibility? Insurance coverage CEOs are equally divided: 49% mentioned it’s extra of a danger, 51% mentioned it’s extra of a possibility. Business executives anticipate utilizing gen AI to gasoline aggressive benefit with improved gross sales, buyer experiences, and organizational capabilities—however they’re cautious of the dangers to cybersecurity and operations and the problems that may come up from inaccuracy and bias.*

Whatever the insurer tendency for prudence and danger mitigation, the strain is on to grab the alternatives. 77% of {industry} executives mentioned they should undertake gen AI shortly to maintain up with rivals.

As insurance coverage organizations stroll a tightrope between quickly constructing new gen AI capabilities and managing gen AI danger and compliance, they’re pushing ahead with adoption, primarily based on new analysis from the IBM Institute for Enterprise Worth (IBM IBV). Investments in gen AI are anticipated to surge by over 300% from 2023 to 2025 as organizations transfer from pilots in a single or two areas to implementations in additional features throughout the enterprise.

Organizations are additionally getting a style of success. Early adopters utilizing gen AI considerably of their customer-facing methods are seeing a marked enchancment in buyer satisfaction over insurers not utilizing it in any respect, together with a 14% increased retention fee and a 48% increased Web Promoter Rating. And insurers that use gen AI throughout their direct, agent, and financial institution channels are bettering gross sales, buyer experiences, and buyer acquisition prices.

Nonetheless, our complete survey of 1,000 world insurance coverage and bancassurance executives and 4,700 insured prospects additionally reveals important areas of discord between insurers and their prospects concerning generative AI expectations and issues. To proceed realizing the advantages, insurers could be smart to take the time to guage each what they’re doing with the expertise and the way they’re doing it.

On this report, we discover three essential elements that monetary service and insurance coverage suppliers ought to take into account in assessing their gen AI technique.

