(Bloomberg) — Analysts are speeding to lift goal costs on Japanese buying and selling corporations as Warren Buffett’s elevated holdings drive their shares to document highs.

Most Learn from Bloomberg

4 of the highest 10 corporations that noticed the steepest goal will increase amongst Japan’s largest corporations have been buying and selling homes, in line with knowledge compiled by Bloomberg. The nation’s 5 greatest buying and selling corporations superior in Tokyo after Berkshire Hathaway Inc. stated on Monday it raised its stake additional within the corporations to a mean of over 8.5%.

Mitsubishi Corp., the most important buying and selling agency, climbed as a lot as 5.7% in Tokyo buying and selling Tuesday, in contrast with a 0.4% lower in Topix. Its friends Sumitomo Corp. gained 3% and Marubeni Corp. rose 5%.

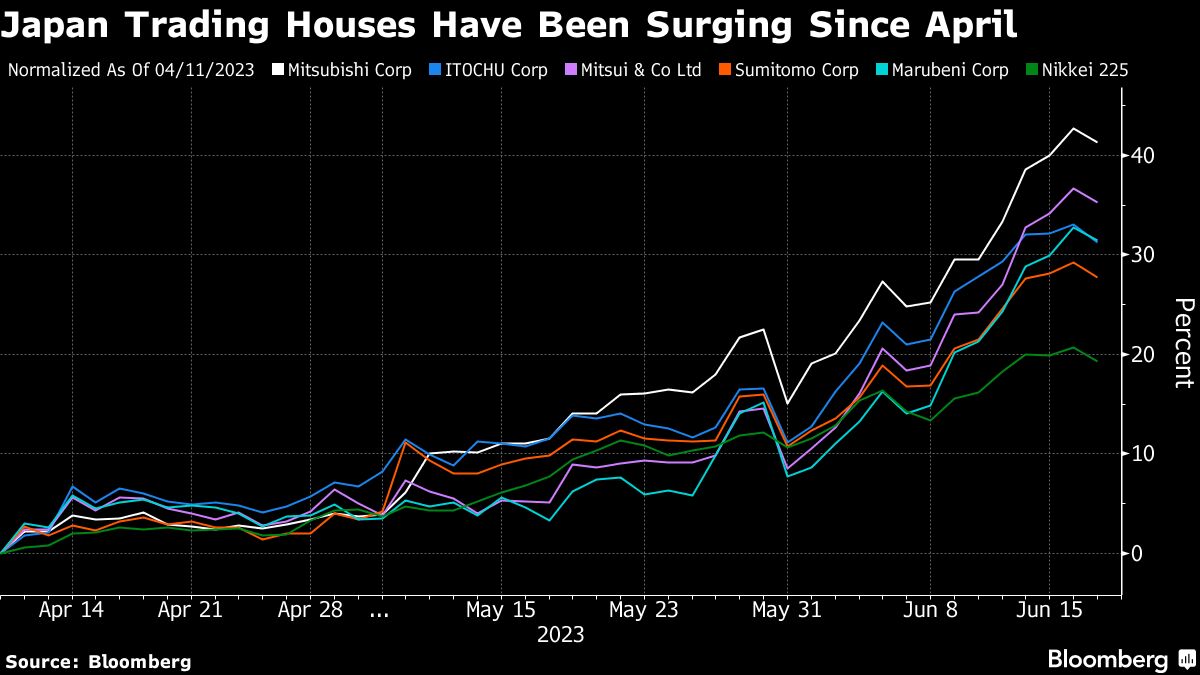

Mitsubishi noticed analysts lifting their worth goal by 18% over the previous month. The goal worth of Sumitomo and Marubeni rose by a mean of 12.3%, in contrast with 5% for Japan’s 50 largest corporations by market worth. Buying and selling homes have soared since Buffett, the chairman of Berkshire, stated in April throughout a visit to Japan that the agency would enhance its holdings.

“He clearly has additional dismissed the widespread adverse biases about investing in Japanese worth shares,” stated John Vail, chief world strategist, Nikko Asset Administration in Tokyo. “Fairly clearly he’s excited by commodities, but in addition within the diversified enterprise acumen of those corporations.”

Berkshire plans to extend investments to as much as 9.9% of every of the 5 Japanese corporations, the corporate stated Monday.

Whereas Berkshire’s stakes are getting nearer to this stage, “we may equally argue there may be nonetheless room for extra shopping for,” SMBC Nikko analyst Akira Morimoto wrote in a observe after Berkshire’s announcement, including that share costs for buying and selling corporations bounced up to now after further shopping for was introduced.

Chip-related shares Advantest Corp. and Tokyo Electron Ltd. have been the 2 corporations that noticed the most important goal worth change over the month. Their shares rallied amid a worldwide bounce in semiconductor shares and funding plans in Japan amid geopolitical tensions between the US and China.

There are indicators of overheating within the trading-house sector. The Topix Wholesale Commerce Index, which has soared about 39% this 12 months to grow to be the most effective performing sector within the nation’s inventory market, has been buying and selling in technically overbought territory since earlier this month.

–With help from Naoto Hosoda.

(Updates with share worth strikes.)

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.