by Stephen Applebaum and Vincent Romans —

Whereas know-how enabled disruption of the automotive ecosystem was already nicely underway previous to 2020, the worldwide pandemic induced even better disruption and lots of the modifications have and can proceed to impression each nook of society and {industry} nicely into the long run. We’ve got recognized deceleration in some areas however acceleration in others. Our intent right here is to place as a lot of this into context as is feasible and gives a view of the “new” future as we see it, following what we’re calling “The Nice Reset.”

Auto Security

Early Site visitors and Driver Security

Site visitors security has been a priority for the reason that first U.S. gasoline powered automobile was launched in 1896. In truth, the primary seat belt patent was granted in 1858. Massachusetts launched the nation’s first statewide site visitors legal guidelines in 1901 limiting speeds to 12 mph in cities and 15 mph on nation roads. New York launched a drunk driving regulation in 1910. And in 1930 the nation’s first three-way site visitors mild was launched.

Earlier than there have been lane departure warning methods, blind spot monitoring, and rearview cameras, the automotive world noticed one of the crucial vital security applied sciences to ever be invented—brake lights. The primary brake lamps appeared as early as 1905, although the necessities for brake lamps took a bit longer to catch on. For a lot of drivers, hand alerts have been sufficient of a warning to different drivers of their intent to cease or flip. This reliance readily available alerts made it tough for a lot of drivers to get pleasure from their vehicles at evening, although, making the brake mild a necessity.

By 1928, 11 states in america had made brake lights a requirement on automobiles. However a very powerful brake mild of all is the third brake mild, first launched in 1974. The third brake mild induced over 60% much less rear-end collisions. After discovering the elevated security, the third brake mild supplied, it shortly grew to become a requirement on all vehicles.

Later on this article we describe more moderen driver security applied sciences, first launched in 1950, and collectively referred to right this moment as ADAS (Superior Driving Help Programs).

Rising Site visitors Deaths

Despite the entire many driver security applied sciences and the numerous impaired and distracted driver legal guidelines launched, U.S. site visitors deaths have continued to rise. One of many many surprising penalties of COVID was the rise in driving pace on a lot much less congested roadways which has resulted in greater accident severity together with extra deadly crashes. The variety of U.S. site visitors deaths surged within the first 9 months of 2021 to 31,720, maintaining a document tempo of elevated harmful driving in the course of the coronavirus pandemic. The estimated variety of individuals dying in motorized vehicle crashes from January to September 2021 was 12% greater than the identical interval in 2020. That represents the very best share enhance over a nine-month interval for the reason that Transportation Division started recording deadly crash information in 1975.

This February the U.S. Division of Transportation (DOT) introduced an formidable security plan with the aim of zero roadway deaths. Calling the established order “unacceptable,” U.S. Secretary of Transportation Pete Buttigieg unveiled the DOT’s new security plan to lower the variety of roadway deaths that might be carried out over the subsequent three years. He famous that almost 95% of U.S. transportation deaths happen on streets, roads and highways. Buttigieg cited Nationwide Freeway Site visitors Security Administration (NHTSA) information that discovered an estimated 38,680 individuals died in motorized vehicle crashes in 2020 and within the first half of 2021 an estimated 20,160 individuals died. That’s an 18.4% enhance in comparison with the primary six months of 2020 and is the most important variety of projected fatalities for January by way of June since 2006.

Collision Restore Trade Consolidation

For the final fifteen years now we have seen the affect of monetary establishments, funding banking and personal fairness’s funding progress technique concentrating on {industry} consolidation by way of Multi-Store Operators (MSOs). Right this moment, small to medium dimension MSOs are actually partnering with non-public fairness corporations to assist speed up their growth and progress. These small to medium, aggressive consolidators, often known as Multi-Location Operators (MLO) corresponding to Crash Champions, Traditional and CollisionRight are constructing their regional and super-regional platforms to compete with the bigger legacy consolidator MSOs like Caliber and Boyd/Gerber.