1. Bridging the AI expertise hole with prospects.

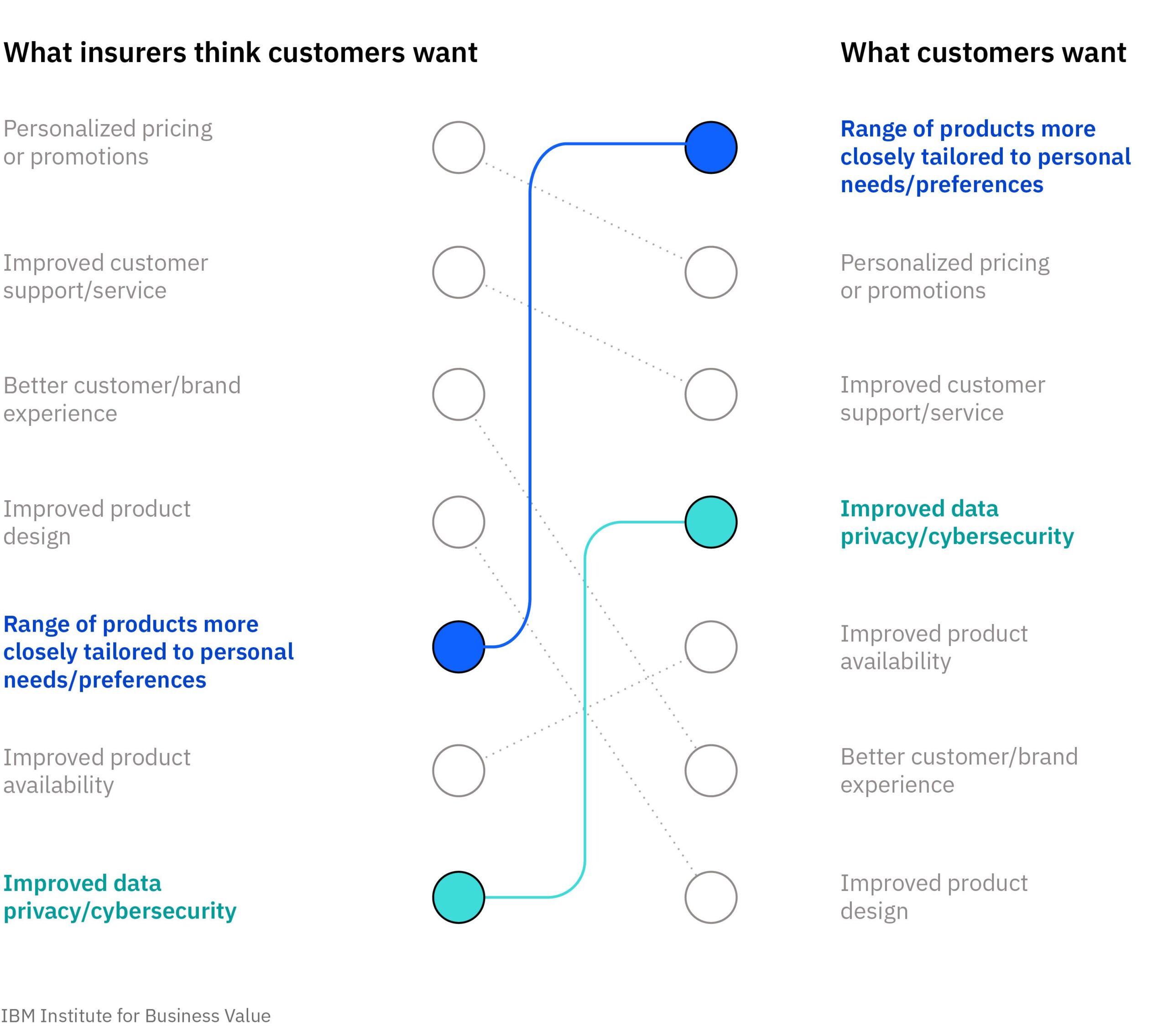

Buyer engagement is already a high precedence amongst insurers’ AI initiatives. Most executives report progress on AI assistants (chatbots or digital assistants), augmented customer support, direct buyer assist, and developer productiveness. However right here’s the disconnect: gen AI instruments in customer support aren’t a high precedence for insurers’ prospects. They prioritize using generative AI for personalised pricing or promotions and tailor-made merchandise to fulfill their wants. Extra gaps are uncovered when prospects’ gen AI issues similar to information privateness and potential dangers for AI-generated inaccurate info. Whereas these divides problem present insurer efforts, additionally they present alternatives for savvy insurers to leap forward of opponents.

Clients have totally different expectations of generative AI than what insurers anticipated.

2. Conquering complexity.

Generative AI is the tip of a widely known insurance coverage iceberg: a fancy expertise property that’s growing older and never at all times receptive to new gen AI fashions and code. Technical debt in insurance coverage core methods makes it troublesome to adapt these methods to new AI capabilities amid shortly altering market situations, buyer preferences, and regulatory necessities. Advanced methods additionally hamper generative AI adoption by limiting the underlying coaching information for the big language fashions. 52% of executives cite information constraints—insufficient, inaccessible, incomplete, or in any other case unusable information—as slowing velocity to market of merchandise. For gen AI to work throughout the enterprise, insurers should take into account AI approaches that function inside their advanced actuality whereas working to enhance the scenario over time. A hybrid-by-design structure can assist the enterprise begin paying off technical debt and produce down run/construct ratios

3. Betting on a versatile working mannequin.

As insurance coverage sector organizations put money into AI and buyer information analytics, they have to be sure that their working mannequin for gen AI helps the fast improvement and deployment of recent services and products. However will that be higher achieved via centralized or decentralized AI improvement and providers, or some mixture of the 2? Whereas executives report totally different approaches, the few which have chosen a decentralized working mannequin are extra profitable throughout a number of metrics, together with run/construct ratio, velocity to market, and buyer retention. Democratizing AI decision-making throughout the enterprise whereas retaining central governance and implementation is crucial to producing actual gen AI worth.

Obtain the report back to discover in additional element the elements impacting the insurance coverage {industry}’s adoption of generative AI. An motion information for every issue affords particular steps insurers can take to transform the potential of generative AI to actuality.

* “Generative AI: State of the Enterprise Market—Insurance coverage.” IBM Institute for Enterprise Worth. 2023. IBM Institute for Enterprise Worth generative AI influence on hybrid cloud pulse survey of 414 executives. 2023.

About IBM

IBM is a number one supplier of worldwide hybrid cloud and AI, and consulting experience. We assist purchasers in additional than 175 nations capitalize on insights from their information, streamline enterprise processes, cut back prices and acquire the aggressive edge of their industries. Greater than 4,000 authorities and company entities in essential infrastructure areas similar to monetary providers, telecommunications and healthcare depend on IBM’s hybrid cloud platform and Purple Hat OpenShift to have an effect on their digital transformations shortly, effectively and securely. IBM’s breakthrough improvements in AI, quantum computing, industry-specific cloud options and consulting ship open and versatile choices to our purchasers. All of that is backed by IBM’s legendary dedication to belief, transparency, accountability, inclusivity and repair. Go to www.ibm.com for extra info.

Supply: IBM

Tags: Synthetic Intelligence (AI), IBM, Innovation, survey, Transformation