onurdongel/E+ by way of Getty Photos

For the week ending June 9, the Industrial Choose Sector (XLI) gained (+1.45%) and was among the many seven, out of the 11 S&P 500 sectors, which closed the week in inexperienced. The SPDR S&P 500 Belief ETF (SPY) additionally rose (+0.46%).

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +9% every this week. YTD, all these 5 shares are within the inexperienced.

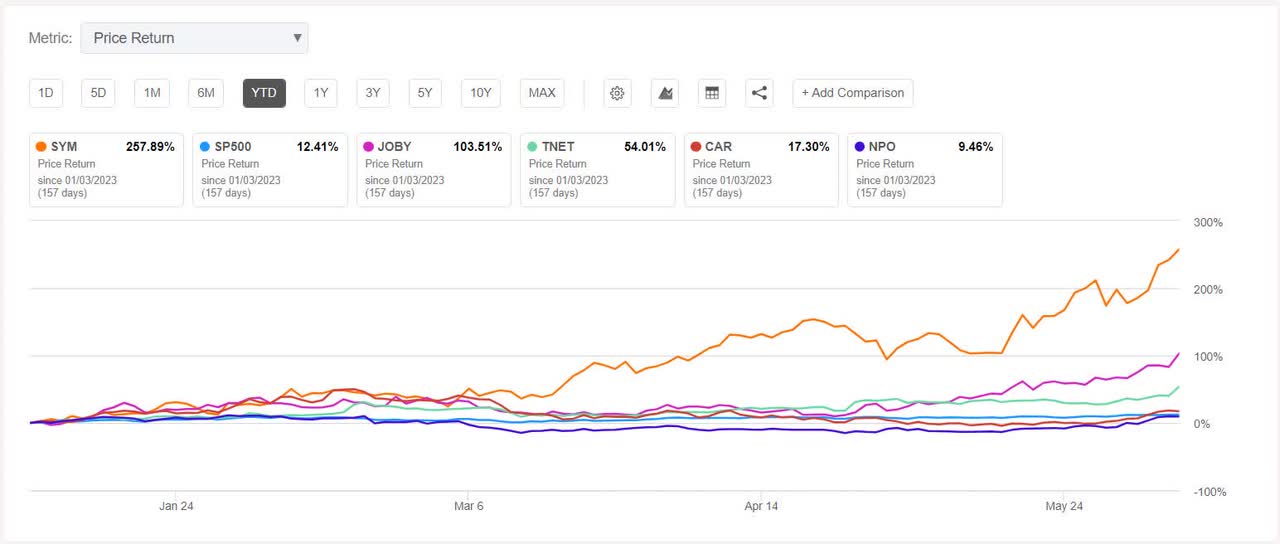

Symbotic (NASDAQ:SYM) +28.86%. The robotics warehouse automation firm noticed its shares surge essentially the most on Wednesday (+12.68%). YTD, the inventory has soared +260.89%, essentially the most amongst this week’s high 5 gainers.

SYM has a SA Quant Score — which takes under consideration components comparable to Momentum, Profitability, and Valuation amongst others — of Maintain. The inventory has an element grade of B+ for Profitability and D for Development. The common Wall Avenue Analysts’ Score differs with a Robust Purchase, whereby 10 out of 13 analysts see the inventory as Robust Purchase.

Joby Aviation (JOBY) +22.32%. The electrical air-taxi maker’s inventory rose essentially the most on Friday (+11.18%) and YTD, the shares have gained +107.76%. The SA Quant Score on JOBY is Maintain with rating of A+ for Momentum however C- for Valuation. The common Wall Avenue Analysts’ Score agrees with Maintain score of its personal, whereby 3 out of seven analysts tag the inventory as such.

The chart under exhibits YTD price-return efficiency of the highest 5 gainers and SP500:

TriNet Group (TNET) +13.03%. The inventory jumped on Friday (+9.79%) after a report that the Dublin, Calif.-based payroll providers supplier was exploring a possible sale. TNET has a SA Quant Score of Maintain with issue grade of A- for Momentum A+ however D for Development. The score is in distinction to the typical Wall Avenue Analysts’ Score of Purchase, whereby 2 out of 6 analysts view the inventory as Robust Purchase. YTD, +57.60%.

Avis Finances (CAR) +10.54%. The automotive rental firm’s shares rose all through the week, barring Friday (-0.89%). YTD, the shares have gained +17.89%. The SA Quant Score on CAR is Maintain, which differs with the typical Wall Avenue Analysts’ Score of Purchase.

EnPro Industries (NPO) +9.36%. YTD, shares of the Charlotte, N.C.-based firm has risen +9.42%. The common Wall Avenue Analysts’ Score is Robust Purchase, which is in distinction to the SA Quant Score of Maintain.

