A behavioral change mannequin profitable in selling more healthy behaviors and efficiently carried out in all of the continents —

By Matteo Carbone, Founder & Director, IoT Insurance coverage Observatory —

About 30 years in the past, Adrian Gore and Barry Swartzberg harbored an instinct that launched a distinct perspective on individuals’s well-being. This method, generally known as Vitality, has since matured into a strategy primed to function a elementary competency for any insurer sooner or later. The insurance coverage sector has wholeheartedly embraced the notion of incorporating preventive measures, as aptly expounded in The Geneva Affiliation’s publication titled “From Threat Switch to Threat Prevention.” The crucial to domesticate much less dangerous behaviors amongst policyholders in private strains and amongst frontline workers in industrial domains stands because the indispensable path in direction of realizing this aspiration.

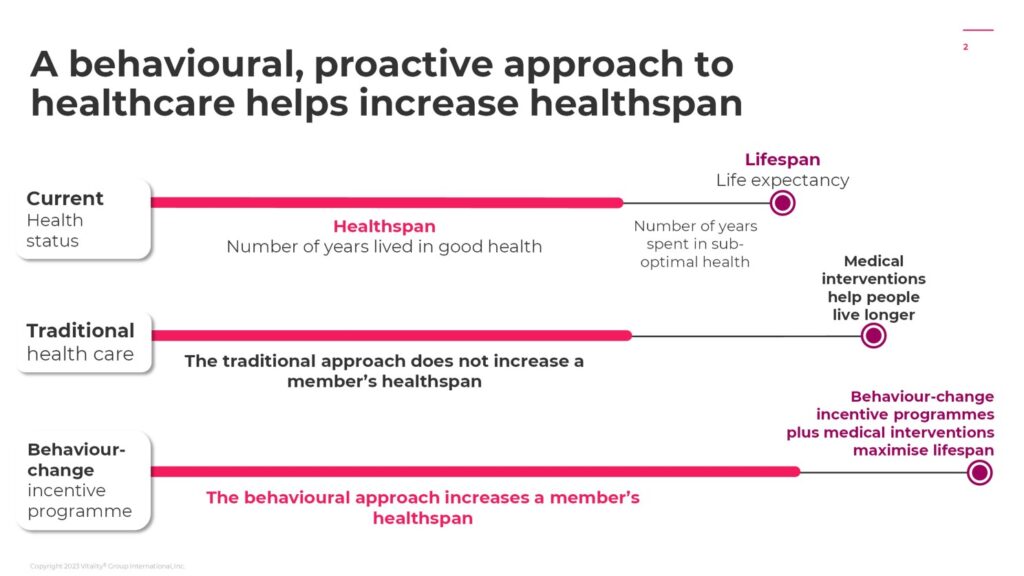

The traditional medical standpoint primarily facilities upon using medical interventions as soon as a illness has manifested. In essence, this method entails prolonging life by extending the interval spent in considerably suboptimal well being, albeit with variations contingent upon the character of the illness. Conversely, Vitality’s behavioral paradigm concentrates on selling more healthy life-style selections able to elongating the period of the policyholder’s time spent in a state of optimum well-being, thus additional extending their lifespan.

A behavioral, proactive method to healthcare (Supply: Discovery)

Realizing these outcomes entails diminishing the frequency and severity of claims for the insurer. This incremental financial worth is then partially channeled towards funding the bills of the behavioral change program. At its core, the Vitality program entails – after adequately underwriting a danger – promising rewards to people exhibiting enhancements of their conduct. This, in flip, garners insurer’s enhanced technical outcomes from these shifts in life-style selections. A portion of those financial upsides is allotted to upholding these guarantees.

Over the previous decade, this method has been replicated in several markets – with totally different nuances program by program, and even one of many worldwide companions has used Vitality as a stand-alone fee-based provide open to clients with none insurer coverage – and has already attracted greater than over 30 million[1] people globally. This journey has showcased an astonishing capability to actively have interaction policyholders. Throughout quite a few Vitality portfolios, a substantial majority of the members, exceeding two-thirds[2], have engaged in each bodily and non-physical actions offering verified info. These days, greater than 100K new units monthly[3] are related by members to the Vitality program.

Discovery has achieved an enrollment fee starting from 50% to 80% of their Vitality program amongst their South African policyholders. This exceptional achievement has been realized even with a month-to-month payment exceeding $17[4] charged to the insured for enrollment.