The collision restore area has long-term, confirmed economics and insurance-industry-driven demand dynamics that create comparatively sturdy money movement stability. A really excessive share of the repairable autos come from Direct Restore Program (DRP) relationships with high ten insurance coverage provider companions with ever-increasing market share. Repairers who present constant high-quality repairs and repair can rely on receiving a gentle stream of repairable autos. The quid professional quo revolves round managed efficiency metrics and agreed income/expense fashions between the repairer and insurer. The higher the efficiency metrics, the extra dependable quantity the provider will proceed to affect to the MSO in addition to rescinding repairable quantity movement if efficiency and buyer satisfaction deviates a lot from efficiency agreements.

Insurers then depend on the MSO restore group to broaden to new areas in insurer focused markets whereas the repairer appears to learn from incremental money movement by way of the working relationship and referrals from the insurance coverage accomplice. This relationship permits the restore group to leverage its insurer referrals with out investing closely in exterior shopper direct advertising.

There isn’t any proof of a slowdown particularly for personal fairness traders as they proceed to see worth and alternative in additional investing in and consolidating the collision restore {industry}, even throughout a worldwide black swan occasion just like the COVID-19 pandemic. At present, there are a complete of 12 MSOs within the U. S. who’ve a complete of 15private fairness or strategic traders or are publicly held.

Caliber and Boyd/Gerber, by far the 2 largest consolidators, have continued to be constant, prolific patrons of MLOs all through the final two years. Service King continues its acquisition hiatus, which now spans nearly 4 years. Two of the most important acquisitions in 2020 have been the acquisition of the U.S. Repair Auto community by Pushed Manufacturers and the Pacific Elite acquisition by Crash Champions.

Due to these and lots of different transactions and regardless of COVID’s impression, 2020 and 2021 ranked as very lively years for a number of location transactions, MLO, transactions with 676 MLO areas acquired representing income transferred by way of these acquisitions of $1,796 billion. Since 2012 after we initiated protection of MLO transactions, 2,271 MLO areas have been acquired reflecting over $6.5 billion of income switch whereas averaging $2.88 million per location.

The Creation and Future Influence of ADAS

Adoption and Influence on Collision Repairs

ADAS have been first getting used as early because the Nineteen Fifties with the adoption of the anti-lock braking system (ABS). Early ADAS embody digital stability management (ESC), anti-lock brakes, blind spot data methods, lane departure warning, adaptive cruise management, and traction management.

There’s little doubt that the adoption of ADAS options on newer autos is already having and can proceed to have a rising impression on all features of collision restore and paint consumption together with materials modifications and penalties inside the auto bodily harm panorama. Under, now we have quantified by way of the present decade these modifications most impactful to the variety of collision repairable autos, PBE and paint firm refinish income and anticipated modifications throughout associated distribution channels.

A newly launched American Vehicle Affiliation research on the effectiveness of driver monitoring methods in autos geared up with superior driver help methods (ADAS) discovered that direct methods with driver-facing cameras to detect driver distraction or disengagement are handiest over those who solely monitor steering wheel use. On common, the % of time drivers have been engaged was roughly 5 instances better for direct methods in comparison with oblique methods.

The U.S. authorities’s annual security rankings of automobiles might quickly give them credit score for having driver-assistance methods, the newest indication that the once-futuristic know-how is turning into mainstream. The U.S. Division of Transportation proposed on Thursday that lane-keeping help, automated emergency braking, blind spot detection and blind spot intervention be integrated into its 5-Star Security Scores program for brand new automobiles.

