(Bloomberg) — US inventory futures edged decrease as traders braced for a print of the Federal Reserve’s key inflation metric, which can assist determine the trail ahead for rates of interest. Bitcoin’s rally prolonged previous $63,000.

Most Learn from Bloomberg

Contracts for the S&P 500 and the tech-heavy Nasdaq 100 each retreated by about 0.3%. European shares edged larger on one other crowded day on the earnings calendar. Moncler SpA rallied after the Italian luxurious firm’s revenue beat expectations. Air France-KLM slumped after reporting a fourth-quarter loss. Anheuser-Busch InBev slipped after lacking analysts’ revenue estimates.

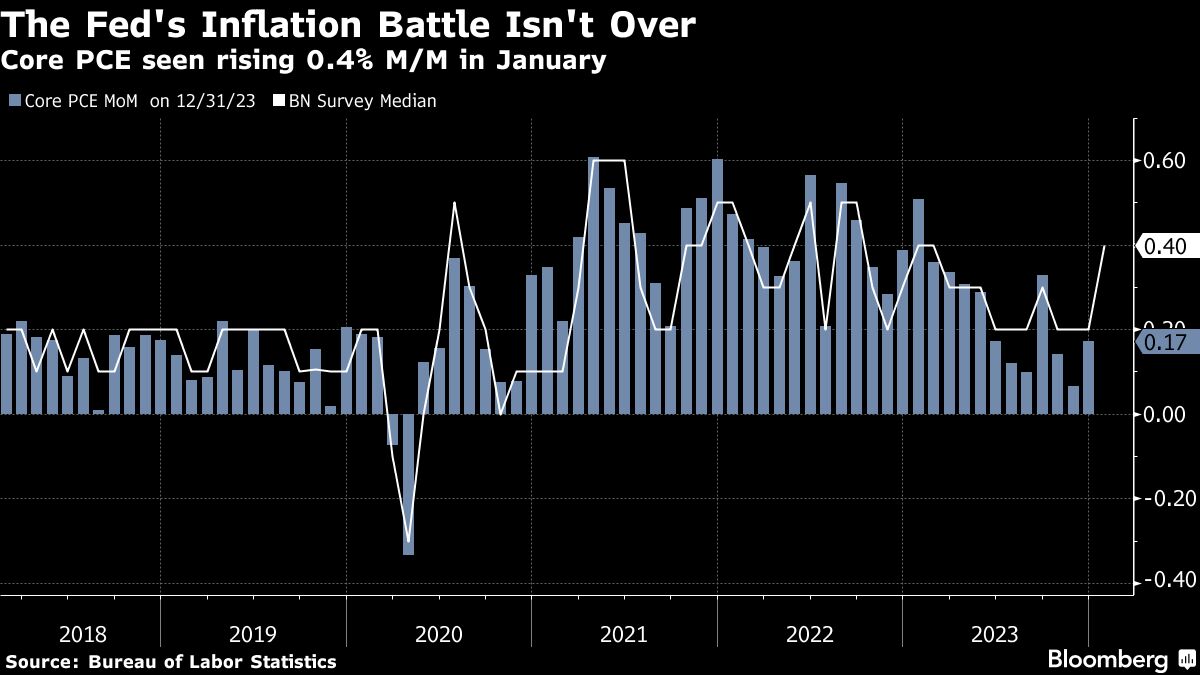

Merchants are braced for the US core private consumption expenditure gauge information due later Thursday, which can possible spotlight the bumpy path the Fed faces in reaching its 2% inflation goal. The PCE studying is anticipated to validate current commentary from central financial institution officers exhibiting no rush to ease financial coverage.

In Asia, a gauge of the area’s equities rose following a rebound in Chinese language shares. The yen climbed probably the most in additional than per week in opposition to the greenback after Financial institution of Japan Board Member Hajime Takata signaled that the case for ending the unfavorable rate of interest coverage is gaining momentum.

Bitcoin prolonged positive aspects after surging above $60,000 for the primary time in additional than two years Wednesday, reflecting new demand from exchange-traded funds. The foreign money virtually touched $64,000. The 2021 document excessive is just under $69,000.

Treasury yields ticked larger after a rally in bonds on Wednesday that noticed the 10-year yield falling 4 foundation factors and the policy-sensitive two-year slipping six foundation factors.

New York Fed President John Williams mentioned Wednesday the central financial institution has “a methods to go,” in its battle in opposition to inflation and Atlanta Fed chief Raphael Bostic urged endurance in regard to coverage tweaks.

Merchants are at present pricing round 80 foundation factors of easing by year-end — virtually according to what officers in December indicated because the likeliest end result. That will equate to a few cuts in 2024 — because the Fed strikes have traditionally been increments of 25 foundation factors. To place issues in perspective, swaps have been projecting virtually 150 foundation factors of cuts this 12 months at first of February.

A gauge of the greenback weakened, with the yen climbing as excessive as 149.61 in opposition to the dollar as traders positioned for a probable narrowing within the rate of interest hole between Japan and the US.

“We anticipate the BOJ to reap the benefits of this reflationary surroundings to exit unfavorable charges, however the coverage stance will stay very accommodative by way of 2025,” Jessica Hinds, director at Fitch Scores, mentioned in a word.

Key Occasions This Week:

-

Germany CPI, unemployment, Thursday

-

US client earnings, PCE deflator, preliminary jobless claims, Thursday

-

Fed’s Austan Goolsbee, Raphael Bostic and Loretta Mester communicate, Thursday

-

China official PMI, Caixin manufacturing PMI, Friday

-

Eurozone S&P International Manufacturing PMI, CPI, unemployment, Friday

-

BOE chief economist Huw Capsule speaks, Friday

-

US building spending, ISM Manufacturing, College of Michigan client sentiment, Friday

-

Fed’s Raphael Bostic and Mary Daly communicate, Friday

A number of the principal strikes in markets:

Shares

-

The Stoxx Europe 600 rose 0.2% as of 8:21 a.m. London time

-

S&P 500 futures fell 0.3%

-

Nasdaq 100 futures fell 0.3%

-

Futures on the Dow Jones Industrial Common fell 0.2%

-

The MSCI Asia Pacific Index rose 0.4%

-

The MSCI Rising Markets Index rose 0.1%

Currencies

-

The Bloomberg Greenback Spot Index fell 0.2%

-

The euro was little modified at $1.0846

-

The Japanese yen rose 0.7% to 149.65 per greenback

-

The offshore yuan was little modified at 7.2084 per greenback

-

The British pound was little modified at $1.2666

Cryptocurrencies

-

Bitcoin rose 4% to $62,973.92

-

Ether rose 5.1% to $3,491.46

Bonds

-

The yield on 10-year Treasuries superior one foundation level to 4.27%

-

Germany’s 10-year yield was little modified at 2.46%

-

Britain’s 10-year yield declined one foundation level to 4.17%

Commodities

This story was produced with the help of Bloomberg Automation.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.