The S&P 500 (SP500) on Friday superior 1.65% for the week to shut at 4,191.98 factors, posting beneficial properties in three out of 5 periods. Its accompanying SPDR S&P 500 Belief ETF (NYSEARCA:SPY) rose 1.71% for the week.

The benchmark index’s beneficial properties stopped a run of two straight weeks of losses.

Sentiment in the course of the week was supported by a mix of things, chief amongst them being the debt ceiling talks. Optimism over a breakthrough within the standoff between Home Democrats and Republicans helped markets finish solidly larger on Wednesday, with each side signaling that default would undoubtedly be prevented.

Congressional leaders have till June 1 to hammer out a deal and lift the debt ceiling earlier than the federal government runs out of cash to pay its payments. Home Speaker Kevin McCarthy on Thursday stated that negotiators might come to an settlement in precept to boost or droop the debt ceiling as quickly as this weekend.

The optimism took successful on Friday after a report that Republican leaders had staged a walkout and that the matter was as soon as once more at an deadlock. Nevertheless, information got here in after hours that discussions had resumed.

Apart from the debt ceiling talks, markets had been additionally helped by a surge in expertise shares, as traders continued to pile again into the expansion sector after shunning it for many of final yr. Each the tech-focused Nasdaq 100 (NDX) index and the Invesco QQQ Belief ETF (QQQ) tied to it scaled new 52-week highs in the course of the week. Chip shares have additionally superior considerably, partly helped by the brand new craze over synthetic intelligence.

Financial knowledge this week continued to level in direction of cooling within the economic system. New York Empire State’s gauge of producing exercise for Might plunged considerably greater than anticipated. Retail gross sales rose lower than anticipated in April, pointing in direction of shopper spending pullback. Jobless claims got here in decrease than anticipated, nevertheless the reliability of the figures had been known as into query given a considerable amount of native fraud.

Nevertheless, regardless of the indications of the financial knowledge, market members have revised their expectations for the anticipated pause in price hikes on the Federal Reserve’s financial coverage committee assembly in June. Furthermore, they’ve considerably tempered their expectations for a 25 foundation level reduce by the Fed at its conferences in July and September.

This recalibration has come amid hawkish feedback from Fed audio system. Dallas Fed President Lorie Logan’s remarks on Thursday seemed to be a significant component, after she stated she could not but be on board for a price pause on the June assembly.

The week additionally noticed the earnings season enter its remaining legs. Merchants digested reviews from retail giants corresponding to Residence Depot (HD), Walmart (WMT) and Goal (TGT). Attire retailers function in subsequent week’s earnings listing, together with well-known names corresponding to American Eagle (AEO), Abercrombie & Fitch (ANF) and The Hole (GPS). The week additionally noticed that point of the quarter the place hedge funds with a minimum of $100M in belongings below administration disclosed their holdings. A notable transfer was Warren Buffett’s Berkshire Hathaway exiting its stake in furnishings and residential fixture retailer RH (RH).