ADAS Options

Whereas there’s not constant {industry} settlement on the nomenclature and options comprising ADAS, there’s common settlement that ADAS right this moment might embody some, any or the entire following 16 security options;

- Reverse Digital camera

- Rear Collision Warning

- Rear Collision Mitigation

- Adaptive Cruise Management

- Computerized Emergency Braking (AEB) or Collision Avoidance

- Brake Help (sensors decide when driver is making emergency cease and applies full braking power)

- Blind Spot Warning

- Blind Spot Mitigation

- Lane Departure Warning/Lane Conserving Assistant (LKA)

- Lane Departure Mitigation

- Cross Site visitors Warning (blind spot alert utilizing lengthy vary radar)

- Ahead Collision Warning

- Ahead Collision Mitigation

- Pedestrian Detection

- Adaptive Headlights

- Driver Monitoring

ADAS Influence on Claims Frequency and Severity

Whereas isn’t but sufficient information to forecast the long-term impression of ADAS on accident frequency, present information and opinion signifies that total accident frequency is more likely to lower as ADAS options proliferate however the nature of accidents will shift till all autos are equally geared up (e.g., present enhance within the share of front-rear collisions as Computerized Emergency Braking and Collision Avoidance know-how reacts extra shortly than the drivers of unequipped autos). Offsetting this lower in accident frequency is the sharply rising severity of accidents as a result of greater prices of ADAS know-how substitute and the mandatory related restore procedures required.

By 2030, 75% or 211.0 M autos of the U.S. carparc of 281.0 M are anticipated to have some variety of ADAS options.

In comparison with comparable autos with none core ADAS options, autos with at the least one core ADAS characteristic resulted in:

- 1% decrease Bodily Harm declare severity

- 1% decrease Property Harm claims severity

- 4% decrease Property Harm declare severity

Supply: LexisNexis Danger Options, November 2021

COVID and the Nice Reset

Pandemic Cuts into Collision Restore Manufacturing

This lack of manufacturing based mostly on technician scarcity has been actual for the reason that starting of COVID. This is because of not solely COVID however can also be based mostly on altering cultural work norms and mores reflecting much less curiosity in being a restore technician. Fewer out there techs = much less manufacturing = extra time to restore = fewer automobiles being repaired = much less collision restore income produced = much less paint gross sales for paint suppliers and distributors.

A half-dozen collision restore corporations in several areas of the nation that have been contacted final week all reported having workers out in the course of the first half of January with COVID-19. A 7-location MSO within the Northeast reported having as many as 15 individuals dwelling sick on the similar time. A store within the Midwest had 10 of its 16 workers on sick depart.

“That is the worst we’ve seen it for the reason that pandemic started,” a West Coast store proprietor mentioned. “Clients and even most insurers have been fairly understanding concerning the delays, however clients are again to asking much more about how we’re cleansing their automobile earlier than they decide it up – extra like they have been doing the primary few months of the pandemic. One girl paid us to ship her automobile and park it in her storage with all of the home windows open, saying she’d look it over the subsequent day.”

Supply: Crash Community

Publish-Pandemic: What Stays, What Reverts?

The worldwide pandemic had a broad vary of impacts, lots of which have been anticipated, just a few of which have been completely surprising and a few of which proceed and are more likely to depart the world completely modified.

Driving Conduct and Deaths

Initially, pandemic lockdowns and Work-From-Residence (WFH) fashions took the vast majority of non-public passenger autos off the roads, nearly immediately reducing automobile accidents and restore volumes and induced most auto insurers to scale back/refund auto premiums in a method or one other. A noticeable uptick in Utilization Primarily based Insurance coverage program adoption shortly adopted, reflecting shoppers’ curiosity in additional carefully matching auto premiums to the brand new realities of danger. It stays to be seen whether or not this adoption will proceed as soon as the pandemic recedes.

Touchless All the things

Out of shopper issues about an infection, touchless every part grew to become pervasive and digital claims options, together with auto photograph accident declare self-service, which was already seeing adoption pre-COVID, completely spiked. As COVID fears started to recede in late 2021 and into 2022, miles pushed returned to nearly pre-pandemic ranges as did accident frequency, however the common severity of every accident and restore has elevated resulting from greater speeds on extra open roads which drivers grew to become used to and the upper value of onboard applied sciences.

Crashes — and deaths — started surging in the summertime of 2020, shocking site visitors consultants who had hoped that comparatively empty roads would trigger accidents to say no. As an alternative, a rise in aggressive driving greater than made up for the decline in driving. And crashes continued to extend when individuals returned to the roads, later within the pandemic.

