BlackJack3D/E+ by way of Getty Photos

The Industrial Choose Sector (XLI) ended its 3-week run within the pink and rose +1.32% for the week ending Might 19. XLI was among the many seven, out of the 11 S&P 500 sectors, which closed the week in inexperienced. In the meantime, the SPDR S&P 500 Belief ETF (SPY) additionally ended its two week shedding streak and gained +1.71%.

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +8% every this week. YTD, 4 out of those 5 shares are within the inexperienced.

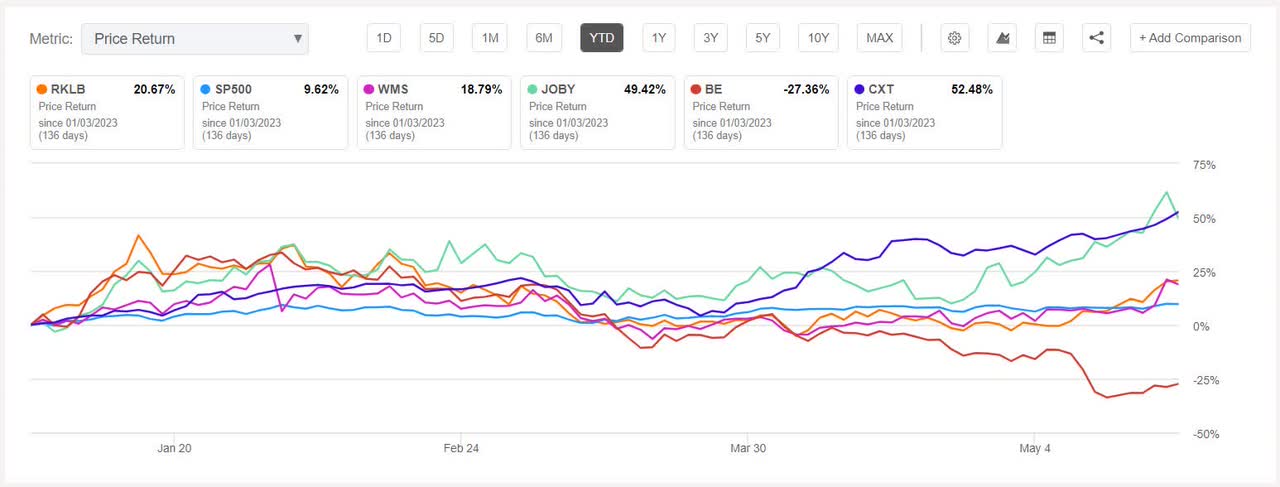

Rocket Lab USA (NASDAQ:RKLB) +13.35%. The corporate introduced introduced on Monday that it was getting ready to launch the second half of NASA’s TROPICS satellite tv for pc constellation for storm monitoring as early as Might 22. YTD, the inventory has risen +23.87%.

RKLB has a SA Quant Score — which takes into consideration elements resembling Momentum, Profitability, and Valuation amongst others — of Promote. The inventory has an element grade of D- for Profitability and C+ for Development. The typical Wall Avenue Analysts’ Score differs with a Purchase, whereby 4 out of 8 analysts see the inventory as Robust Purchase.

Superior Drainage Programs (WMS) +12.70%. The Hilliard, Ohio-based firm noticed its shares rise +10.97% on Thursday after This autumn outcomes beat estimates. The SA Quant Score on WMS is Maintain with rating of C+ for Momentum however F for Valuation. The ranking is in distinction to the typical Wall Avenue Analysts’ Score of Purchase, whereby 4 out of seven analysts tag the inventory as Robust Purchase. YTD, +17.79%.

The chart beneath exhibits YTD price-return efficiency of the highest 5 gainers and SP500:

Joby Aviation (JOBY) +9.66%. The electrical air taxi maker’s inventory gained essentially the most on Thursday +5.74% however fell on Friday (-7.59%). On Thursday an SEC submitting knowledgeable about proposed sale of securities by an organization officer.

JOBY has a SA Quant Score of Maintain with issue grade of A- for Momentum however D- for Profitability. The typical Wall Avenue Analysts’ Score agrees with Maintain ranking of its personal, whereby 3 out of 6 analysts view the inventory as Maintain. YTD, the shares has soared +52.54%.

Bloom Power (BE) +9.59%. J.P. Morgan upgraded the inventory to Chubby from Impartial which despatched the shares hovering +5.11% on Wednesday. Nevertheless, YTD, the shares have declined -27.09%. The SA Quant Score on BE is Promote, which is in stark distinction to the typical Wall Avenue Analysts’ Score of Purchase.

