By Lucia Mutikani

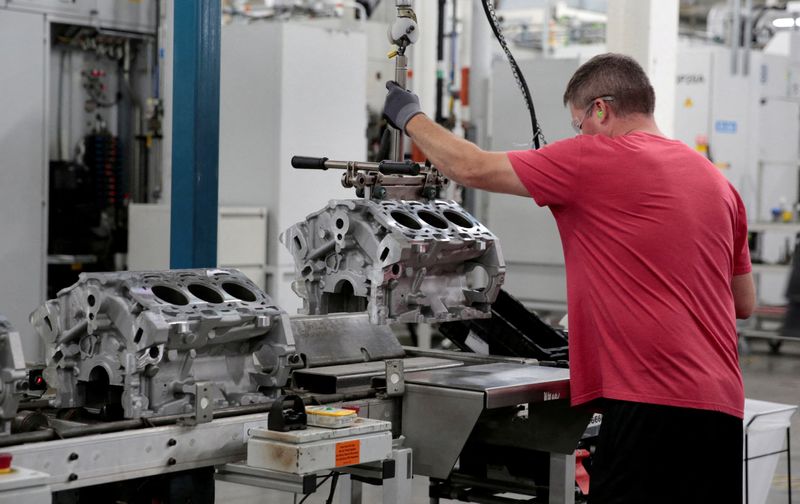

WASHINGTON (Reuters) -U.S. manufacturing grew for the primary time in 1-1/2 years in March as manufacturing rebounded sharply and new orders elevated, however employment at factories remained subdued amid “sizable layoff exercise” and costs for inputs pushed greater.

The survey from the Institute for Provide Administration (ISM) on Monday prompt the sector, which has been battered by greater rates of interest, was on the mend, although dangers stay from rising uncooked materials costs. Timothy Fiore, who chairs the ISM’s manufacturing enterprise survey committee, mentioned “demand stays on the early levels of restoration, with clear indicators of bettering situations.”

Whereas the manufacturing rebound is a lift for the financial system’s progress prospects, the rise in uncooked materials costs prompt items inflation might decide up within the months forward. Items deflation was the important thing driver of an inflation slowdown final 12 months.

“If the contraction of producing exercise is over, far too quickly to say, and worth pressures are constructing in manufacturing, which seems to have been taking place for the final three months, then this is able to have implications for the trail for rates of interest in 2024,” mentioned Conrad DeQuadros, senior financial advisor at Brean Capital in New York.

The ISM mentioned its manufacturing PMI elevated to 50.3 final month, the best and first studying above 50 since September 2022, from 47.8 in February. The rebound ended 16 straight months of contraction in manufacturing, which accounts for 10.4% of the financial system. That was the longest such stretch because the August 2000-January 2002 interval.

A PMI studying above 50 signifies progress within the manufacturing sector. Economists polled by Reuters had forecast the PMI would rise to 48.4. The ISM and different manufacturing unit surveys had grossly overstated the weak spot in manufacturing, which has been constrained by greater borrowing prices.

Authorities knowledge on Thursday confirmed manufacturing output rose at an annualized charge of 0.9% within the fourth quarter. It grew 1.6% in 2023 in comparison with 0.8% in 2022. Although client spending has shifted to providers, demand for items stays supported.

9 industries, together with textile mills, paper merchandise, main metals, chemical merchandise and transportation tools, reported progress final month. Electrical tools, home equipment and elements, equipment and pc and digital merchandise have been among the many six industries reporting a contraction.

Commentary from companies was pretty upbeat. Makers of chemical merchandise reported that “efficiency continues to defy projections of a downturn in exercise,” including that “demand stays robust, and the pipeline for orders is powerful.”

Transportation tools producers mentioned they have been “anticipating to see orders and manufacturing decide up for the second quarter.” Makers of wooden merchandise reported that “enterprise exercise is up,” including that “many producers are anticipating higher enterprise within the second quarter.”

However producers of equipment struck a cautious be aware, saying they have been “noticing a rise in suppliers’ selectiveness concerning orders they quote and take.” Makers of paper merchandise have been fearful about “vitality pricing.” Laptop and digital merchandise producers mentioned “demand stays tender, however optimism is excessive that orders are ‘simply on the horizon.'”

U.S. shares have been buying and selling decrease. The greenback rose in opposition to a basket of currencies. U.S. Treasury costs fell.

NEW ORDERS REBOUNDS

The ISM survey’s forward-looking new orders sub-index elevated to 51.4 final month from 49.2 in February. Output at factories rebounded, with the manufacturing sub-index surging to 54.6 from 48.4 within the prior month.

There was no signal of provide chain constraints from assaults on worldwide delivery within the Crimson Sea by Yemen’s Houthi militants. However the ISM famous that “some suppliers are struggling to maintain up.” The survey’s measure of provider deliveries slipped to 49.9 from 50.1 within the prior month. A studying under 50 indicating sooner deliveries.

Nonetheless, inflation on the manufacturing unit gate picked up. The survey’s measure of costs paid by producers rose to 55.8 from 52.5 in February, indicating uncooked supplies costs elevated final month. Twenty-four p.c of corporations reported greater costs in comparison with 18% within the prior month.

Manufacturing facility employment contracted for the sixth consecutive month, although at a reasonable tempo. Companies reported persevering with to cut back head counts by means of layoffs, which the ISM mentioned accounted for 76% of the decline in employment, up from 50% in February. Attrition and hiring freezes have been additionally being utilized by corporations to trim head rely.

The survey’s measure of producing employment elevated to 47.4 from 45.9 in February. This measure has, nevertheless, not been helpful in predicting manufacturing payrolls within the authorities’s intently watched employment report.

Whereas manufacturing has turned the nook, building spending is taking a step again. A separate report from the Commerce Division on Monday confirmed building spending unexpectedly dropped 0.3% in February after an unrevised 0.2% decline in January.

Energy in single-family homebuilding, which continues to underpin building, was greater than offset by weak spot in nonresidential and public initiatives. Economists had forecast building spending would rebound 0.7%. Development spending elevated 10.7% on a year-on-year foundation in February.

(Reporting by Lucia Mutikani; Modifying by Chizu Nomiyama and Paul Simao)