Now america is enduring its most extreme enhance in site visitors deaths for the reason that Forties. Deaths from automobile crashes have usually been falling for the reason that late Sixties, due to automobile enhancements, decrease pace limits and declines in drunken driving, amongst different components. By 2019, the annual loss of life price from crashes was close to its lowest degree since automobiles grew to become a mass merchandise within the Nineteen Twenties. However then got here the Covid-19 pandemic.

And digital claims inspection continues to achieve traction as the popular Technique of Inspection (MOI) for insurance coverage claims of many varieties, led by private strains auto with private property shut behind. There seems to be no going again to historic ranges of workers or unbiased appraisal strategies.

Work-From-Residence and The Nice Resignation

Many people initially assumed that working from dwelling can be short-term and {that a} return to pre-pandemic working fashions was solely a matter of time. We now know that to be mistaken. A majority of the workforce, if given the selection, would now want some type of WFH, both hybrid or full, to a full time return to the office.

An absence of work-life steadiness and declining job satisfaction are among the many best components contributing to mass worker departures, known as The Nice Resignation. Owing to the pattern of working from dwelling, the strains between work and leisure typically get blurred, making professionals work past their devoted hours. Working remotely for nearly two years has gotten a number of workers used to the brand new pattern. Some workers will inevitably stop their present jobs and seek for new alternatives if their employers depart them with no choice however to work on-premise.

Current analysis reveals that 71 % of corporations modified return-to-the-workplace plans as a result of latest surges.

- The latest rise of COVID-19 instances resulted in 71 % of respondents’ corporations delaying plans to return to the office or reverting to distant/hybrid work.

- 30 % have been again within the office and reverted to distant/hybrid work.

- 41 % rescheduled or canceled plans to return

- Almost half (48 %) haven’t decided a date to return to the bodily office.

Supply: Convention Board, February 2022

Auto Claims, the Present State of Collision Restore, and Trying Forward To 2030

Throughout the collision restore {industry}, 2019 was the top yr for alternative and success. Restore services have been flush with repairable autos and the related whole addressable market (TAM) reached its all-time historic excessive of $38.3 billion.

Then with little or no warning in March of 2020, the scourge of the COVID-19 pandemic emerged and continued by way of 2020, 2021 and whereas the Omicron variant appears to be slowing COVID proceed by way of the start of 2022. For the U.S. the auto bodily harm ecosystems, in addition to the whole world, 2020 will perpetually be seen as a yr of great disruption and structural change with far-reaching financial, social and political implications.

It clearly has not been a short-term expertise. Following is among the 2020-2021 collision restore {industry}’s confluences of developments and constructs impacting the whole auto bodily harm ecosystem.

- Consolidation remained nicely underway and was intensified by the quite a few non-public fairness traders and their MSO patrons. M&A exercise remained sturdy and very lively in 2020 and all through 2021, persevering with inside the collision restore section and all through the broader auto bodily harm panorama together with the numerous segments inside its orbit: insurance coverage, components, know-how, sellers, glass, and paint, physique and tools and many others.

- We estimate that 2020 repairable claims have been down round 22 % nationally when in comparison with 2019. We’ve got seen some restoration in 2021 and estimate the yr to finish up 10-13 %, with repairable claims reaching 2019 ranges by late 2022 to early 2023 barring some exterior occasions like COVID continuation or a Russia invasion of the Ukraine.

- Technician labor and ability shortages proceed to negatively impression income and manufacturing alternatives whereas rising prices

- Growing components prices, coupled with sourcing and supply delays, are including to the rise in whole restore cycle time.

- Digital transformation of the restore course of, nicely underway in 2019, was aggressively stepped up in 2020 by the insurance coverage {industry} and supported by know-how and knowledge providers corporations. The digital restore course of mannequin was turning into ubiquitous by way of the usage of self-service photograph estimating, synthetic intelligence, AI, and human intervention as a option to co-manage estimating automobile harm. This mannequin morphed into an auto-generated picture seize of car harm supported by adjuster exception-based estimating. Video estimating supported by AI, machine studying and pc imaginative and prescient is inevitable and has already surfaced inside many areas of claims processing.

