(Bloomberg) — Asian semiconductor shares acquired a recent enhance from a stellar set of outcomes at Nvidia Corp., the usual bearer of the bogus intelligence theme that propelled good points within the sector earlier this yr.

Most Learn from Bloomberg

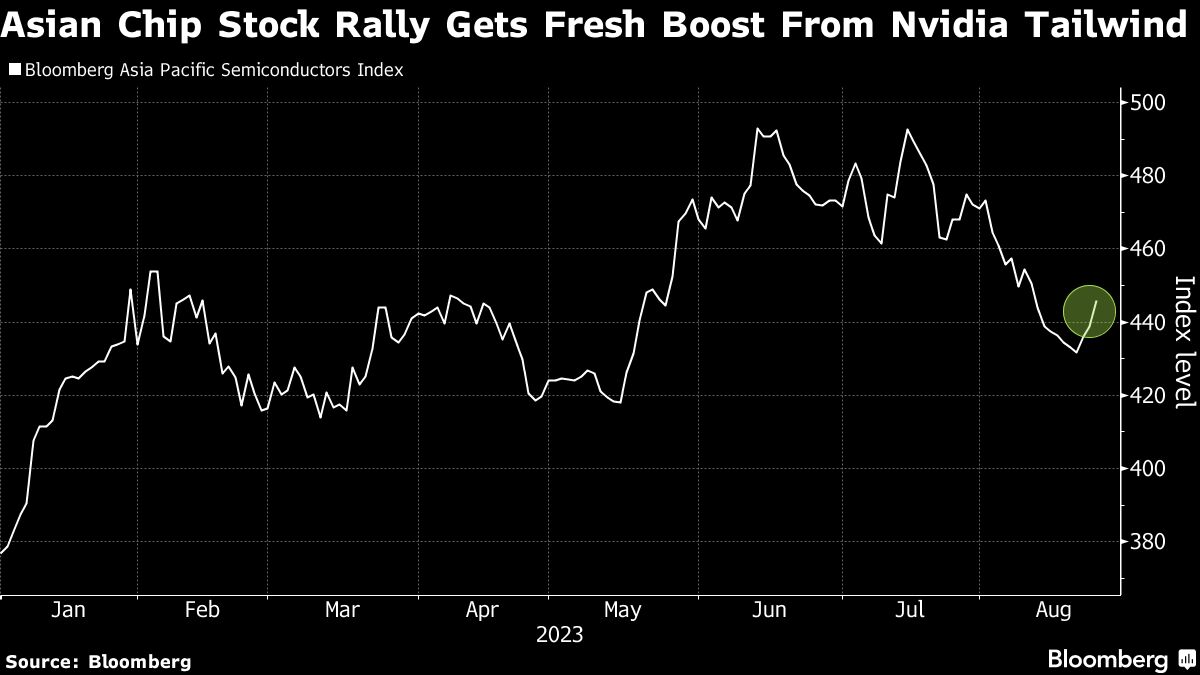

The Bloomberg Asia Pacific Semiconductors Index climbed practically 3%, probably the most since July 11. A trio of Nvidia suppliers seen as among the many area’s greatest beneficiaries of the AI growth boosted the gauge, with South Korea’s SK Hynix Inc. and Japan’s Advantest Corp. every leaping greater than 5% and Taiwan Semiconductor Manufacturing Co. rising about 2%.

Nvidia’s outcomes for the newest quarter and its outlook for the present interval trumped analyst expectations on a surge in demand for its AI processors. The rising expertise has helped the US chipmaker overcome a stoop in additional conventional semiconductor enterprise, and pushed its share value to greater than triple in worth to date in 2023.

Nvidia Soars as Insatiable AI Demand Fuels Blowout Forecast

The most recent blowout outcomes despatched Nvidia shares hovering 10% in US post-market buying and selling Wednesday. The soar supplied a recent tailwind for Asian chip shares, serving to the Bloomberg Asia chip gauge pare its decline from a June excessive. The measure continues to be up 19% yr to this point.

“Nvidia’s post-market surge is favorable,” mentioned Search engine optimization Sang Younger, a strategist at Mirae Asset Securities Co. “It has raised expectations for the AI trade that it isn’t only a non permanent theme.”

The US chipmaker’s outcomes “got here in stronger than anticipated on datacenter/AI demand power from hyperscalers together with Amazon, Google, Meta, and Microsoft,” Citigroup Inc. analyst Carrie Liu wrote in a be aware. That is optimistic for tech shares together with Taiwan’s Quanta Pc Inc. and Wistron Corp. as “AI enablers,” she added.

Whereas the AI rally is getting a recent leg up, dangers stay for inventory traders, together with valuations. Advantest is buying and selling at about 10 occasions ebook worth whereas Nvidia is at 48 occasions, each having reached all-time excessive ranges this yr.

Shares flying so excessive are topic to huge drops if outcomes disappoint. And if competing merchandise emerge, costs of Nvidia chips might tumble mentioned Lee Seung-Woo, an analyst at Eugene Funding & Securities Co.

“It’s a matter of how lengthy this peak can be maintained and whether or not its rivals can catch up,” he mentioned.

–With help from Lianting Tu.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.