by Domitille Dien, Advertising Supervisor, Zelros —

In right now’s fast-paced digital age, insurance coverage firms are going through intense competitors and should frequently enhance their lead era methods to remain forward of the sport. The stress is on for gross sales brokers, customer support representatives (CSR), and advertising groups to determine which leads are most certainly to turn out to be prospects. Nevertheless, conventional lead acquisition strategies typically fall brief on account of incomplete or inaccurate knowledge, restricted time and assets, and inconsistent lead qualification standards. There are quite a few duties that may be inefficient and time-consuming in the case of figuring out safety gaps and wishes of your shoppers and prospects, in addition to providing them the suitable coverage on the acceptable time. As an insurer, how do you distinguish your self from the competitors? How do you improve the shopper expertise? Moreover, how do you equip your gross sales and advertising groups with the required instruments?

To chop by way of the noise and stand out in a crowded market, insurance coverage firms have to create compelling touchpoints that resonate with their target market. This implies embracing cutting-edge applied sciences and progressive methods that push competitiveness and problem the established order.

Right here’s how one can construct a profitable lead acquisition and conversion technique:

The right way to Create Personalised Campaigns with Generative AI

One of the vital efficient methods to create compelling touchpoints is thru personalised suggestions with Generative AI. Insurance coverage firms can make the most of the facility of Generative AI to robotically create content material akin to personalised messaging, subsequent greatest questions, and coverage suggestions by way of the mixing of Open AI to their advice engine. This integration permits gross sales and advertising groups to spice up their creativity and productiveness by counting on the engine to do the heavy lifting. Good content material era is predicated on enriched buyer insights to robotically create significant and compelling touchpoints with the objective to nudge and convert potential prospects alongside their shopping for journey or lifecycle (together with renewals). This method supplies a simple and constant buyer expertise.

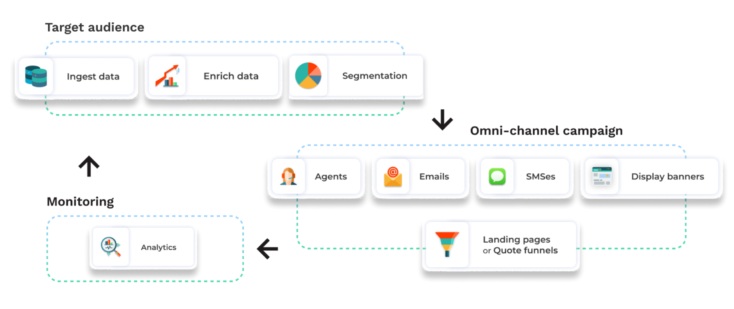

Automating the shopper journey is one other approach to create compelling touchpoints. By delivering personalised messages and provides at key touchpoints, insurance coverage firms can spin up new campaigns inside quarter-hour by creating focused dynamic touchdown pages that reply primarily based on prospects’ intent and sign knowledge to speed up the lead qualification course of. Gross sales brokers and producers can now speed up the gross sales course of by offloading the heavy-lifting of qualification and prioritizing for his or her ‘in-market’ leads. The touchdown web page will robotically reply to the target market visiting with personalised messaging, subsequent greatest questions (to seize private preferences aka Zero-party knowledge), and coverage suggestions. This method shaves break day the gross sales cycle, whether or not the marketing campaign targets are for consumer acquisition, cross-sell, upsell or retention campaigns, and helps lower acquisition prices whereas boosting lead conversion efficiency.

Introducing Zelros: The platform that delivers constant buyer expertise by way of seamless on-line and agent Interactions

It’s important to remember that personalizing content material loses its significance if the viewers segmentation is just not precisely assessed. Zelros is available in by leveraging sensible segmentation primarily based on life-style modifications, life occasions, and potential dangers, you may faucet into untapped populations inside your policyholders’ base. Zelros acknowledges that knowledge is paramount for efficient segmentation and provides a spread of options that can assist you enrich your buyer insights. With Zelros, you may unlock the total potential of segmentation and achieve a deeper understanding of your prospects, which in flip permits you to present tailor-made content material and provides which might be really related and worthwhile to them.