- A niche continues to exist between insurers and OEMs concerning the OEM automobile restore normal and its rising adoption and implementation and the right way to steadiness and resolve holding the repairer out of the center concerning restore procedures accomplished and cost for similar. Regardless of the insurer/OEM restore normal hole, forward-thinking repairers took the chance to diversify their companies by leaning into their relationships with OEMs by way of taking part in OEM certification applications.

- As of November 2021, year-over-year inflation was at 6.1 % and rising. Inflation jumped to 7.5 % in January 2022.

- In response to Enterprise Holdings Inc., the typical size of rental is now simply over 17 days, a rise of three.9 days from the fourth quarter one yr earlier.

- Regardless of enchancment in front-end claims restore course of discount, primarily resulting from a lower in cycle time at FNOL assisted by telematics and AI, the center to back-end of the restore course of has been rising resulting from lots of the constructs talked about above.

- We count on automobile restore prices to rise reasonably, however steadily, sooner or later resulting from a number of components:

- A scarcity of certified and devoted technicians which is fueling the necessity for more and more aggressive worker acquisition and retention compensation applications.

- Elevated automobile restore complexity and embedded ADAS know-how.

- Expense of taking part in OEM certification applications together with ongoing participation, coaching, tools and instruments.

- Elevated use of OEM components and extra line-item repairs resulting from OEM certification program participation necessities and rising acceptance of OEM restore requirements.

- Rising long-term danger of present and proposed nation of origin tariffs elevating the price of vehicles manufactured outdoors the U.S.

- Quick to medium time period Inflation

Most repairers remained opened in the course of the pandemic. With enterprise down 50 to 60 % within the early days, repairers minimize prices, accepted PPP cash from the federal government, and furloughed personnel. In some instances, repairers shuttered their companies for a time, finally reopening with restricted work. Many of those areas are single, mom-and-pop-style outlets that may battle to make the kinds of investments wanted as automobiles develop into extra refined. This state of affairs implies that an increasing number of work will proceed to shift to bigger, extra refined operations with brand-specific coaching and certifications.

The disruption attributable to the pandemic will speed up change in ways in which make it tough to seek out readability round each close to and long-term results. The anticipated and unintended penalties of the pandemic will act as an accelerant to what now we have profiled beforehand because the dynamic and interactive confluence of prevailing developments and circumstances all through the broader auto bodily harm ecosystem.

We count on to emerge from 2021 with stronger nascent and legacy companies who have been nicely capitalized pre-COVID-19 and with rising disrupters who occur to be on the proper place and time with new options that develop into each alternatives for achievement and aggressive benefits inside the broader aftermarket.

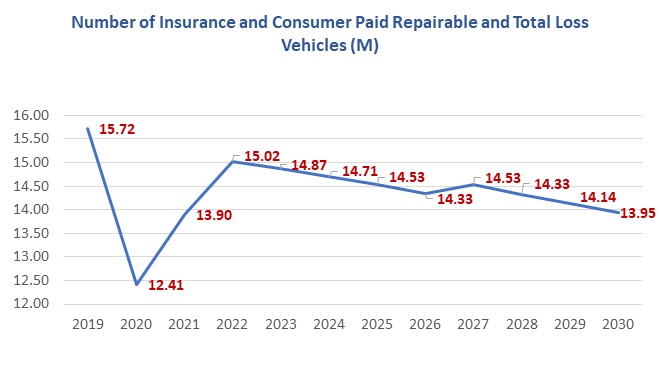

The pandemic induced a dramatic lower in automobile repairs and whole losses from the 2019 whole of 15.72 million to 12.41 million in 2020. 2021 noticed a partial return to pre-pandemic ranges with 13.9 million autos repaired. Nonetheless, our projections (see determine under) point out that the {industry} is unlikely to ever return to 2019 ranges as ADAS options proceed to penetrate the carparc and considerably scale back collisions. There could also be some short-term anomalies in restore quantity in early 2022 because the {industry} works to clear its document backlog as labor and components shortages ease.