Crane NXT (CXT) +8.67%. The Stamford, Conn.-based firm’s inventory rose all through the week. YTD, +53.84%, essentially the most amongst this week’s prime 5 gainers. The typical Wall Avenue Analysts’ Score is Robust Purchase, with 1 Purchase and 1 Robust Purchase ranking.

This week’s prime 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -3% every. YTD, 1 out of those 5 shares is within the pink.

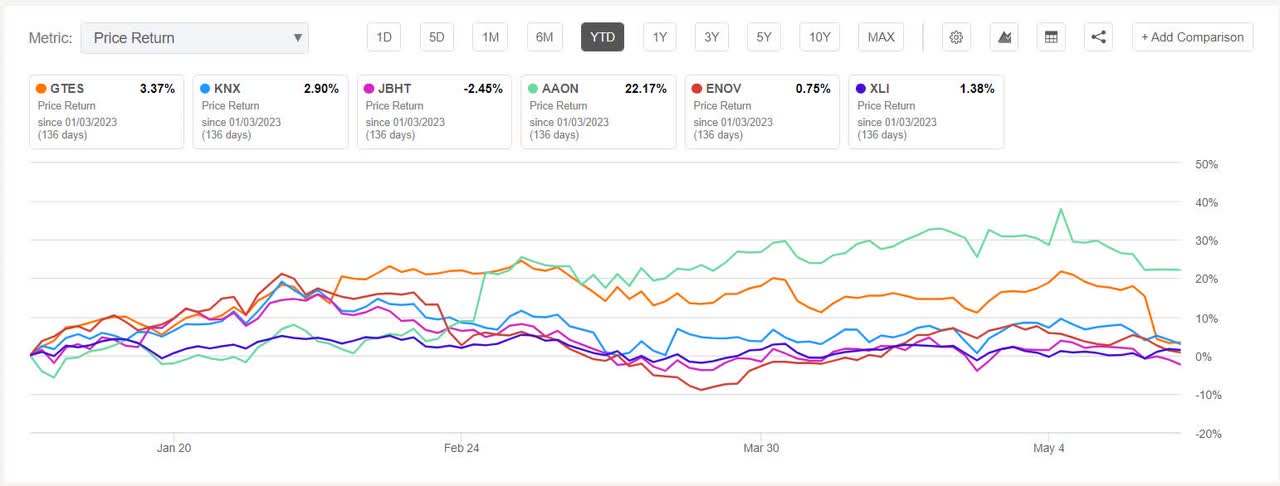

Gates Industrial (NYSE:GTES) -11.60%. The Denver-based maker of engineered energy transmission merchandise noticed its inventory fall -9.60% on Wednesday after the corporate stated sure promoting stockholders related to Blackstone had been providing of as much as 22.5M odd shares on the market. Nevertheless, YTD, the inventory has gained +4.82%.

The SA Quant Score on GTES is Maintain with an element grade of B- for Profitability and C for Development. The typical Wall Avenue Analysts’ Score differs with a Purchase, whereby 4 out of 12 analysts see the inventory as Robust Purchase.

Knight-Swift Transportation (KNX) -4.70%. Credit score Suisse downgraded a number of shares, of which one was Knight-Swift (KNX) Impartial however stayed in inexperienced on Wednesday (+1.14%). The SA Quant Score on KNX is Maintain with an element grade of B- for Momentum and D+ for Valuation. The ranking is in distinction to the typical Wall Avenue Analysts’ Score of Purchase, whereby 11 out of 20 analysts tag the inventory as Robust Purchase. YTD, +4.16%.

The chart beneath exhibits YTD price-return efficiency of the worst 5 decliners and XLI:

J.B. Hunt Transport Providers (JBHT) -4.43%. JBHT was one other transportation companies supplier in addition to Knight-Swift which was within the decliners’ record. Nevertheless, YTD, J.B. Hunt’s shares have fallen -3.44%. The SA Quant Score on JBHT is Maintain, with a rating of A- for Profitability and C+ for Development. The typical Wall Avenue Analysts’ differs with a Purchase ranking, whereby 11 out of 26 analysts view the inventory as Robust Purchase.

AAON (AAON) -3.45%. Tulsa, Okla.-based cooling and heating gear maker was among the many decliners for the second week in a row. Nevertheless, YTD, the inventory has gained +21.38%, essentially the most amongst this week’s worst performers. The SA Quant Score on AAON is Maintain, which is in distinction to the typical Wall Avenue Analysts’ ranking of Purchase.

Enovis (ENOV) -3.04%. YTD, the inventory has risen +2.41%. The SA Quant Score on ENOV is Maintain, which differs with the typical Wall Avenue Analysts’ ranking of Purchase.