Governments and insurers should work collectively urgently to arrange communities and households for wildfires, floods, windstorms and hail whereas bettering Canada’s response to and restoration from these more and more frequent and extreme disasters —

By Craig Stewart, Vice President, Local weather Change and Federal Points, IBC —

Within the final decade, greater than 880,000 Canadians and 87,000 companies have suffered monetary losses because of injury brought on by extreme climate and pure catastrophes, with property & casualty insurers paying out greater than $30 billion in claims for a majority of these occasions.

Past these numbers lie the hard-to-quantify prices to society by way of lives disrupted, properties misplaced and monetary hardship skilled by people, households and companies. As well as, Canadian households pay deductibles and shoulder non-insured losses, whereas governments take up impacts to infrastructure and depend on tax payers to fund catastrophe help. The overwhelming majority of these affected are low- and middle-income Canadians and small and medium-sized companies.

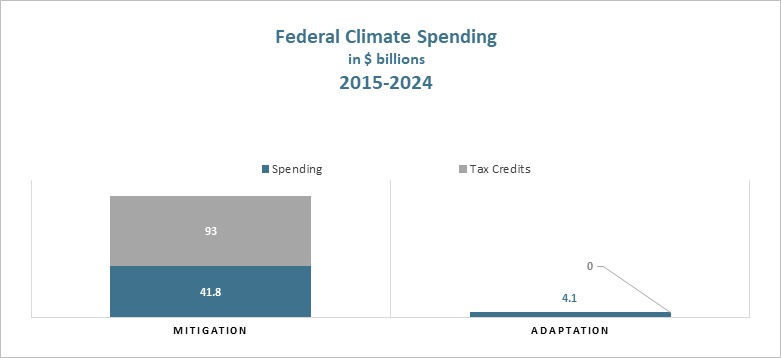

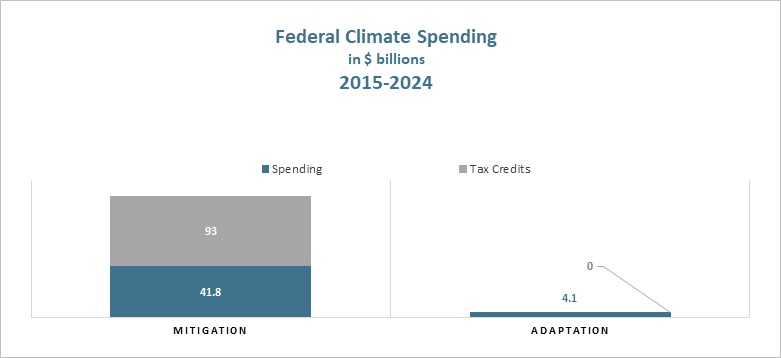

Ten years in the past, Canada started to take important motion to deal with local weather change. As a rustic, we centered on lowering carbon emissions, and have allotted $41.8 billion since 2016 to fund mitigation measures, equivalent to people who affected or labored towards the discount of Canada’s greenhouse fuel emissions, together with investments within the improvement of electrical autos.[1]

However any severe plan to struggle the impacts of our altering local weather should embrace adaptation measures to assist households and communities grow to be extra resilient to the intense climate we’re already dealing with. Adaptation measures that have an effect on or work towards adjusting to the results of local weather change embrace investments in emergency preparedness.

Within the phrases of revered hockey coaches, we now have to play offence and defence, at each ends of the rink, if we wish to win in opposition to local weather change. Nevertheless, solely a tenth of the quantity spent on mitigation – $4.1 billion – went to adaptation in those self same 10 years.

This lack of spending on adaptation leaves us considerably underprepared for the rising impacts of our altering local weather, as witnessed within the staggering outcomes of the catastrophic climate occasions of 2024, which adopted shut on the heels of the worst wildfire season in Canadian historical past in 2023.

In July and August of 2024, roughly 1 / 4 of one million Canadians suffered monetary losses from 4 main catastrophic climate occasions that brought about $7 billion in insured losses (and rather more injury that was uninsured). And these occasions occurred at a time when housing affordability and different cost-of-living challenges are top-of-mind for customers in every single place. Throughout the identical two months, greater than 7,800 companies had been interrupted by the disasters and compelled to scale back monetary exercise in two of the nation’s largest cities. And that’s not all. Over all the course of 2024, insurers paid out over $8.5 billion in extreme climate claims for a sequence of occasions that possible price Canadian householders, enterprise homeowners and their governments nearly $20 billion total (insured and uninsured injury prices mixed).

Insured payouts for catastrophic climate occasions reached $1 billion in 2019 and 2020, $2 billion in 2021, $3 billion in 2022 and 2023, and over $8 billion in 2024. It’s horrifying to assume the place this development could also be headed.

Insurers are actually near paying out extra in claims for a single occasion than has been allotted on the nationwide degree to local weather adaptation over the previous decade. Such a small funding in resilience and catastrophe preparedness is now costing Canadian households and communities. Given the worsening impacts of Canada’s extreme climate occasions, Canadians want their governments in any respect ranges to collaborate and shield residents from the ever-escalating variety of extreme floods, wildfires, windstorms and hailstorms.

Canada has completed its half to guide the world on aggressively slicing greenhouse fuel emissions. We’ve been all-in on offence. However now’s the time to concentrate on defence and shield Canadians right here at dwelling.

The P&C insurance coverage trade stands able to do its half and work with governments in any respect ranges. As we proceed to assist Canadians decide up the items and get better from final 12 months’s extreme climate occasions, the safety hole is rising and prices are rising, affecting affordability and even availability of insurance coverage protection. Canadians want governments and the non-public sector to collaborate on options to guard them from the extreme climate of immediately and tomorrow.

If that doesn’t occur, we must always all get able to dwell in an uninsurable nation a decade from now.

Notes

1. IBC carried out an evaluation of spending on mitigation versus adaptation within the federal fiscal framework from 2016–2024.

About The Writer

Craig Stewart leads nationwide work on catastrophe resilience and local weather change at Insurance coverage Bureau of Canada. He co-chairs the Nationwide Advisory Desk on Catastrophe Resilience and Safety which advises federal Ministers on improvement of Canada’s Nationwide Adaptation Technique and catastrophe danger discount typically.

Craig is taken into account one in all Canada’s foremost specialists on catastrophe danger discount and local weather adaptation and has testified at quite a few Senate and Home of Commons Committees in addition to to federal, provincial and territorial Ministerial conferences repeatedly over the previous decade.

About Insurance coverage Bureau of Canada

Established in 1964, Insurance coverage Bureau of Canada (IBC) is the nationwide trade affiliation representing Canada’s non-public dwelling, auto and enterprise insurers. Its member firms make up the overwhelming majority of Canada’s extremely aggressive property and casualty (P&C) insurance coverage market. Because the main advocate for Canada’s non-public P&C insurers, IBC collaborates with governments, regulators and stakeholders to help a aggressive atmosphere for the P&C insurance coverage trade to proceed to assist shield Canadians from the dangers of immediately and tomorrow. IBC believes that Canadians worth and deserve a responsive and resilient non-public P&C insurance coverage trade that gives insurance coverage options to each people and companies.

For extra data, go to www.ibc.ca. When you’ve got a query about dwelling, auto or enterprise insurance coverage, contact IBC’s Client Info Centre at 1-844-2ask-IBC.

Supply: Insurance coverage Bureau of Canada (IBC)

Tags: local weather change, Insurance coverage Bureau of Canada (IBC), Pure Catastrophes, pure catastrophe losses, record-breaking losses