Collision Claims and Restore Quantity

The common restore severity stood at $3,527 at June 30,2021, up 6.0% in comparison with $3327 for the prior 12-month interval.

As proven within the chart under, the variety of insurance coverage and shopper paid repairable and whole loss autos dropped precipitously in 2020, partially recovered over 2021 and 2022 however are unlikely to ever return to 2019 ranges as the long run societal and cultural modifications persist and as ADAS geared up autos proceed to signify a bigger section of the carparc. The forecasted lower between the 15.72M repairs in 2019 to the 13.95M repairs in 2030 is 11.6%.

Supply: Romans Group and Insurance coverage Options Group market analysis (knowledgeable by our understanding of the information and developments associated to ADAS adoption and its impression on repairable autos)

Future View

There isn’t any doubt that EVs (Electrical Autos) and AVs (Autonomous Autos) will displace gas-powered automobiles – that transition has already begun. Normal Motors and Ford have vowed to section out inside combustion engine (ICE) autos – GM by 2035 and Ford by 2030 — and a few states may even ban gas-powered autos by 2035. Joint ventures between OEMs may even proceed, corresponding to these between BMW and Toyota on the Supra and Subaru and Toyota on an SUV. In truth, Ford simply introduced that it’s splitting into two distinct enterprise segments – Ford Blue managing legacy inside combustion engine (ICE) autos and Ford Mannequin E for electrical autos (EVs).

As well as, there’s a associated transformation rising which is able to rework the way forward for the auto ecosystem – the brand new OEM technique across the related or Software program-Outlined Automobile (SDV), a time period that describes a automobile whose options and features are primarily enabled by way of software program, a results of the continuing transformation of the auto from a product that’s primarily hardware-based to a software-centric digital system on wheels. The implications are huge and much reaching. Present plans name for OEMs to earn subscription charge revenues within the tens of billions by 2030 for a variety of journey, security and leisure services and products corresponding to insurance coverage, premium ADAS options and tailor-made model and automobile experiences that embody household actions, off-roading adventures, and performance-oriented outings.

The questions now are at what price ought to we count on these modifications and what is going to they imply to the numerous gamers, giant and small, throughout the broad automotive ecosystem?

Let’s begin right here with 5 main short-term developments recognized by CCC Clever Options:

- The altering work panorama and its continued impression on auto gross sales, site visitors volumes, and accident severity;

- The expansion of Superior Driver Help Programs and related automobile applied sciences;

- Local weather Change and its emergence as a major think about the way forward for insurance coverage danger and rules;

- New buyer expectations in our on-demand, need-it-now world;

- A carry-over from 2021: Growing complexity given all these components persevering with to disrupt the established order.

Know-how and the Way forward for Collision Restore: EVs, AVs, SDVs and Pc Imaginative and prescient

One main {industry} that’s and can proceed to be closely impacted by the proliferation of EVs, AVs and SDVs is the collision and mechanical restore {industry}. The EV market carparc share within the U.S. at December 30, 2021 was solely 3.5% however EVs might account for as much as 40% of recent automobile gross sales by 2030. One {industry} knowledgeable predicts that supplier service quantity will decline by 35% whereas tire substitute, glass and visibility providers, and size of possession will all enhance with EVs. Till autonomous autos are broadly in use by shoppers there might be many AV fleets, robotaxis, supply and industrial vans, and trains, particularly in and close to city areas.

OEMs are catering to Millennial and Gen Z shoppers who count on on-line and app connectivity. And outlets must have a web-based presence to achieve them as a result of each generations look on-line for every part, together with the place to take their automobiles for repairs. OEM-certified restore networks will exert rising affect over restore procedures and referrals.

Collision repairers might want to pivot from conventional physique restore work to develop into extra like pc technicians. New and completely different abilities might be required and the {industry} might start to look extra interesting to younger individuals and as compensation charges enhance. New specialised coaching applications will emerge to serve this new occupation. Automobile restore prices may double between now and 2030. One {industry} knowledgeable predicts that in 5 years the typical restore order might be $6,000-$7,000 as a result of enhance in components and technician prices as restore complexity continues. The collision restore {industry} of the long run will want EV charging stations and devoted work areas or separate areas with the intention to restore EVs.