The worldwide partnerships are yielding constant proof as properly, demonstrating penetration charges of as much as 70%[5] for Vitality in companions’ new enterprise applications deployed in mature nations – even with a payment requested to policyholders to affix this system and about 5 years available on the market – and as much as 80% in rising economies[6]. Analogous outcomes have been replicated in company wellness initiatives, the place as a lot as two-thirds of eligible workers have participated, in distinction to the trade’s common of 30% participation.

This engenders a virtuous cycle whereby policyholders crave to share their wholesome behaviors with their insures and luxuriate in substantial benefits, with advantages that that the advantages might be larger than the premium paid. Concurrently, this Shared-Worth Insurance coverage mannequin permits the provider to attain superior outcomes, thereby producing noteworthy constructive externalities for society at massive.

The inspiration of the Vitality method resides in selling behaviors immediately contributing to delaying ailments. Discovery’s three-decade journey offers sturdy proof {that a} important improve within the stage of bodily exercise reduces by 49% the mortality for people aged 45 to 65, and a exceptional 61% discount for these older.[7] Optimistic impacts have additional manifested inside annual medical expenditures, the place probably the most engaged individuals 15% decrease declare price[8] than the much less engaged, risk-adjusted by age and medical circumstances. A longitudinal examine on the individuals who confirmed a low stage of bodily exercise throughout the preliminary six-month interval confirmed a subsequent 14% discount in-hospital medical prices for the subgroup that notably elevated their engagement ranges over the following 4 and a half years.[9]

Mortality advantages from change in train (Supply: Discovery)

As intuitively anticipated a program encouraging wholesome behaviors and incentivizing people showcasing such conduct inherently possesses additionally the potential to draw and retain extra individuals with a wholesome life-style. In an indication of this impact, Discovery’s newest knowledge pertaining to their SA well being portfolio confirmed that the financial worth the insurer garners by the Vitality method is derived to the extent of 31% from the attraction and retention of youthful members, and 20% from the attraction of people extra more likely to train. Consequently, practically half of the accrued financial worth might be attributed to habits change—an elevated stage surpassing the 28% recorded in 2016.[10]

The enhancement evident within the attained outcomes is a direct final result of Discovery’s steady innovation effort. This ongoing endeavor has persistently honed their mastery in behavioral modification, seamlessly making use of it throughout numerous geographical areas and contours of enterprise. As illustrated by the determine beneath, the dynamic utilization of Energetic Rewards and loss aversion mechanisms (such because the mechanism to reimburse the Apple watch) – methodologies systematically examined and incrementally carried out throughout all applications over current years – has showcased extraordinary efficacy in participating members. This, in flip, has the direct causal impact of accelerating the embrace of the specified wholesome behaviors amongst Vitality’s members.[11]

Energetic Rewards and Apple Watch profit impacts on the UK portfolios (Supply: Discovery)

Upon inspecting the affect of Energetic Rewards on Discovery’s member bodily exercise, members who participated in Energetic Rewards noticed greater than a 20% improve in bodily exercise days no matter their well being standing. This improve is observable throughout the complete spectrum of well-being, encompassing people categorized as “wholesome,” “with steady power situation,” “with important power situation,” and “with complicated power situation.”[12]

An evaluation of the bodily exercise patterns throughout the similar member cohort, each previous to and subsequent to the implementation of those two superior behavioral change methodologies, has yielded notable findings. Following publicity to Energetic Rewards, the common exercise stage exhibited a commendable upswing of 18%. Furthermore, with the added incorporation of Apple Watch advantages, this common exercise escalation escalated to a formidable 35%. This enhancement is persistently noticed throughout various generational segments, with all age brackets showcasing increments surpassing 20%. Notably, people aged 50 and above displayed a very substantial uptick of 51%.[13] Related items of proof have been measured in South African, UK, US, and Australian portfolios.

The larger the proportion of engaged members, the upper the impression created on the insurer’s technical outcomes. A Swiss Re’s “Well being and Wellness Engagement Impacts” examine inspecting a life insurance coverage habits change program estimated a threshold of 25% engagement as requisite to make sure a constructive ROI for the insurer. Exceeding 90%[14] of Vitality’s markets with multiple 12 months of maturity have already achieved engagement ranges surpassing this specified threshold amongst members. One of the vital efficient worldwide applications – a mature market – has reached a exceptional 64% engagement[15] fee amongst its members.