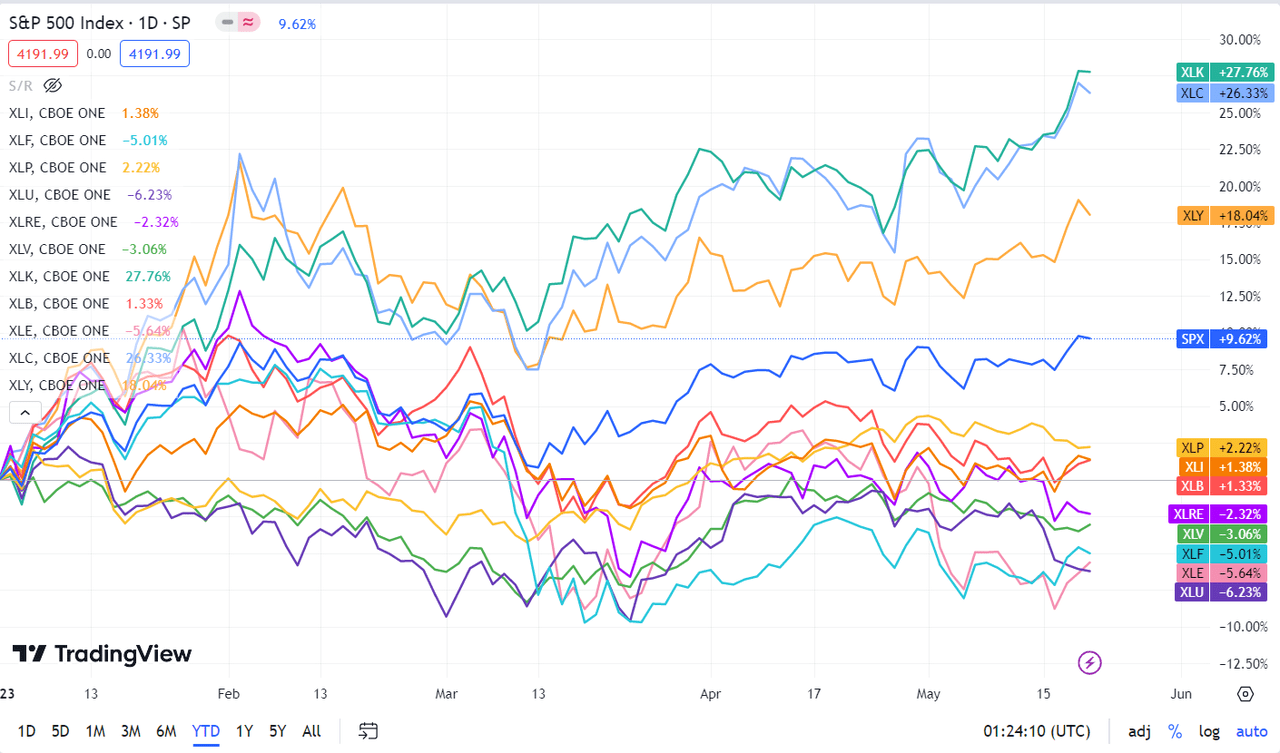

Turning to the weekly efficiency of the S&P 500 (SP500) sectors, seven ended within the inexperienced, led by a whopping +4% soar in Expertise. Communication Providers rose greater than 3%, whereas Client Discretionary and Financials added greater than 2% every. Utilities topped the losers. See under a breakdown of the weekly efficiency of the sectors in addition to their accompanying SPDR Choose Sector ETFs from Might 12 near Might 19 shut:

#1: Info Expertise +4.19%, and the Expertise Choose Sector SPDR ETF (XLK) +4.33%.

#2: Communication Providers +3.06%, and the Communication Providers Choose Sector SPDR Fund (XLC) +2.85%.

#3: Client Discretionary +2.63%, and the Client Discretionary Choose Sector SPDR ETF (XLY) +2.52%.

#4: Financials +2.18%, and the Monetary Choose Sector SPDR ETF (XLF) +2.19%.

#5: Vitality +0.90%, and the Vitality Choose Sector SPDR ETF (XLE) +1.43%.

#6: Industrials +1.22%, and the Industrial Choose Sector SPDR ETF (XLI) +1.32%.

#7: Supplies +0.66%, and the Supplies Choose Sector SPDR ETF (XLB) +0.68%.

#8: Well being Care -0.67%, and the Well being Care Choose Sector SPDR ETF (XLV) -0.67%.

#9: Client Staples -1.68%, and the Client Staples Choose Sector SPDR ETF (XLP) -1.56%.

#10: Actual Property -2.40%, and the Actual Property Choose Sector SPDR ETF (XLRE) -2.37%.

#11: Utilities -4.36%, and the Utilities Choose Sector SPDR ETF (XLU) -4.23%.

Beneath is a chart of the 11 sectors’ YTD efficiency and the way they fared towards the S&P 500. For traders wanting into the way forward for what’s taking place, check out the Searching for Alpha Catalyst Watch to see subsequent week’s breakdown of actionable occasions that stand out.