This week’s high 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -3% every. YTD, 2 out of those 5 shares are within the crimson.

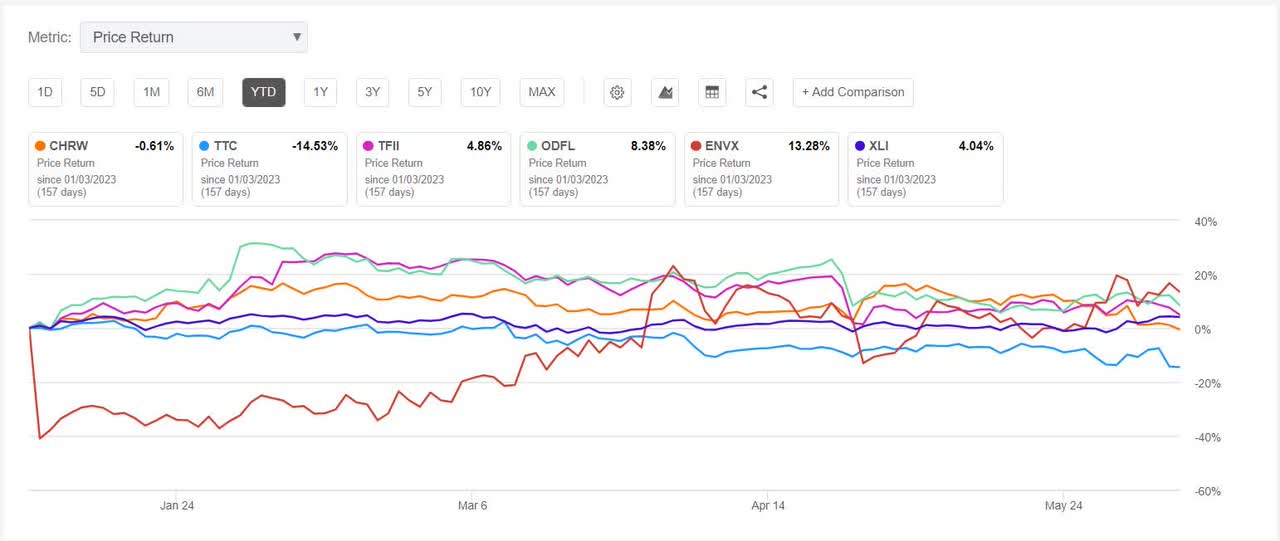

C.H. Robinson Worldwide (NASDAQ:CHRW) -8.13%. The freight transport providers supplier’s inventory dipped on Monday (-6.42%) after reviews prompt that the corporate was closing in on naming Ford govt David Bozeman as its CEO. The official announcement was made a day later.

The SA Quant Score on CHRW is Maintain with an element grade of A for Profitability however F Development. The common Wall Avenue Analysts’ Score concurs with a Maintain, whereby 19 out of 29 analysts see the inventory as such. YTD, -2%.

The Toro Firm (TTC) -5.19%. The shares fell -7.29% on Thursday after the mowing tools maker narrowed its gross sales and EPS steerage for the yr. The corporate’s Q2 income additionally missed estimates.

The SA Quant Score on TTC is Maintain with an element grade of C for Momentum and D- for Valuation. The common Wall Avenue Analysts’ Score can also be Maintain, whereby 4 out of 6 analysts tag the inventory as such. YTD, the inventory has fallen -14.54%, essentially the most amongst this week’s high decliners.

The chart under exhibits YTD price-return efficiency of the worst 5 decliners and XLI:

TFI Worldwide (TFII) -4.93%. The Canadian logistics providers supplier is within the inexperienced YTD, +4.75%. The SA Quant Score on TFII is Maintain, with a rating of A- for each Profitability and Development. The common Wall Avenue Analysts’ score differs with a Purchase score, whereby 9 out of 21 analysts view the inventory as Robust Purchase.

Outdated Dominion Freight Line (ODFL) -4.22%. The freight transport firm on Monday stated that its income per day for Might fell -15.7% Y/Y. YTD, the shares have risen +7.90%. The SA Quant Score and the typical Wall Avenue Analysts’ score, each, on ODFL is Maintain.

Enovix (ENVX) -3.78%. The inventory fell essentially the most on Monday (-8.13%) however the lithium-ion battery maker did pare off losses on Tuesday (+4.65%) after asserting agreements with Japanese firm Elematec and South Korean energy administration and IoT-focused distributor Semicomtech.

YTD, the shares have risen +10.37%. The SA Quant Score on ENVX is Maintain, which differs with the typical Wall Avenue Analysts’ score of Robust Purchase.