The offered proof undeniably underscores the effectiveness of this method—based on expertise and knowledge shared by policyholders—in enhancing the Profitability of the insurance coverage portfolio. This type of direct affect on technical outcomes serves as a major cause for the incorporation of any insurtech methodology throughout the insurance coverage area. Nonetheless, once we embrace my 4Ps framework for evaluating insurtech initiatives an extra trio of impacts warrants consideration to focus innovation efforts throughout the insurance coverage sector. These embody Persistency, highlighting elevated retention; Proximity, denoting frequency of interplay with the shopper; and Productiveness, indicating improved prime line.

All Vitality portfolios have persistently demonstrated superior retention charges when contrasted with the broader market. Moreover, the churn ranges noticed inside probably the most engaged members sometimes vary between one-third and half[16] of these noticed in clusters exhibiting much less wholesome behaviors. This phenomenon exerts an distinctive affect upon the lifetime worth of a policyholder cohort—what actuaries quantify as New Enterprise Worth—leading to a shift within the high quality of the insurance coverage e-book.

The heightened stage of engagement, described within the first a part of the article – undoubtedly amplifies the frequency of interactions (app utilization, push notifications, emails, …) between the insurance coverage provider and the policyholder. A number of of the Vitality life portfolios have encountered a mean above 20 touchpoints monthly with policyholders[17], a marked departure from the historically minimal touchpoints related to life portfolios. Noteworthy is a selected Vitality portfolio whereby the utilization of the insurer’s digital channels amongst members has surged greater than fourfold[18] after the introduction of the above-mentioned Energetic Rewards.

One in every of Discovery’s worldwide companions has disclosed the impact on cross-selling: the depend of insurance policies per buyer is fivefold larger amongst Vitality members compared to the standard portfolio.[19] A similar development is obvious inside an evaluation of Discovery’s policyholder cohort with over 5 years of engagement. The examination reveals that probably the most engaged members keep a mean of fifty%[20] extra insurance policies in distinction to their much less engaged counterparts. This drive to extend productiveness is the final however not least space of impression.

The gross sales performances are evidently influenced by a mess of things, encompassing the insurer’s technique and initiatives, contingent market circumstances, and aggressive dynamics. Consequently, attaining a precise quantification of the impression of the Vitality method proves to be a formidable problem. Nonetheless, a plethora of anecdotal proof lends credence to the notion that this side might certainly be considered one of appreciable significance:

- A life portfolio progress fourfold the market, with market share rank from eleventh to seventh in 4 years (mature nation)[21];

- Well being carriers had a 33%[22] top-line progress over 6 years in contrast with a shrinking market (mature nation);

- A life bancassurance participant elevated market share from 2% to 7% in 4 years (rising economic system)[23].

This detailed overview demonstrates with details and figures the effectiveness of the Vitality mannequin – concretely attaining adoption and engagement among the many complete spectrum of well-being – and the profitable journey in replicating it in all of the geographies.

Following the identification of the underlying causes of claims, this method successfully incentivizes policyholders to reveal verified behavioral info, thereby securing rewards. This Shared-value mechanism serves to optimize their ongoing engagement whereas additionally yielding superior outcomes for the insurance coverage enterprise, a portion of which is shared again to the policyholders.

Discovery has meticulously cultivated a collection of specialised competencies, encompassing the adept steering of behavioral change, adept engagement with policyholders, the skillful orchestration of an ecosystem of retail companions to sustainably ship interesting rewards, and a complete array of supplementary aptitudes required to make sure the seamless integration and alignment of the Vitality method throughout actuarial, advertising and marketing, and distribution features. This prowess has been perpetually honed by collaboration with worldwide companions and an unwavering dedication to steady innovation.

Evidently, this technique utilized to well being and life transcends the scope of a traditional wellness program, regardless of bodily exercise constituting a foundational incentivized element over its three-decade trajectory. It signifies an emergent insurance coverage paradigm that holds the potential for extension throughout various insurance coverage enterprise strains (in South Africa, Discovery has efficiently utilized it to auto insurance coverage). This extension goals to foster much less dangerous behaviors amongst policyholders and, when deployed inside industrial strains, extends its affect to embody front-line workers.

Notes

1. Discovery web site, https://www.discovery.co.za/company/investor-relations-about-us.

2. Discovery Group unaudited interim outcomes for the six months ended 31 December 2022 (slide 9), https://www.discovery.co.za/property/discoverycoza/company/investor-relations/2023/results-final.pdf.