The right way to enrich your buyer insights

To additional enrich buyer insights, insurance coverage firms can make the most of expanded knowledge sources by way of Zelros Information Market designed for the insurance coverage trade. This supplies simple API-driven entry to attach with related third get together knowledge sources to complement buyer profiles. The catalog of knowledge sources consists of, amongst others, threat knowledge, climate knowledge, buyer preferences, life occasions, and extra to achieve a greater understanding of consumers and higher serve them. Examples of knowledge to leverage embody:

- Third-party knowledge suppliers to entry demographic and behavioral knowledge about prospects,

- Information from credit score bureaus and different monetary establishments to achieve insights into buyer credit score scores, cost histories, and different monetary indicators that can be utilized to tell underwriting and pricing selections,

- Information from public information to achieve a extra full image of buyer threat profiles and to tell underwriting and claims administration selections, trade experiences

- Information from market analysis corporations to achieve insights into market traits, aggressive dynamics, and rising dangers and alternatives within the insurance coverage trade,

- Information from advertising automation platforms and different advertising expertise instruments to achieve insights into buyer habits, preferences, and engagement ranges, intent knowledge, and to develop simpler advertising and outreach methods.

Capturing Zero Get together Information can revolutionize the digital expertise with ultra-personalized touchdown pages that enhance the shopper expertise. Insurance coverage firms can simply create and host personalised touchdown pages and combine them into their buyer journey to seize worthwhile data by way of personalised messages and questions. This ultra-personalization can then be leveraged to supply merchandise that really meet the wants of their shoppers. This method maximizes buyer retention and helps lower acquisition prices.

The right way to optimize your buyer journey with steady real-time monitoring

Optimizing the shopper journey with steady real-time monitoring and enchancment is crucial to creating compelling touchpoints. After the gathering of knowledge, it’s essential to have the ability to analyze it by way of dwell analytics and efficiency measurement to measure the influence of gross sales and advertising engagement methods. Actual-time knowledge analytics dashboards enable insurance coverage firms to see lead efficiency insights akin to views, conversions, and click-through charges from the suggestions served to the shoppers throughout channels. The insights allow fast analysis of marketing campaign efficiency and the relevance of goal audiences and personalization methods. The info administration visualization characteristic permits you to simply measure the reliability, accuracy, and high quality of your knowledge. This supplies real-time insights into any knowledge gaps or incomplete buyer profiles to determine alternatives for knowledge enrichment.

With steady knowledge high quality enchancment, Zelros helps illuminate any knowledge blind spots – guaranteeing the integrity, high quality, and completeness of the information isn’t compromising the precision of suggestions over time.

In conclusion, accelerating lead acquisition by creating compelling touchpoints by way of marketing campaign personalization is a strong technique for insurance coverage firms to extend their buyer base and enhance buyer retention. By using personalised suggestions with Generative AI, enriching buyer insights with expanded knowledge sources, capturing zero-party knowledge, and optimizing the shopper journey with real-time knowledge analytics, insurance coverage firms can supply a simple and constant buyer expertise whereas lowering acquisition prices and boosting lead conversion efficiency. With the assistance of superior applied sciences, insurance coverage firms can keep forward of the competitors and really assist stop loss and defend what issues most to prospects.

To be taught extra about how Zelros may help you preserve and develop your management place out there, contact us right now so we are able to reply any questions you may need and present you a demo of our platform in motion. Get a demo.

About Zelros

Zelros was based in 2016 by Christophe Bourguignat, Fabien Vauchelles, and Damien Philippon. Zelros is a B2B unbiased software program vendor creating Synthetic Intelligence for insurance coverage and financial institution insurance coverage gamers. We not too long ago raised a $11M Collection A, and have been acknowledged as a frontrunner within the AI-based Superior Insurance coverage Distribution Platform class by Frost & Sullivan. For extra data, please go to zelros.com.

Supply: Zelros