By Kevin Buckland

A take a look at the day forward in European and world markets from Kevin Buckland

Simply as markets begin to get snug with the concept of a dovish Fed, ugly U.S. producer inflation figures threaten to crash the get together, organising a nervy await a shopper value studying later immediately.

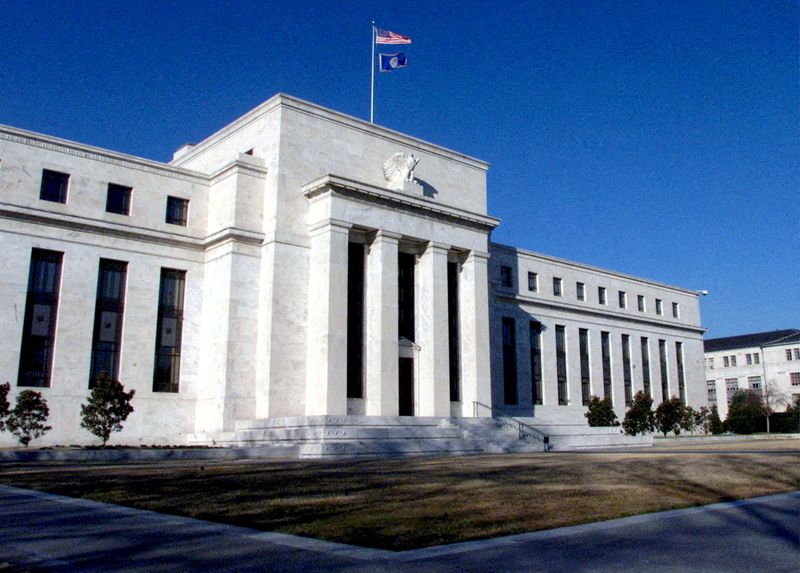

For now, the constant and – for fairness traders – very welcome chorus from Fed officers that warning is warranted earlier than additional price rises has drowned out any considerations about information.

Asia-Pacific shares have picked up the baton from Wall Avenue, with positive aspects far exceeding 1% for Japan’s Nikkei and Hong Kong’s Grasp Seng.

However simply how rapidly markets turned firstly of the week reveals how rapidly they might flip once more. Regardless of the dovish trimmings, the core Fed message stays that charges will rise so far as they must with a view to rein in inflation.

Whereas the prospect of U.S. yields returning again towards 16-year peaks above 5% is actually a threat, there is a sense that the ceiling could also be decrease now, with secure property presently wanted in opposition to geopolitical dangers.

Fed regional financial institution heads Lorie Logan, Susan Collins and Raphael Bostic have the possibility to air their views in remarks at separate occasions immediately.

In the meantime, Financial institution of England chief economist Huw Capsule shall be talking at an IMF assembly in Washington, on the identical day boss Andrew Bailey travels to Marrakesh for the IMF/World Financial institution annual conferences.

It is a huge day for British information as nicely, with GDP and industrial manufacturing due very first thing.

The BoE stored rates of interest on maintain at its assembly final month for the primary time because it started its tightening cycle in December 2021, however merchants make it a coin toss for one more hike by the top of the primary quarter subsequent 12 months.

Key developments that might affect markets on Thursday:

UK GDP, industrial manufacturing (each Aug)

U.S. CPI (Sep), preliminary jobless claims (week ending Oct 7)

U.S. 30-year Treasury public sale

(Reporting by Kevin Buckland. Modifying by Sam Holmes)