OEMs and the Linked Automobile Economic system

Self-driving automobile corporations from Tesla Inc. to Normal Motors Co.’s Cruise are racing to start out earning profits with their know-how, outrunning efforts by regulators and Congress to write down guidelines of the street for robot-driven autos. This month, Cruise mentioned that SoftBank Group Corp. will make investments one other $1.35 billion in anticipation of Cruise launching industrial robotaxi operations. Cruise is opening up its driverless robo taxi service to the general public in San Francisco because the GM subsidiary creeps towards commercialization with a contemporary $1.35 billion funding from SoftBank Imaginative and prescient Fund.

OEM will proceed to push to certify collision restore outlets, which implies that the restore work have to be performed to every OEM’s really helpful restore tips to ensure that outlets to be a part of these licensed networks, obtain restore referrals and keep automobile guarantee provisions. This can seemingly enhance the typical value of restore to auto insurers, placing upwards strain on auto premiums. It can additionally seemingly disrupt the multi-billion-dollar aftermarket components and distribution markets as extra OEM components are bought to licensed restore outlets. Extra auto insurer-OEM partnerships are more likely to emerge out of financial pragmatism, particularly as the aptitude to routinely generate real-time crash notifications and triage accident and restore administration. Fifth-generation (5G) mobile community will allow this period of extra dependable connectivity that facilitates quicker information throughput charges and better community capacities, whereas ultra-low latency ensures quick response instances between senders and receivers.

Telematics will finally join every part to the automobile, the city infrastructure, houses and different property.

One regulatory motion that would impede or sluggish these developments is the “Proper to Restore” laws that’s quickly rising at federal and state ranges. These rights are positioned as giving shoppers selection, the correct to their automobile’s information and safeguarding a free and honest restore market. Most notably amongst these proposals is the “Proper to Equitable and Skilled Auto Trade Restore Act” launched by United States Rep. Bobby Rush (D-Sick.)

Abstract

If we’ve realized something from COVID, it’s that the long run isn’t simple to foretell or sure to unfold based mostly on present developments. Nonetheless, we’re assured that barring one other “black swan” occasion within the subsequent decade, the automotive ecosystem of 2030-2035 might be nearly unrecognizable from right this moment. Some legacy market leaders will lose floor and disappear, new market entrants possessing really transformative know-how and enterprise fashions will rise, new and unprecedented inter-industry partnerships and alliances will emerge, and above all, evolving shopper preferences and selections will dictate nearly the entire change.

Concerning the Authors

Stephen E. Applebaum, Managing Associate, Insurance coverage Options Group, is a topic knowledgeable and thought chief offering consulting, advisory, analysis and strategic M&A providers to members throughout the whole North American property/casualty insurance coverage ecosystem centered on insurance coverage data know-how, claims, innovation, disruption, provide chain, vendor and efficiency administration. Mr. Applebaum can also be a Senior Advisor to Waller Helms Advisors. WHA is the premier funding banking boutique centered on the crossroads of the Insurance coverage, Healthcare and Funding Companies sectors.

Stephen is a frequent chairman, visitor speaker and panelist at insurance coverage {industry} conferences and contributor to main insurance coverage {industry} publications and has a ardour for teaching, mentoring, enterprise course of innovation and constructive transformation, making use of disruptive know-how, and managing organizational change within the North American property/casualty insurance coverage {industry} and buying and selling accomplice communities. He might be reached at [email protected].

Vincent Romans is the founding principal and managing accomplice of The Romans Group LLC. established in 1996 leveraging 4 a long time of enterprise operator and consulting expertise with home and world enterprises. The Romans Group gives enterprise, market, monetary and strategic growth consulting and advisory providers to the collision restore, property and casualty auto insurance coverage, and the auto bodily harm aftermarket ecosystem. Contact him at [email protected].