(Bloomberg) — The heartbeat of US inflation doubtless continued to sluggish at the beginning of the yr, serving to to feed expectations that the Federal Reserve will discover interest-rate cuts extra palatable within the coming months.

Most Learn from Bloomberg

The core client worth index, a measure that excludes meals and gas for a greater image of underlying inflation, is seen rising 3.7% in January from a yr earlier.

That may mark the smallest year-over-year advance since April 2021, and underscore the inroads Fed Chair Jerome Powell and his colleagues have made in beating again inflation. The general CPI in all probability rose lower than 3% for the primary time in almost two years, economists forecast Tuesday’s report to indicate.

Whereas acknowledging that progress, policymakers have been cool to the concept charges could also be lowered as quickly as subsequent month.

Learn Extra: Fed Officers Add to Refrain Tempering Hopes for Price Cuts Quickly

Their persistence has roots in an financial system that’s flashing inexperienced lights, the largest of which is the labor market. Sturdy employment progress has saved customers spending. A separate report on Thursday is projected to disclose one other enhance in retail gross sales, excluding motor autos and gasoline.

The cooling of inflation, together with expectations that borrowing prices will head decrease this yr, explains the current enchancment in client confidence. A College of Michigan survey scheduled for launch on Friday is forecast to indicate an index of sentiment holding close to the very best degree since July 2021.

Buyers may also monitor Fed officers talking within the days following the CPI knowledge, to gauge the timing of any future fee reduce. Amongst these on the schedule are regional financial institution presidents Raphael Bostic of Atlanta and Mary Daly of San Francisco, who each vote on coverage this yr.

What Bloomberg Economics Says:

“In deciding when to begin chopping charges, the Fed must reconcile the info they’ve in hand – which present inflation on a quick observe to the two% goal — with dangers that inflation might flare up once more or the labor market might weaken extra sharply. Knowledge within the coming week will issue into that call — however received’t present a definitive reply.”

— Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For full evaluation, click on right here

Turning north, Canadian house gross sales will reveal whether or not the market continues to warmth up forward of anticipated mid-year fee cuts. Housing begins and manufacturing knowledge may also be launched.

Amongst world highlights this week, Japanese gross home product, UK inflation and wages, and testimony by the euro-zone central financial institution chief will characteristic.

Click on right here for what occurred final week and beneath is our wrap of what’s arising within the world financial system.

Asia

Japan’s financial system is predicted to rebound from its dismal efficiency over the summer season, offering one other sign for the Financial institution of Japan because it prepares to finish its detrimental fee coverage.

Figures out Thursday are additionally set to verify that Japan has slipped to the fourth-largest financial system on the earth, behind the US, China and Germany.

China’s markets will likely be closed for Lunar New Yr celebrations, and no main releases are scheduled.

Reserve Financial institution of India Governor Shaktikanta Das, who saved a hawkish stance at Thursday’s fee assembly, may even see some progress in his inflation combat at the beginning of the week with client costs anticipated to have grown at a slower tempo in January. That in all probability received’t be sluggish sufficient to immediate discuss of a pivot, nevertheless.

The Philippine central financial institution is seen holding charges regular on Thursday after costs continued to weaken there too.

Australian jobs figures earlier within the day are seen displaying a return to progress after the losses in December.

Singapore will revise its gross home product figures forward of commerce knowledge the next day.

RBNZ Governor Adrian Orr units out his newest place on coverage and a couple of% inflation in a speech Friday morning, with Malaysian GDP numbers closing out the week.

Europe, Center East, Africa

UK knowledge will take the limelight. On Tuesday, wage numbers might present the weakest pay pressures since 2022, cheering Financial institution of England officers who — like world friends — are pivoting towards fee cuts.

Policymakers may also scrutinize an anticipated blip larger in inflation on the headline gauge, and the core measure that strips out unstable components resembling power, in knowledge due Wednesday.

