Kwarkot

REITs ended the week decrease as a pause on the debt-ceiling talks weighed on market sentiments surrounding the sector.

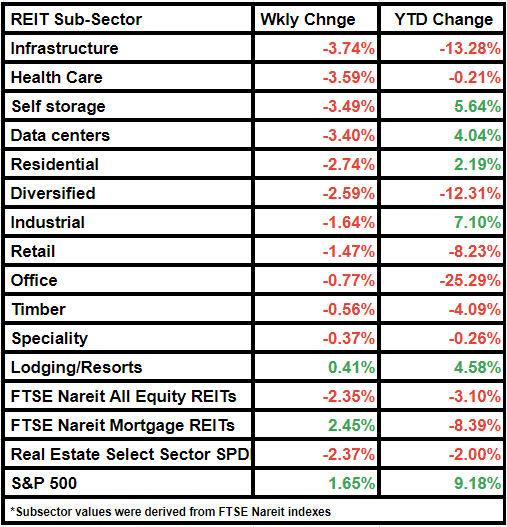

The FTSE Nareit All Fairness REITs index fell by 2.35% on a weekly foundation, whereas S&P 500 gained by 1.65%.

The broader actual property index decreased by 2.37%, whereas the mortgage REITs index rose by 2.45%.

All three main U.S. inventory indices fell to session lows on Friday after the information that the talks on elevating the federal authorities’s $31.4T debt ceiling hit a roadblock.

Debt default would damage REITs with authorities publicity, Morgan Stanley’s head of U.S. REITs, Ron Kamdem, mentioned in an interview to CNBC.

Lower than 10% REITs within the sector have authorities publicity. Some workplace REITs have authorities companies as tenants and a few healthcare REITs have publicity to expert nursing amenities that depend on Medicare and Medicaid funds for reimbursement, Kamden famous.

If a compromise is reached, the REIT sectors can considerably flourish, based on the interview.

Infrastructure REITs have been the most important laggards, having decreased by 3.74% from final week. Healthcare and self storage REITs adopted.

In the meantime, resort REITs have been outliers, having gained 0.41% in worth. Here’s a take a look at the subsector efficiency: