(Bloomberg) — The worldwide oil market is trying more and more native as militant assaults within the Purple Sea and surging freight charges make provides from nearer to dwelling extra enticing.

Most Learn from Bloomberg

A hunch in tanker visitors via the Suez Canal is spurring the beginnings of a cut up, with one buying and selling area centered across the Atlantic Basin and together with the North Sea and the Mediterranean, and one other encompassing the Persian Gulf, the Indian Ocean and East Asia. There’s nonetheless crude shifting between these areas — through the longer and costlier journey across the southern tip of Africa — however latest shopping for patterns level to disconnection.

Throughout Europe, some refiners skipped purchases of Iraqi Basrah crude final month, in response to merchants, whereas consumers from the continent are snapping up cargoes from the North Sea and Guyana. in Asia, a soar in demand for Abu Dhabi’s Murban crude led to a spike in spot costs in mid-January, and flows from Kazakhstan to Asia are down sharply.

Crude loadings from the US to Asia, in the meantime, plunged by greater than a 3rd final month from December, ship-tracking knowledge from Kpler present.

The fragmentation is not going to be everlasting, however for now it’s making it harder for import-dependent nations like India and South Korea to diversify their sources of oil provide. For refiners, it limits their flexibility to reply to quickly altering market dynamics and will finally eat into margins.

“The pivot towards logistically simpler cargoes makes business sense, and that would be the case for so long as the Purple Sea disruptions hold freight charges elevated,” mentioned Viktor Katona, lead crude analyst at knowledge analytics agency Kpler. “It’s a troublesome balancing act selecting between safety of provide and maximizing income.”

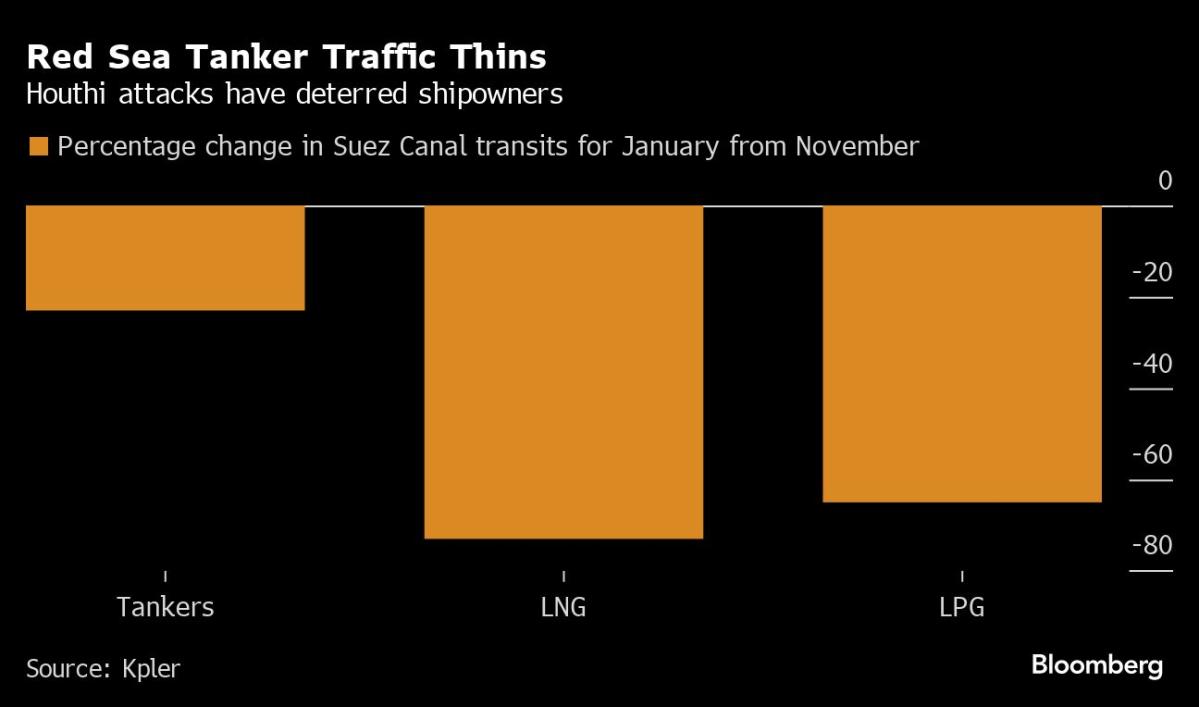

Oil tanker transits via the Suez Canal have been down 23% final month in contrast with November, Kpler mentioned in a observe launched Jan. 30. The drop was much more pronounced for liquefied petroleum fuel and liquefied pure fuel, which fell 65% and 73%, respectively.

In product markets, flows of diesel and jet gas from India and the Center East to Europe, and European gas oil and naphtha heading to Asia have been most affected. Asian costs of naphtha, a petrochemicals feedstock, hit the best in virtually two years final week on fears it will develop into harder to supply it from Europe.

Learn Extra: Purple Sea Transport Turmoil Sends Financial Shockwaves Extensively

The impression of the Purple Sea assaults is feeding via to grease costs through greater transport prices, which is encouraging refiners to go native the place they will. Charges for Suezmax crude tankers from the Center East to Northwest Europe have jumped by round half since mid-December, Kpler mentioned. International benchmark Brent crude is up round 8% over the identical interval.

In the meantime, the delivered value of oil to Asia from the US, the place manufacturing is surging, rose by greater than $2 a barrel over a three-week interval in January, in response to merchants concerned available in the market.

“Diversification continues to be attainable, however it comes at the next worth,” mentioned Giovanni Staunovo, a commodity analyst at UBS Group AG. “Except it may be handed onto the tip shopper, it will lower into the margins of refineries.”

The state of affairs within the Purple Sea isn’t anticipated to result in a long-term rearrangement of oil flows, however it’s additionally tough to see a decision of the battle within the close to time period. As a substitute, there’s a major danger of extra disruptions, notably after the Houthi strike on a tanker carrying Russian gas late final month. That assault was noteworthy because the Iranian-backed militant group had beforehand indicated that Russian and Chinese language ships wouldn’t be focused.

“Geopolitics usually are not good for commerce,” mentioned Adi Imsirovic, director of consultancy Surrey Clear Vitality. “If I used to be a purchaser, I’d be on my toes. It’s a tough time for refiners, particularly Asian refiners, who should be extra versatile.”

–With help from Sherry Su, Lucia Kassai and Elizabeth Low.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.