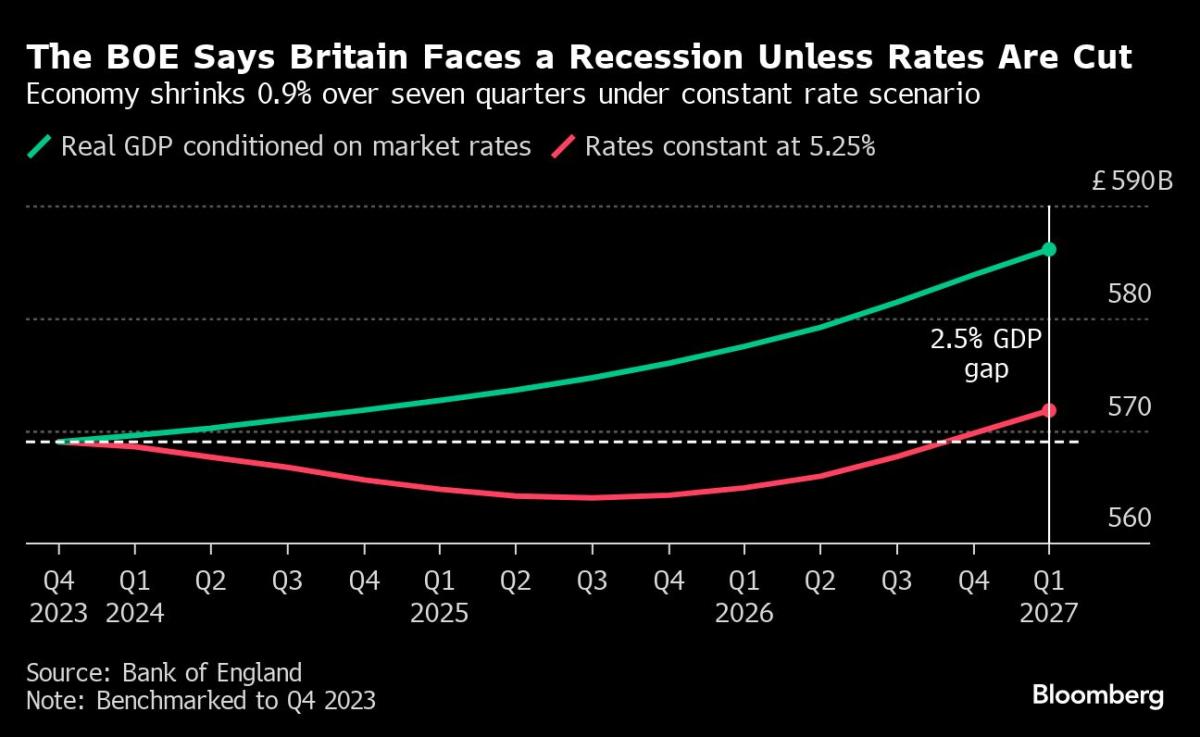

The following day, GDP will level to how BOE tightening is hitting progress. Economists reckon the UK stagnated within the fourth quarter, narrowly avoiding a recession for now.

Inflation knowledge for January may also be launched across the wider area this week:

-

Swiss consumer-price progress in all probability slowed to 1.6%, whereas Denmark will launch equal numbers.

-

In Jap Europe, inflation is anticipated to have weakened markedly in Poland and the Czech Republic, whereas edging larger in Romania.

-

In Ghana, the speed is prone to have eased from 23.2% a month earlier, whereas Nigeria’s studying might have accelerated from 28.9% amid foreign money weak point.

-

And in Israel, inflation is predicted to have slowed to 2.7%.

A sequence of fourth-quarter GDP numbers are additionally scheduled, with progress in Jap European economies and Norway as properly prone to have stayed subdued.

Euro-zone industrial manufacturing on Thursday is a spotlight within the foreign money area, with a fourth month-to-month drop in December predicted by economists amid falling manufacturing facility output in economies together with Germany.

Policymaker appearances will draw consideration. European Central Financial institution President Christine Lagarde testifies to lawmakers on Thursday, whereas a number of occasions that includes her colleagues are additionally scheduled.

Talking this weekend, ECB Governing Council member Fabio Panetta mentioned “the time for reversal of the financial coverage stance is quick approaching,” warning in opposition to ready too lengthy on fee cuts.

In Norway, Governor Ida Wolden Bache will make her annual deal with to Norges Financial institution’s supervisory council.

A handful of fee choices are on the calendar all through the broader area:

-

In Romania on Tuesday, the central financial institution will in all probability hold its fee at 7% as buyers look ahead to clues on potential cuts.

-

Zambian officers are poised to lift borrowing prices on Wednesday to help a battered foreign money and curb mounting worth pressures.

-

The identical day, Namibia’s policymakers will doubtless depart borrowing prices unchanged according to South Africa’s pause final month.

-

And on Friday, the Financial institution of Russia might keep on maintain after Governor Elvira Nabiullina indicated in December that the important thing fee will stay elevated for an prolonged interval to deal with inflation working at virtually double the 4% goal.

Latin America

The Carnival vacation makes for a quiet begin to the week, however Argentina returns on Wednesday to put up its January inflation report.

Client costs doubtless rose 21.9% final month, in keeping with economists surveyed by the central financial institution, down from 25% in December. That forecast implies an annual fee of over 250%, up from 211% at year-end 2023.

Inflation has surged within the wake of President Javier Milei’s 54% peso devaluation and elimination of worth controls on a whole lot of on a regular basis client merchandise.

Colombia publishes a raft of information, underscoring the precipitous slowdown in what had been one among Latin America’s post-pandemic vivid lights.

Industrial output, manufacturing and retail gross sales have all been detrimental since March, whereas fourth-quarter output in all probability shrank from the earlier three months. Full-year GDP progress might solely simply prime 1%, properly off the 2021 and 2022 readings of 11% and seven.5%.

Brazil posts December GDP-proxy figures forward of the quarterly and full-year report due March 1, whereas Peru publishes December financial exercise knowledge together with January unemployment for Lima, the capital and largest metropolis.

Lastly, Chile’s central financial institution serves up the minutes of its January choice to ship a 100 basis-point reduce, to 7.25%. Economists surveyed by the central financial institution see that hitting 4.75% by year-end with inflation again at 3%.

–With help from Piotr Skolimowski, Robert Jameson, Monique Vanek, Brian Fowler, Abeer Abu Omar, Tony Halpin and Laura Dhillon Kane.

(Updates with Panetta in EMEA part)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.