(Bloomberg) — Merchants are betting on fewer and slower interest-rate cuts within the euro-area and the UK this 12 months, after a surprisingly scorching inflation studying within the US spurred a fast repricing within the outlook for financial coverage globally.

Most Learn from Bloomberg

Cash markets indicate slightly below three quarter-point cuts from the European Central Financial institution this 12 months after officers held charges regular and reiterated their willpower to get inflation again to focus on. Earlier this week, three reductions had been totally priced and there was a 50% probability of a fourth.

Within the case of the BOE, buyers are pricing fewer than two interest-rate cuts this 12 months, down from as many as three earlier than the US inflation report.

It’s an abrupt turnaround from the current market narrative, which had more and more seen all three main central banks delivering cuts in unison from the center of the 12 months. However with the US economic system outperforming many of the developed world, that thesis is unraveling, setting markets up for an episode of upper volatility and a stronger greenback.

Whereas the ECB’s resolution to carry charges got here as no shock, merchants will now scrutinize remarks by President Christine Lagarde for clues on the longer term path of coverage. Knowledge Wednesday confirmed US inflation topped forecasts for a 3rd straight month, bolstering the case for a extra cautious method to easing by the Federal Reserve.

The ECB has beforehand signaled it could decrease borrowing prices from June. Whereas that’s nonetheless the bottom case for the market, it’s solely seen as a 76% chance. The euro, which had its worst each day drop in additional than a 12 months on Wednesday, fell 0.2% to $1.0725 after the choice.

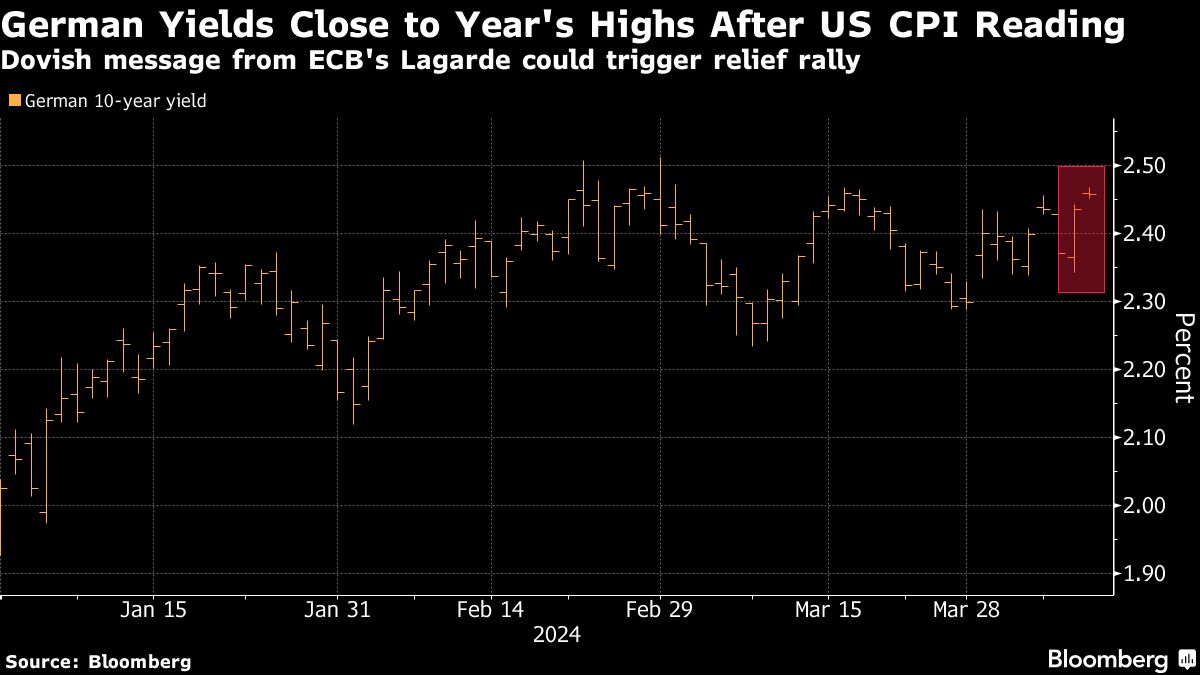

Bonds fell as merchants reassessed the charges outlook. The yield on the two-year German word was two foundation factors increased at 2.98%, near its highest degree since November. Gilts dropped, sending yields as a lot as 10 foundation factors increased throughout the curve.

Not like the US, Europe’s economic system has been flirting with a recession for greater than a 12 months, a divergence that has grow to be all of the extra stark over the current weeks. A current survey of financial institution lending confirmed plunging company demand. Euro-area inflation undershot final month, slowing to 2.4% from 2.6% in February.

Hawkish coverage within the US might make it troublesome for policymakers within the euro space to ship a number of cuts. A major divergence in rates of interest might weigh closely on the widespread forex, doubtlessly sending it again towards parity with the greenback.

US Treasuries added to losses after posting their largest selloff in months on Wednesday. Buyers are signaling the Federal Reserve will reduce rates of interest simply twice this 12 months.

“The Fed’s capacity to chop charges anytime quickly may very well be additional questioned within the close to time period if official knowledge stays strong – and extra importantly – if US inflation dynamics refuse to level in direction of the Fed’s goal once more,” ING Group strategists together with Padhraic Garvey. “Vital for euro charges will probably be how the ECB is perceived as distancing itself from these dynamics.”

–With help from Naomi Tajitsu and James Hirai.

(Provides ECB financial coverage resolution, updates costs all through.)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.