3. Based mostly on knowledge from the Vitality Gadget Platform.

4. Discovery web site, https://www.discovery.co.za/vitality/join-today/.

5. Discovery Group audited outcomes for the 12 months ended 30 June 2023 (slide 62), https://www.discovery.co.za/property/discoverycoza/company/investor-relations/2023/results-final-fy-2023-update.pdf.

6. Discovery Group audited outcomes for the 12 months ended 30 June 2021 (slide 77), https://www.discovery.co.za/property/discoverycoza/company/investor-relations/2021/fy-results-final-2021.pdf.

7. Discovery Group unaudited interim outcomes for the six months ended 31 December 2022 (slide 21), https://www.discovery.co.za/property/discoverycoza/company/investor-relations/2023/results-final.pdf.

8. Discovery Group unaudited interim outcomes for the six months ended 31 December 2022 (slide 10), https://www.discovery.co.za/property/discoverycoza/company/investor-relations/2023/results-final.pdf.

9. The case for getting energetic and driving properly, white paper.

10. Evaluation by Discovery Well being Medical Scheme, 2020.

11. RAND Europe Examine: Incentives and bodily exercise

12. The case for getting energetic and driving properly, white paper.

13. AIA Vitality, Introduction to Energetic Advantages and Apple Watch Profit, https://www.aia.com.au/content material/dam/au/en/docs/press-releases/2022/apple-watch-insights.pdf.

14. Discovery Group unaudited interim outcomes for the six months ended 31 December 2022 (slide 9), https://www.discovery.co.za/property/discoverycoza/company/investor-relations/2023/results-final.pdf.

15. Discovery Group audited outcomes for the 12 months ended 30 June 2023 (slide 62), https://www.discovery.co.za/property/discoverycoza/company/investor-relations/2023/results-final-fy-2023-update.pdf.

16. Sourced from knowledge from numerous Vitality companions.

17. Why well being and wellness initiatives matter for actuaries: John Hancock Vitality as a case examine, John Hancock, 2019, https://www.soa.org/globalassets/property/information/e-business/pd/occasions/2019/annual-meeting/pd-2019-10-annual-session-041.pdf.

18. Based mostly on Discovery knowledge.

19. Sourced from knowledge from Vitality companion.

20. Based mostly on Discovery knowledge.

21. Sourced from knowledge from Vitality companion.

22. Vitality companion market knowledge in contrast with knowledge from the sixteenth Version of the LaingBuisson Well being Cowl report.

23. Sourced from knowledge from Vitality companion.

About The Writer

Matteo Carbone is the founder and director of the IoT Insurance coverage Observatory, co-founder of Archimede Spac, and a world InsurTech thought chief and investor. He’s internationally acknowledged as an insurance coverage trade strategist with a specialization on innovation. Matteo is creator and world-renowned authority on InsurTech – ranked amongst prime worldwide InsurTech Influencers – and he has spoken to audiences in twenty totally different international locations. He printed the primary bestseller devoted to InsurTech: “All of the insurance coverage gamers will probably be insurtech” and is member of the Forbes New York Enterprise Council. Matteo has suggested greater than 100 totally different gamers in ten insurance coverage markets world wide and has large insurance coverage expertise which incorporates arrange of business and industrial plans, progress technique definition and help within the start-up of recent initiatives, digital technique growth, insurance coverage merchandise innovation, channel technique and industrial mannequin definition, startups mentorship and recommendation M&A offers. He has labored immediately with gamers accounting for greater than 80% of the worldwide IoT insurance coverage volumes (variety of insurance policies on auto telematics, sensible house, and related well being). Earlier than creating the IoT Insurance coverage Observatory and co-founding Archimede, he spent eleven years in Bain & Firm’s Monetary Service observe.

About IoT Insurance coverage Observatory

The IoT Insurance coverage Observatory is a world insurance coverage think-tank which has put collectively executives from greater than 70 insurance coverage teams, establishments and the Web of Issues ecosystem to debate the good potential of probably the most mature InsurTech development, in addition to the challenges it poses to the insurance coverage enterprise. The main focus is on any insurance coverage resolution based mostly on sensors for accumulating knowledge on the state of an insured danger and telematics for distant transmission and administration of the information collected. For extra info, go to iotinsobs.com.

SOURCE: Matteo Carbone