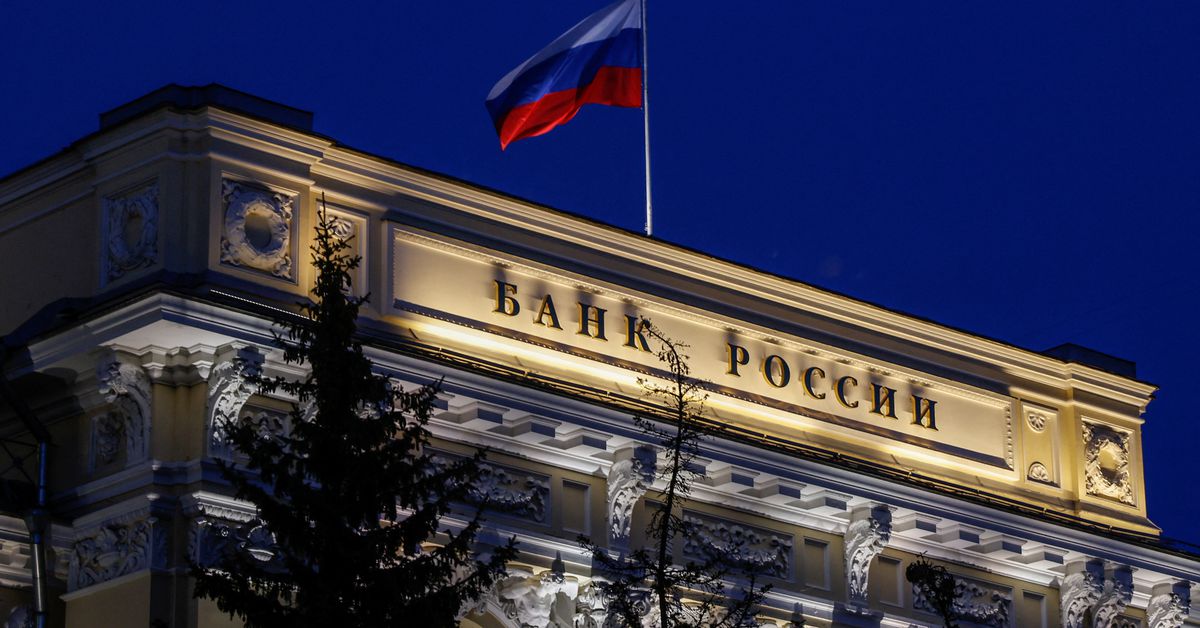

MOSCOW, April 11 (Reuters) – Russians’ international foreign money holdings at international banks exceeded these held at home ones final yr, the central financial institution mentioned on Tuesday, in a shift pushed by Western sanctions, commissions on FX accounts and Moscow’s efforts to scale back greenback property.

Sanctions imposed towards Moscow over the battle in Ukraine and countermeasures launched by Russian authorities, together with restrictions on FX withdrawals, have lowered Russians’ entry to exhausting foreign money prior to now yr.

“Residents’ accumulation of international foreign money property has shifted overseas towards the backdrop of sanctions stress and the introduction of fee by plenty of banks on FX accounts,” the central financial institution mentioned in an summary of Russia’s monetary sector in 2022.

It added that the nation’s fostering of a drive to scale back publicity to foreign exchange had additionally performed an element.

Central financial institution knowledge confirmed that Russians’ deposits with international banks reached $94 billion final yr.

“Not all these funds are literally financial savings,” the financial institution mentioned. “They could partially have been spent on parallel import purchases. Additionally, a sure a part of funds in accounts overseas could have been utilized by residents leaving Russia to cowl their dwelling wants.”

Moscow has been pushing a so-called “parallel imports” scheme to assist Russian shoppers keep entry to a number of international merchandise as western corporations have exited the market over Russia’s actions in Ukraine.

Many Russians, in the meantime, have opted to go away the nation fearing retribution or navy call-ups.

The international foreign money holdings by Russian nationals have shifted in the direction of these of ‘pleasant’ currencies, primarily China’s yuan, with depositors involved their funds could also be blocked. Moscow considers international locations that imposed sanctions as ‘unfriendly’.

The yuan has develop into a significant participant, with its share in Russia’s import settlements leaping to 23% from 4% final yr, however the share of greenback and euro deposits in Russian banks stays considerably greater, the central financial institution mentioned.

Reporting by Elena Fabrichnaya; Writing by Alexander Marrow; Modifying by Andrew Heavens and Mike Harrison

Our Requirements: The Thomson Reuters Belief Rules.