(Bloomberg) — A few of the largest multi-strategy hedge funds are lagging this yr, as they wrestle to maintain up with different companies and their very own previous efficiency.

Most Learn from Bloomberg

The anemic returns for 2023 observe years of traders flocking to multi-manager, multi-strategy companies together with Millennium Administration, Balyasny Asset Administration, ExodusPoint Capital Administration and Schonfeld Strategic Advisors, searching for constant returns no matter market situations.

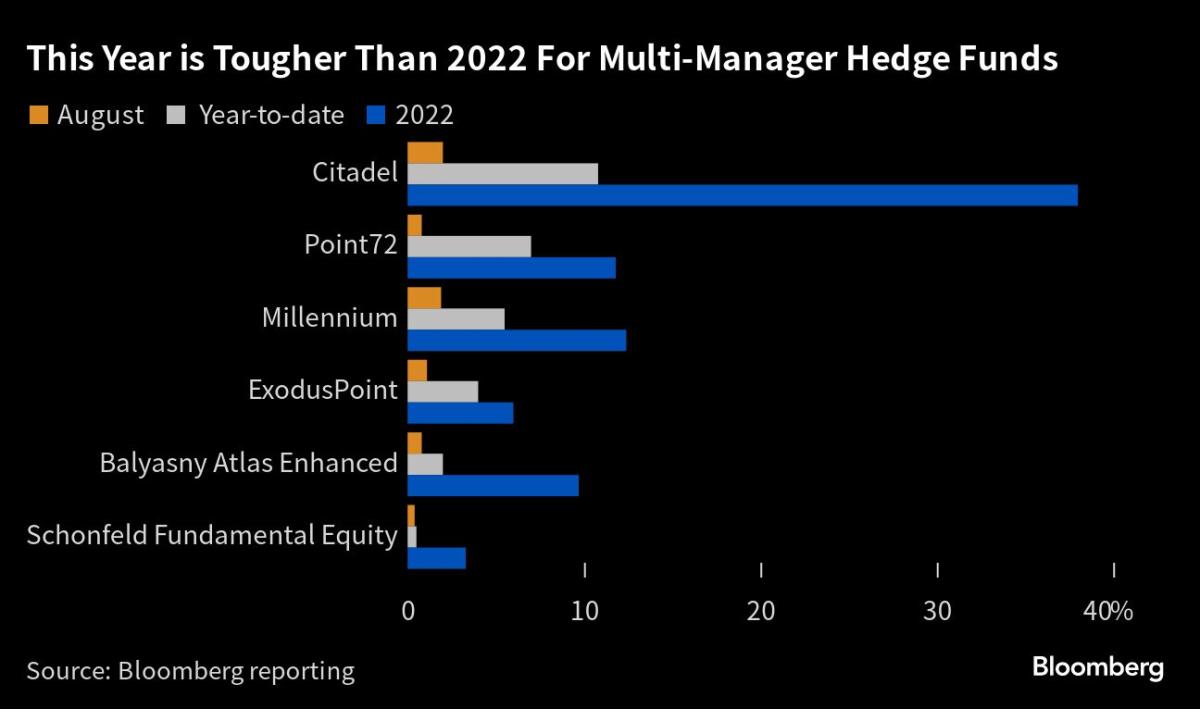

However thus far this yr, their efficiency has trailed different varieties of funds, even after these managers posted robust August returns.

The PivotalPath Multi-Technique Index — which features a broad array of multi-strategy companies — has posted an annualized return of seven.4% since January 2019. This yr it’s up an estimated 3.9% via August.

Extra Skepticism

This yr’s efficiency seems to be even weaker contemplating Treasury payments can yield 5.5%, mentioned Jon Caplis, head of hedge fund analysis agency PivotalPath.

“When the risk-free charge is zero, a 7.4% return is nice,” Caplis mentioned. “When the risk-free charge is 5.5%, it creates much more skepticism across the multi-strats — particularly given the dangers embedded within the technique.”

These dangers embrace the possibility of huge losses from crowded trades or a spike in charges, on condition that bills in these companies are usually handed via to purchasers. On the finish of 2022, traders paid between 3% and seven% in pass-through bills, in line with a Barclays Plc survey.

A lopsided transfer in shares this yr is a part of the rationale for the lackluster returns, given {that a} handful of firms, together with Nvidia Corp. and Apple Inc., are chargeable for a lot of the 17.4% return within the S&P 500 via August.

Multi-strategy hedge funds run their large inventory portfolios in a market-neutral method, which means the lengthy positions and the brief positions stability one another out and are by no means focused on a particular sector, equivalent to know-how.

“For these companies to generate profits, they want volatility and dispersion, and this yr there was neither,” Caplis mentioned.

What’s extra, final yr’s greatest cash maker, macro investing, has faltered in 2023.

“In 2022, the hedge funds that had a minimum of some publicity to macro outperformed, whereas these with extra publicity to fairness and credit score markets had decrease returns,” mentioned Roark Stahler, US head of strategic consulting at Barclays.

This yr macro returns are flat on the identical time that a lot of the giant multi-manager companies are beefing up the variety of macro portfolio managers.

“It might be there’s extra money chasing fewer alternatives,” Stahler mentioned.

Whereas Ken Griffin’s Citadel outpaced rivals with a ten.8% return this yr via August, that also trails its personal 38% return final yr fueled largely by commodities trades.

Right here’s how different hedge funds are faring this yr:

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.